3 Cryptos that Catch Analysts’ Attention: BTC Hits Rp2.4 Billion, XRP Weakens, DOGE Corrects!

Jakarta, Pintu News – The cryptocurrency market is currently entering a consolidation phase with significant movements of three major assets: Bitcoin (BTC), Ripple (XRP), and Dogecoin (DOGE). Based on the latest technical analysis by Arman Shirinyan of U.Today (September 16, 2025), Bitcoin only needs a little push to reach new highs, while XRP and DOGE are still struggling to keep their psychologically important levels.

1. Bitcoin (BTC) Needs a Little Push Towards Rp2.4 Billion

According to technical analysis from U.Today, the current price structure of Bitcoin (BTC) is in a favorable position for potential gains. After a sharp correction in September, the price of BTC stabilized above the $115 , 000 level. This area is now a fairly strong short-term support.

Analysts revealed that the 50- and 100-day moving averages (EMAs) are at around $113,400 ( US$1.85 billion) and $111,300 (US$1.82 billion) respectively, indicating that the current price position is still above these key indicators. The Relative Strength Index (RSI) is at 55, signaling that there is still room for upside without a high risk of being overbought.

If Bitcoin is able to cross resistance in the range of $120,000-$125,000 (Rp1.96 billion – Rp2.04 billion), the path to $150,000 (Rp2.45 billion) will be more open. Upside catalysts could come from increased fund flows from crypto ETFs and institutional demand which is currently still moderate.

Also Read: 5 Shocking Facts about BNB Almost Penetrating Rp15 Million: CZ’s Call to the World Banks!

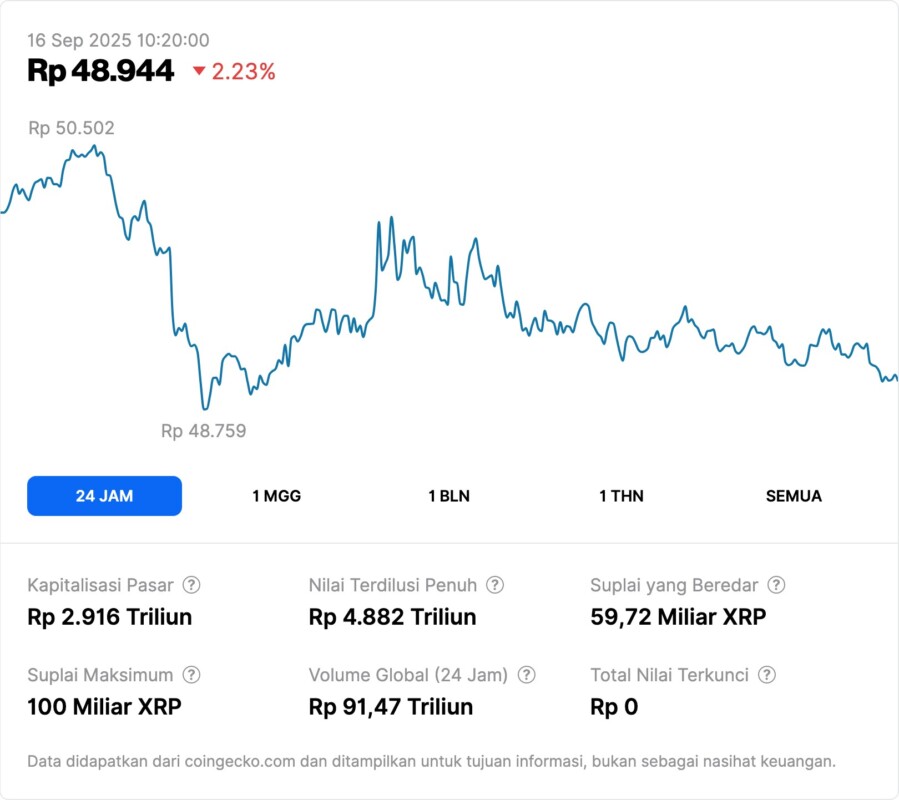

2. Ripple (XRP) fails to stay above Rp49,000 again

Ripple (XRP) has dropped below the crucial $3 (Rp49,071) level again, according to a report from U.Today. After breaking $3.20 (IDR52,328) earlier this month, XRP is now back to $2.99 (IDR48,907) due to strong selling pressure from investors.

Technically, XRP failed to sustain the breakout from the descending resistance line since July. The price rejection occurred right at the resistance area, signaling weak bullish momentum. Short-term support is at $2.96 (IDR48,559) and major support is at the 100-day EMA around $2.81 (IDR46,007).

Fundamentally, Ripple’s network activity also saw a significant decline compared to August. Daily transaction volumes declined sharply, suggesting that the weakness is not just in the charts, but also in the real-world aspects of using XRP technology.

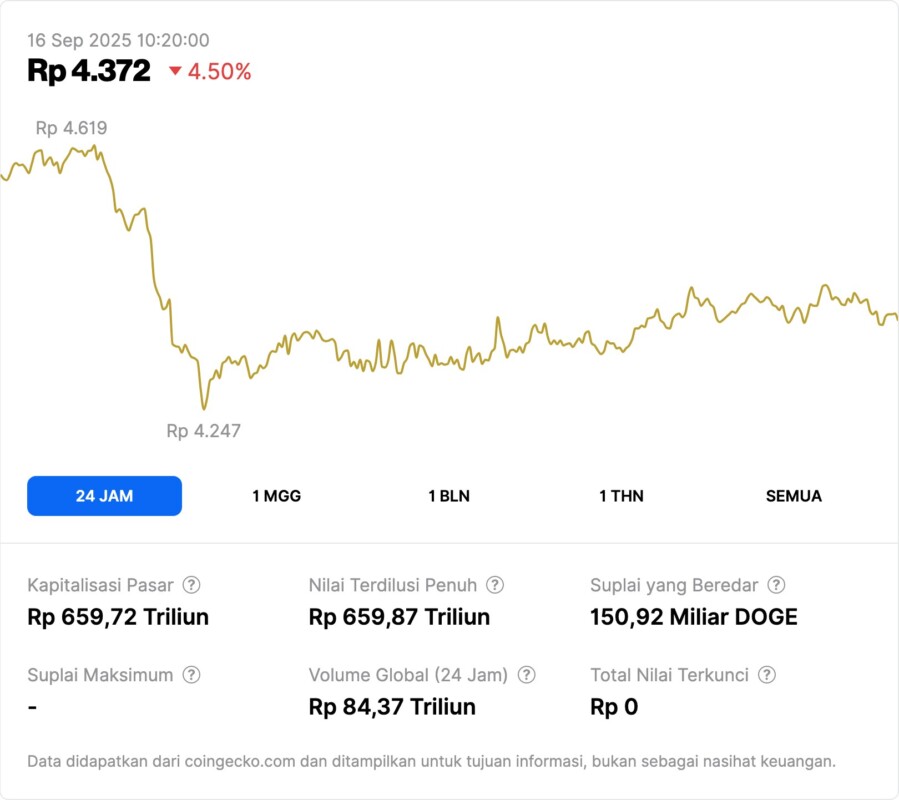

3. Dogecoin (DOGE) experiences biggest correction since July

Dogecoin (DOGE) recorded a sharp decline from $0.30 (€4,907) to around $0.27 (€4,416). This is the biggest correction since July and raises the question of whether this is just a healthy correction or the start of a longer downward trend, according to a U.Today report.

The increase in selling volume during the decline indicates profit-taking by investors. However, DOGE is still holding above the important EMA, so the medium-term trend is still considered positive. If DOGE is able to hold at the $0.26-$0.27 (IDR4,252-IDR4,416) support area, the potential for a rebound to $0.30 (IDR4,907) is still open.

But if the support fails to hold, DOGE is likely to test the $0.22-$0.21 (IDR3,598-Rp3,435) level where the 100- and 200-day EMAs intersect. A further drop to this area could indicate the end of the uptrend that started since mid-year.

Conclusion

The current movement of the cryptocurrency market shows mixed dynamics: Bitcoin (BTC) is showing structural strength to continue its rally, Ripple (XRP) is weakening due to technical and fundamental pressure, and Dogecoin (DOGE) is at the tipping point between correction and trend reversal.

With volatility still high and reliance on global sentiment and institutional fund flows, investors are expected to remain vigilant and keep up to date with the technical and fundamental analysis of the crypto assets of interest.

Also Read: 5 Surprising Monero (XMR) Actions After Breaking Rp4.9 Million Despite the Reorg!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.