Bitcoin Hits $115K on September 16 — Could a Bigger Recovery Be on the Horizon?

Jakarta, Pintu News – Bitcoin (BTC) has been in an active uptrend since the beginning of this month, continuing to creep up towards higher resistance levels.

However, this momentum may soon be tested as investors begin to show signs of caution. A short-term shift in sentiment could weaken Bitcoin’s ability to hold the support level at $115,000.

Then, how is the current Bitcoin price movement?

Bitcoin Price Drops 0.06% in 24 Hours

On September 16, 2025, Bitcoin was trading at $115,221, equivalent to IDR 1,889,999,738, after a slight 0.06% dip over the past 24 hours. During this time, BTC hit a low of IDR 1,878,159,575 and climbed to a high of IDR 1,914,369,271.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 37,525 trillion, while its 24-hour trading volume has surged by 50%, reaching IDR 747.34 trillion.

Bitcoin Holders Start Selling

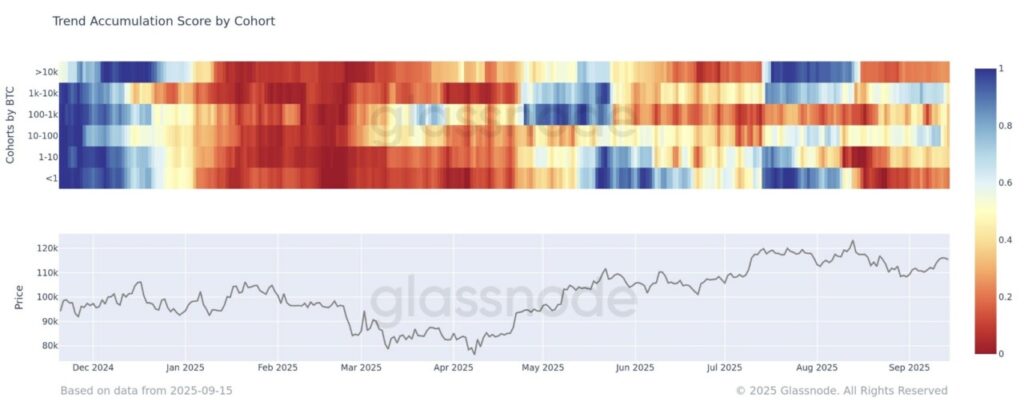

The distribution among Bitcoin holders shows that selling pressure is still a major factor in the market.

Most investor groups are currently below the 0.5 threshold, signaling limited accumulation interest. This keeps the general market sentiment skewed towards distribution, where investors favor taking profits over adding to positions.

At the same time, no group of Bitcoin holders showed an accumulation rate above 0.8 – a threshold that usually reflects high conviction buying.

In the absence of strong fund flows from long-term investors or “whales,” the market remains in a neutral-to-distribution state, limiting the chances of a significant breakout.

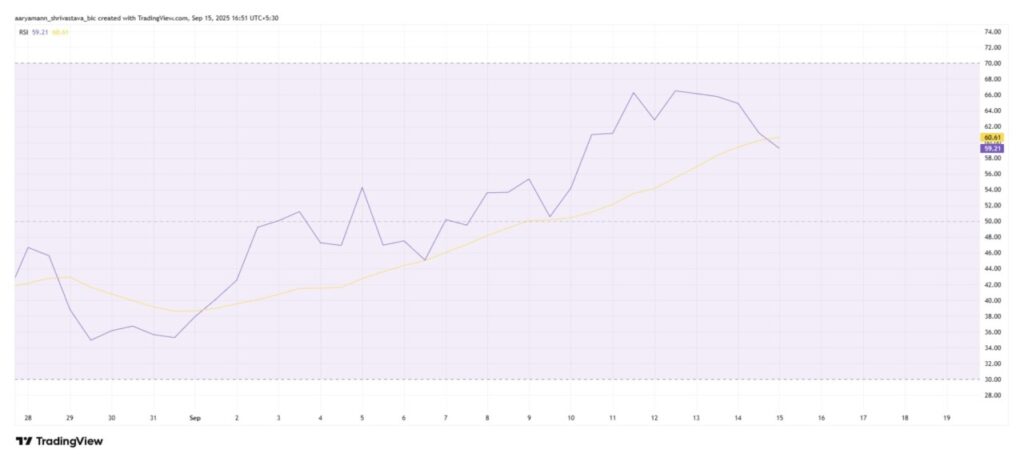

From a technical perspective, Bitcoin’s momentum is starting to show signs of weakening. The Relative Strength Index (RSI) indicator, which was previously in bullish territory, is now showing a slight decline. Although the RSI still supports the uptrend, this mild decline is a signal that the buyers’ strength is starting to fade.

If this RSI weakness continues, Bitcoin could potentially experience a short-term correction before rallying again. Traders often see this as a sign that bullish momentum is starting to weaken, which could lead to a temporary price drop.

For BTC, this could mean a retest of lower support levels before resuming the upside.

Read also: 3 Cryptos That Caught Everyone’s Eye This Week

BTC Price Potentially Recovers

As of September 15, Bitcoin was trading at $114,770, breaking below the $115,000 support level. If the bearish sentiment continues, BTC risks falling further and testing the uptrend line that has underpinned its price movement since the beginning of the month. This point will be a crucial moment for investors.

If the selling pressure intensifies, Bitcoin will most likely struggle to maintain the $115,000 level as support and could drop towards $112,500. This would be a significant setback, reinforcing the ongoing distribution phase among BTC holders, as well as limiting the price’s upside potential in the short-term.

On the other hand, if Bitcoin is able to absorb the selling pressure and regain momentum, a recovery above the $115,000 level could trigger a further rally.

In this scenario, BTC has a chance to target $117,261 in the next few days, which will strengthen the bullish outlook and boost investor confidence.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Price’s Grip on $115,000 Weakens-Here’s Why This Is Happening. Accessed on September 16, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.