Ethereum Holds Steady at $4,500 — Is a Push Toward $6,000 Next?

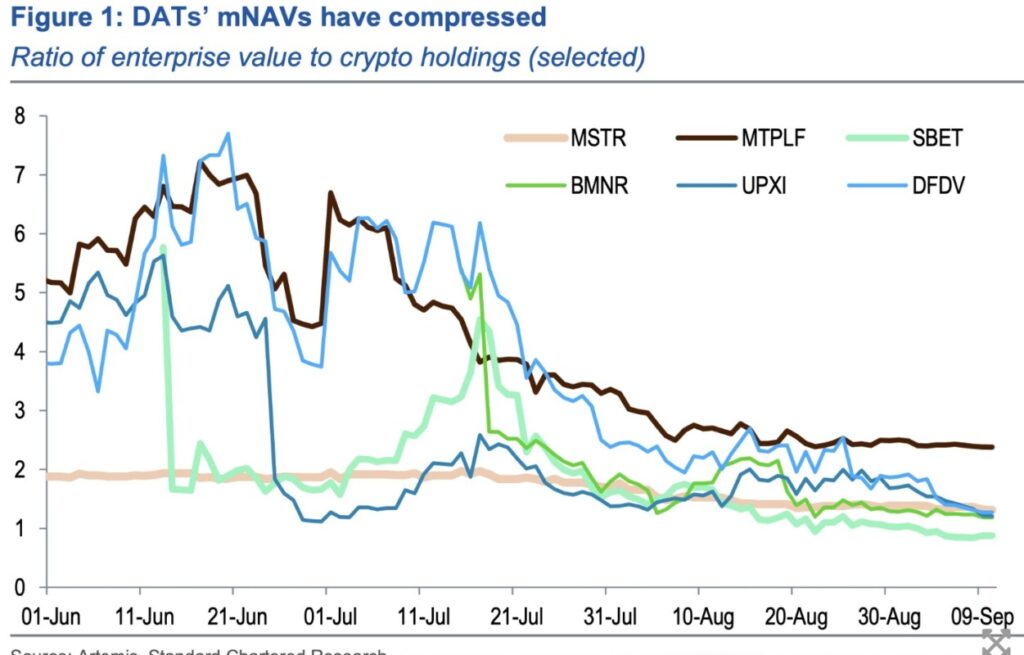

Jakarta, Pintu News – ETH price is now in the spotlight as treasury flows start to play a significant role in digital asset market movements. Standard Chartered Bank recently emphasized that Ethereum (ETH) could potentially benefit more from digital asset treasury activity than Bitcoin (BTC) or Solana (SOL).

The bank’s research highlights that consolidation and sustainability factors will be the key determinants in determining which assets will grow amid buying pressure from treasuries.

This further strengthens the discussion around Ethereum’s price, although overall the market is still cautious of long-term allocation trends.

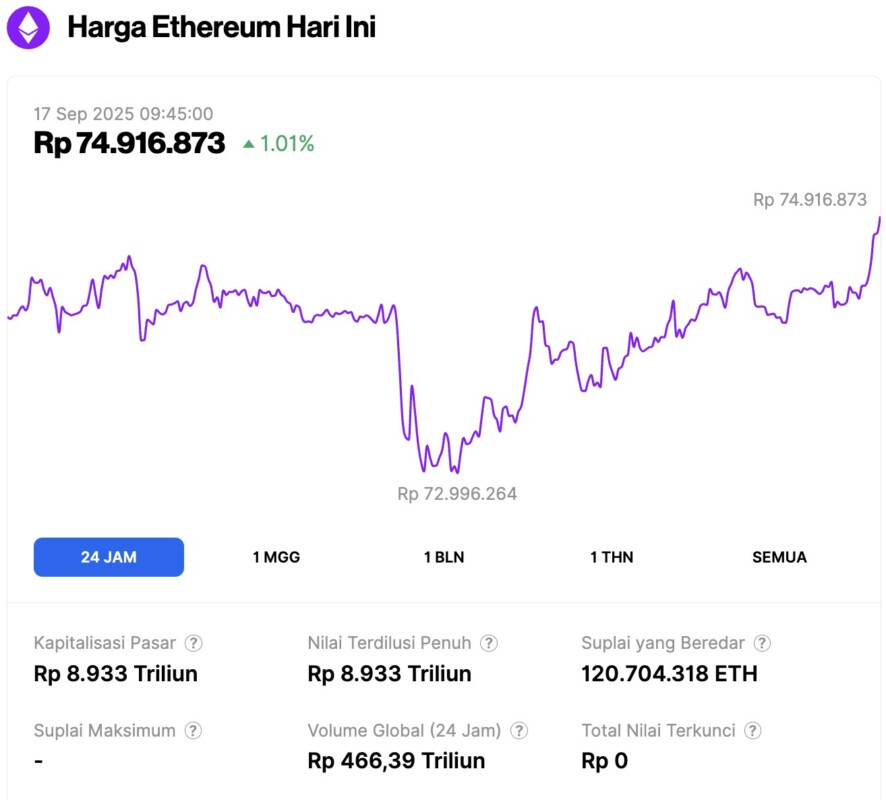

Ethereum Price Up 1.01% in 24 Hours

Read also: Could Ethereum Drop to $2,200? Citigroup’s Latest Analysis and Price Forecast Explained

As of September 17, 2025, Ethereum is trading at approximately $4,549, or around IDR 74.9 million, marking a 1.01% gain over the past 24 hours. Throughout the day, ETH saw a low of IDR 72.99 million and reached a high of about IDR 74.93 million.

At the time of writing, Ethereum’s market capitalization stands at roughly IDR 8,933 trillion. Meanwhile, daily trading volume has dropped by 16% in the last 24 hours, settling at IDR 466.39 trillion.

Standard Chartered: ETH Is the Biggest Beneficiary of Treasury Fund Flows

ETH price received strong support from Geoffrey Kendrick, head of global digital asset research at Standard Chartered, who highlighted Ethereum’s resilience compared to Bitcoin and Solana, according to a report from The Block.

He stated that the Bitcoin treasury is now starting to experience saturation, while the Solana treasury is still immature and vulnerable to restrictions from shareholders.

In contrast, Kendrick explained that Ethereum treasuries have the advantage of offering returns on staking and already having deeper institutional positions.

He cited the example of BitMine Immersion, which has currently raised more than two million ETH, or nearly 5% of the total supply, but has yet to reach its long-term target.

BitMine Accumulates $258 Million in ETH

Recently, Tom Lee’s company BitMine increased its Ethereum holdings again through a $358 million acquisition, which brings their total ETH treasury to nearly 1.95 million ETH, reinforcing the trend of treasury-driven accumulation.

Consolidation among treasuries is possible, but Kendrick asserts that Ethereum is in a better position to sustain buying pressure. He also notes that the ETH price has a stronger foundation thanks to the presence of established treasuries.

Kendrick concluded his statement by saying:

“Relatively speaking, we see that DAT (Digital Asset Treasury) activity will be a more positive driver for ETH than BTC or SOL going forward.”

This statement puts ETH at the forefront of projected treasury activity-driven growth, surpassing its competitors.

Read also: Pudgy Penguins on the Rise as PENGU Breaks Out, Signaling the End of Its Correction Phase

ETH Price Predictions Show Clear Path to $6,000 Target

As of September 16, ETH price was briefly at $4,511, holding firmly above the 50-day EMA which is around $4,275. Since the 50 EMA is located below the current price, this technical setup indicates a possible retest of support at $4,455 before the next upside push occurs.

Ethereum price also continues to respect the ascending trendline, keeping the medium-term uptrend structure intact. The key resistance level is around $4,946, and if the price is able to break it, it is likely that the upward momentum will get stronger.

If this structure is maintained, ETH price projections point to a potential rise to above $6,000 by December, in line with the bullish view of the market. This prediction is also reinforced by a statement from Standard Chartered, which mentions that fund flows from treasuries will continue to be a key driver of prices.

The current support levels are also quite clear, so downside risks are relatively contained, while upside potential still dominates. Overall, the long-term outlook for ETH prices remains strong, provided buyers are able to keep prices above the trend line.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Ethereum Price Prediction As Standard Chartered Says Treasury Buying Will Boost ETH Over Rivals. Accessed on September 17, 2025

- The Block. Standard Chartered says Ethereum to benefit more from DAT buying than Bitcoin or Solana. Accessed on September 17, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.