Solana or Ethereum: Which One Dominated Crypto in Q4 2025?

Jakarta, Pintu News – According to AMB Crypto, capital on the blockchain network is now starting to shift from Ethereum (ETH) to Solana (SOL). Since September 9, Solana’s supply on exchanges has decreased from 5.29% to 4.72%.

This indicates off-exchange accumulation, or in other words, investors are withdrawing their SOL from the exchange for storage.

Why Solana Outperforms Ethereum?

Around 9.06 million SOLs were withdrawn from the exchange, which pushed the SOL price up by 16.19% in the past week, reaching $250.

Read also: Crypto Analyst Predicts Solana’s Big Rally as SOL AUM Hits Record $4.1 Billion

In contrast, Ethereum saw an inflow of nearly 20,000 ETH to exchanges, indicating a weakening of buying pressure (bullishness). Following this shift, the SOL to ETH ratio jumped by 8.66%, becoming the largest weekly gain since early April.

In short, FOMO (fear of being left behind) is currently heading towards Solana. Previously, until the middle of the third quarter, Ethereum dominated the altcoin market with a yield (ROI) of over 90%, pushing its dominance to an annual high of 15%.

But now, ETH’s dominance has decreased by 8.3%, while SOL has recorded eight times the monthly growth of ETH, which has only increased by 7%.

In conclusion, Solana is withdrawing capital flows from Ethereum. This difference in on-chain trends suggests that institutional investors or “smart money” are reorganizing their portfolios.

According to the AMBCrypto report, this capital rotation could determine the direction of market movement ahead of the fourth quarter (Q4).

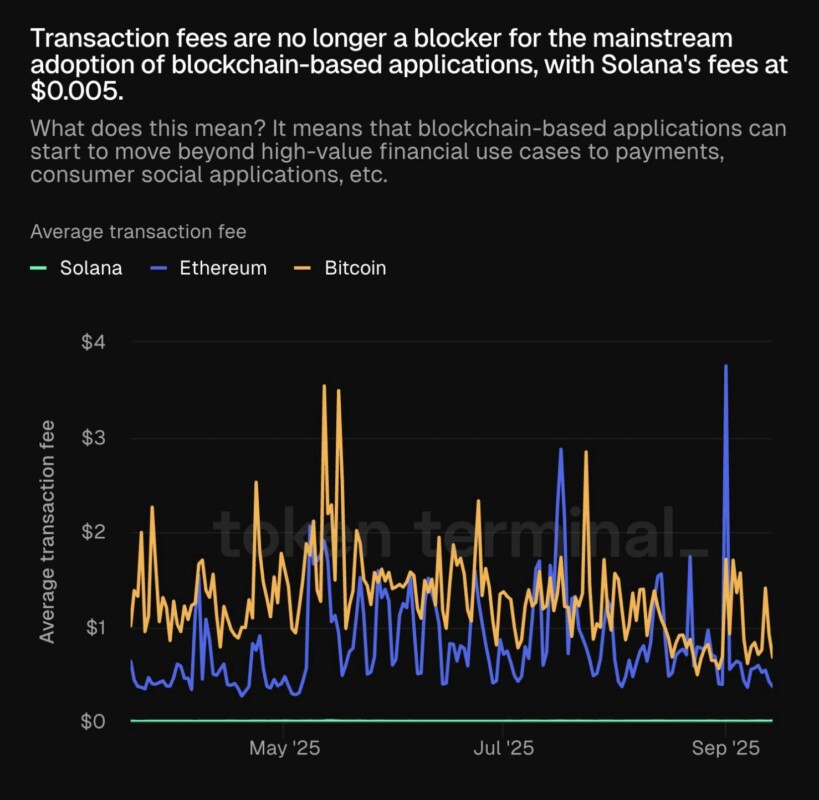

Transaction Fees Pave Solana’s Path to Mass Adoption

As highlighted by the AMBCrypto page, Solana’s adoption is now starting to penetrate into major financial sectors such as Wall Street.

Read also: Ethereum Holds Steady at $4,500 — Is a Push Toward $6,000 Next?

However, the inflows into Solana were not merely speculative, given that Ethereum (ETH) still recorded an ROI of over 80% in the third quarter. So, what’s driving the capital shift to SOL? The answer lies in cost efficiency. In this regard, Solana outperforms both Ethereum and Bitcoin (BTC).

In September, Ethereum’s average transaction fee jumped to close to $3, while Bitcoin’s was below $1. In contrast, Solana’s transaction fee has remained stable at around $0.005-much cheaper and making it more user-friendly.

In short, the use of Solana as a Layer 1 (L1) blockchain is growing. This fact is directly reflected in the network activity.

On-chain data shows that the SOL token’s daily volume is up 135% so far this month, while ETH has only increased by around 20%. Technically, Solana attracted almost 10 times more daily activity than Ethereum, in line with a monthly price increase of 17%.

With a combination of factors such as capital rotation away from ETH, super low fees, and increased L1 activity, Solana looks poised to continue outperforming Ethereum. As such, the fourth quarter (Q4) has the potential to be a banner cycle for SOL.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Solana vs Ethereum: Which altcoin looks poised to lead Q4? Accessed on September 17, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.