Ethereum Soars to $4,600 as of Sept 18 — Whales Take Profit, But On-Chain Signals Remain Strong

Jakarta, Pintu News – According to renowned crypto analyst and trader Ali Martinez, Ethereum (ETH) whales have sold around 90,000 ETH in just the last 48 hours. This massive sell-off signals that bearish pressure is looming over the second-largest digital asset.

This sudden sale briefly pushed the price of ETH down below the $4,500 level, before eventually managing to recover and stabilize around $4,543.85. Based on data from CoinMarketCap, ETH still recorded a gain of more than 5% in the past week.

So, how is Ethereum’s price moving right now?

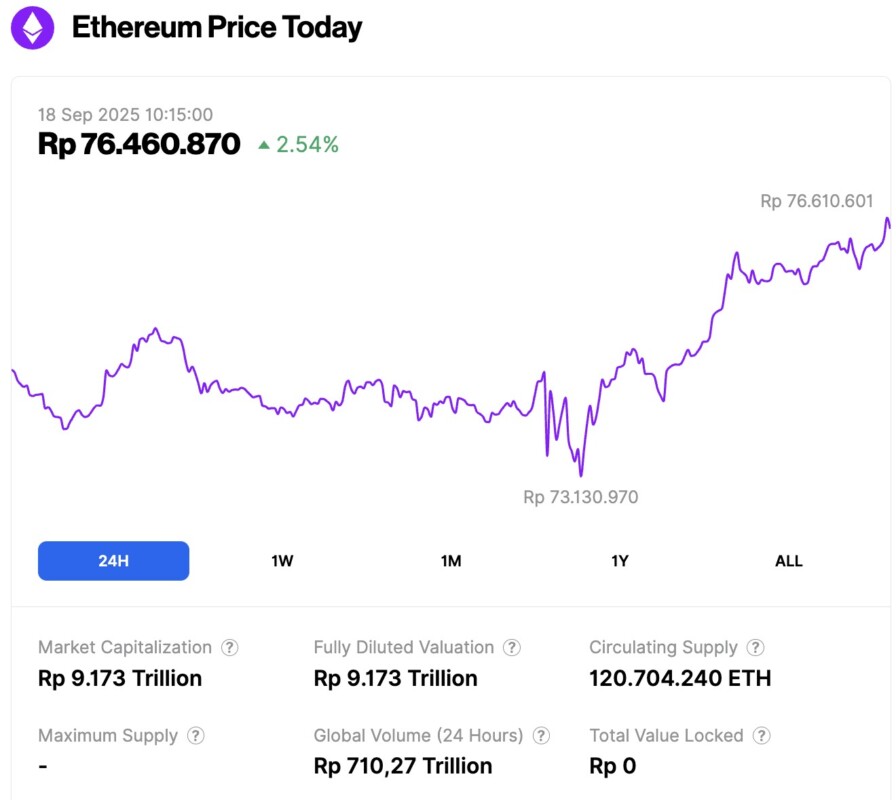

Ethereum Price Up 2.54% in 24 Hours

On September 18, 2025, Ethereum’s price climbed to approximately $4,632, or around IDR 76,460,870, marking a 2.54% increase in the past 24 hours. During this period, ETH traded between a low of IDR 73,130,970 and a high of IDR 76,610,601.

As of this writing, Ethereum’s market capitalization has reached about IDR 9,173 trillion, while its 24-hour trading volume surged 43% to IDR 710.27 trillion.

Read also: Bitcoin Surges to $117,000 as Traders Set Sights on $120K Post-FOMC

Citi’s Conservative Prediction vs Market Reality

Reuters reported that Citigroup set a price target for Ethereum (ETH) at the end of 2025 of $4,300 – a fairly cautious projection, considering ETH recently hit a record high of $4,955.

Citi’s prediction takes into account a number of risk factors, including global macroeconomic conditions, potential regulatory barriers, and the possibility of a correction after a significant surge in ETH prices.

However, on-chain fundamental data suggests a much more optimistic outlook. According to CryptoQuant, Citi’s $4,300 figure likely reflects the lower limit of price support rather than a realistic projection of Ethereum’s future price movement direction.

Bullish Factors Grow Stronger

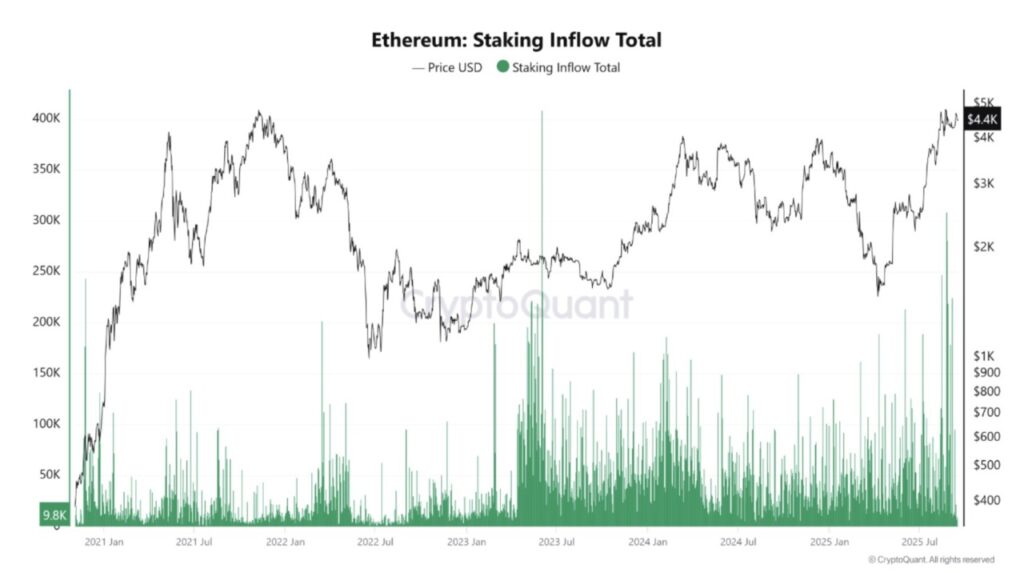

Data from CryptoQuant shows that Ethereum (ETH) staking flows surged to the highest level since mid-2023. In the period from August 14 to September 4, ETH inflows continued to rise, with the peak reaching 308,000 ETH on August 25.

A seven-day moving average of 150,000 ETH on August 30 further reinforced the optimistic sentiment, signaling reduced supply in circulation and increased confidence from validators. Investors are increasingly locking in their ETH at high prices.

Another bullish factor is the steady decline of ETH balances on centralized crypto exchanges, which are now at their lowest levels in years.

With less ETH available for sale in the near future, the risk of a sudden supply shock is reduced. This strengthens the prospect that Ethereum could be the next crypto asset to “explode” in 2025.

Read also: Solana or Ethereum: Which One Dominated Crypto in Q4 2025?

ETH Price: Correction Over, Ready to Continue the Rally?

After reaching the target level of $4,811.71, Ethereum went through a healthy correction phase. However, analysts like Javon Marks are now seeing signs of bullish forces returning.

According to Marks, if ETH manages to reclaim and break the $4,811 level, it could be the point of a surge towards $8,557.68 – a potential gain of 77%.

Ethereum’s ability to stay above the $4,500 level also suggests that the correction phase is likely over, and the market is now preparing for the next leg up.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinSpeaker. Ethereum Whales Sell Big, but On-Chain Data Signals Strength. Accessed on September 18, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.