BNB Hits All-Time High as Market Cap Soars to $133 Billion — Is the $1,000 Milestone Next?

Jakarta, Pintu News – A new milestone has been reached by Binance Coin (BNB) by recording an all-time high price of $955, which increases the market capitalization to around $132-133 billion.

Not only does this elevation place BNB among large-scale global assets, but it also marks a new era for Binance after exiting the US Department of Justice (DOJ) compliance monitoring phase.

BNB and its New Position in the Global Market

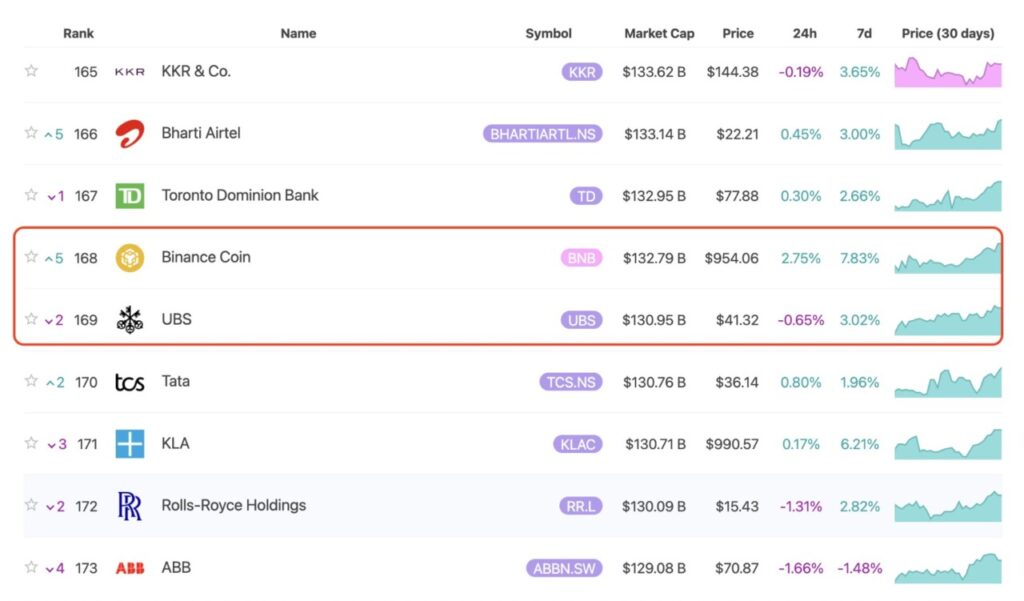

Reporting from BeInCrypto (17/9/25), Binance Coin is now ranked 136th in global asset market capitalization, surpassing UBS with a market capitalization of around $132-133 billion. This achievement shows wider recognition of BNB as an important asset in the financial world.

Read also: XRP Price Prediction Soars, Is $4 the Next Target?

Binance’s exit from the DOJ’s compliance monitoring phase is seen as the removal of one of the biggest regulatory obstacles that previously weighed on the exchange rate. The return of former CEO, Changpeng Zhao (CZ), to Binance in a new role also added to the positive speculation in the market.

The partnership between Binance and Franklin Templeton adds credibility and strengthens the narrative that the BNB ecosystem is recognized as an infrastructure for traditional financial products. This opens up opportunities for more on-ramp applications, which can increase the real demand for BNB in its ecosystem.

BNB Prospects Approaching $1,000

Analysis of derivative data and market sentiment shows that BNB still has upside potential. While Open Interest rates remain high, funding rates have declined sharply, signaling that there is still room for BNB to grow.

One trader expressed confidence that BNB could touch $1,000 before a significant price withdrawal occurs. However, he also warned about a possible sharp correction later in the week.

Kaleo analysts note that BNB’s current chart looks “clean” and similar to the conditions before BNB experienced a huge surge in early 2021. If history repeats itself, a rise towards $1,000 is highly likely.

However, it’s important to remember that deep price drops often follow big spikes before the uptrend resumes.

Read also: Top 3 Cryptocurrencies That Surged Over 30% Today

Capital Rotation to BNB and Other L1s

Some market participants prefer Solana (SOL) and BNB over Ethereum (ETH) in the short term. The reason for this is that Ethereum (ETH) has experienced large gains before, and new capital is now flowing into less “overheated” assets.

This rotation may add buying pressure for BNB if capital flows turn in line with expectations. This capital rotation indicates changing market dynamics and investor preferences adapting to current market conditions.

With an ever-increasing market capitalization, BNB has the potential to become a top choice for investors looking for diversification in their crypto portfolio.

Overall, with various supporting factors, including the exit from DOJ supervision and strategic cooperation, BNB shows potential that is not only theoretical but also supported by market data and analysis.

This significant increase in BNB price may just be the beginning of what Binance Coin can achieve in the future.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. BNB ATH Rally Pushes Market Cap to $133B Amid Breakout Hype. Accessed on September 18, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.