3 Altcoins Worth Monitoring Post Fed Rate Cut Decision

Jakarta, Pintu News – The Federal Reserve’s recent interest rate cut has been an important catalyst for global financial markets, including the crypto ecosystem.

This policy signals the United States central bank’s efforts to maintain economic stability while encouraging liquidity, which often has a positive impact on risky assets such as altcoins.

This article will discuss 3 altcoins worth monitoring after the Fed’s rate cut policy, complete with prospects and factors that investors need to pay attention to!

Clearpool (CPOOL)

Clearpool, a lending project that focuses on real assets, is currently trading at $0.155. Despite falling 1.2% in the past week and 12% in the past month, the asset is still up 40% in the past three months.

Beneath the surface, accumulation from large holders is strong. The top 100 wallets, which include mega-holders and whales, have added 25.21 million CPOOL in the past seven days, worth about $3.91 million at current prices.

The 10.8 million drop in CPOOL’s on-exchange balance shows that despite selling from retail and smart money, whales continue to accumulate. Technically, CPOOL formed an inverted head and shoulders structure.

Neckline resistance is at $0.181, with the next hurdle at $0.193. If it manages to break this level, the price could surge up to $0.240. Momentum indicators such as the Relative Strength Index (RSI) are also showing a hidden bullish divergence, which often indicates trend continuation.

Read also: Top 5 Altcoins that Rise when Altseason Index is High

Hyperliquid (HYPE)

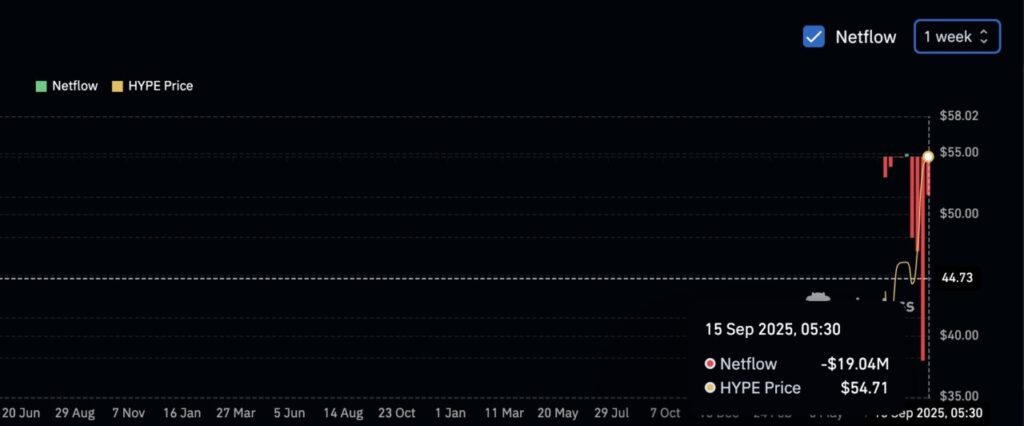

Hyperliquid (HYPE) was in the spotlight after Circle announced plans to extend USDC to its validators, giving a strong narrative boost to the project. Nonetheless, price action in the short term looks stagnant. HYPE is trading around $54, stable over the past seven days but still up 25% in the past month.

On-chain data shows that retail wallets have been consistently selling, with last week’s net outflow reaching $101.21 million. Despite increased selling pressure from retail, prices did not experience a significant correction, suggesting that buyers still dominate.

The Chaikin Money Flow (CMF) indicator showed massive buying by large wallets, which pushed liquidity higher. HYPE just broke out of a bull flag pattern on the daily chart, with an upside target of up to $73, or about 35% higher than current levels.

Also read: Who is the Biggest XRP Owner in 2025?

Cardano (ADA)

Cardano (ADA), one of the leading Layer-1 networks, is trading at $0.87, moving flat over the past week and down 3.6% over the month. However, in the past three months, ADA is still up 47%. On-chain data shows that whale wallets have added 60 million coins since September 9, increasing their total holdings to 1.94 billion ADA.

The sudden addition of 40 million ADA by another large group in the past 24 hours suggests significant long-term and short-term buying. ADA has just completed a cup and handle formation, with the token breaking the upper trendline of the handle, indicating a potential end to consolidation. If ADA manages to break $0.95, it will confirm the breakout and target $1.17.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Altcoins to Watch Following Fed Rate Cut. Accessed on September 18, 2025

- Featured Image: Generated by AI

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.