After the Fed’s 0.25% Rate Cut, ETH, SOL, and XRP Whales Make Bold and Unexpected Moves

Jakarta, Pintu News – The 25 basis points (bp) interest rate cut by the Federal Reserve triggered significant moves from the biggest “whales” in the crypto market.

From massive purchases of Ethereum (ETH), to institutional withdrawals of Solana (SOL), to changes in the supply dynamics of XRP (XRP) – these responses show how macro policies are now heavily influencing crypto market flows.

ETH whale spends $112 million after Fed rate cut

Just hours after the Fed announced a quarter-point interest rate cut, on-chain trackers recorded large purchases of Ethereum (ETH).

Read also: PEPE Coin Price Prediction: Whale Moves $25 Million – Is Breakout to $0.00002 Near?

Whale address 0xd8d0 spent $112.34 million worth of USD Coin (USDC) to buy 25,000 ETH at $4,493 per coin, according to data from Lookonchain.

This aggressive accumulation action reflects a renewed belief that lower borrowing costs and a weakening US dollar could encourage liquidity flows into riskier assets like crypto.

ETH has been driven from the start by expectations of staking demand and increased scalability, and now whale activity has increased sharply. This suggests that institutions may be ahead of the broader market rally.

Meanwhile, another whale with address 0x96F4 separately withdrew 15,200 ETH (worth approximately $70.44 million) from the Binance exchange in just two hours. This further strengthens speculation that massive accumulation of ETH by large investors is taking place.

Institutions Continue to Pile Up on Solana

Solana is also showing high activity. Institutional brokerage firm FalconX withdrew 118,190 SOL worth $28.39 million from Binance – another signal of growing institutional confidence in the asset.

According to data from Lookonchain, there are now six strategic reserve entities each holding more than 1 million SOL.

Forward Industries is in pole position with a massive portfolio of 6.82 million SOL worth $1.58 billion, with an average purchase price of $232 per coin.

With Solana futures trading volume reaching $22.3 billion in recent weeks, and SOL now an eligible asset for ETF listing under the SEC’s new standards, demand from both institutions and whales is expected to continue to strengthen.

Whale XRP sends $50 million to Coinbase

XRP activity is showing a different pattern compared to other cryptocurrencies. A whale moved 16.4 million XRP worth over $50 million to the Coinbase exchange – a move that traders interpreted as profit-taking or preparation for the launch of a new derivatives market.

Read also: CME Group Set to Launch Solana and XRP Futures Options Amid Surge in Institutional Demand

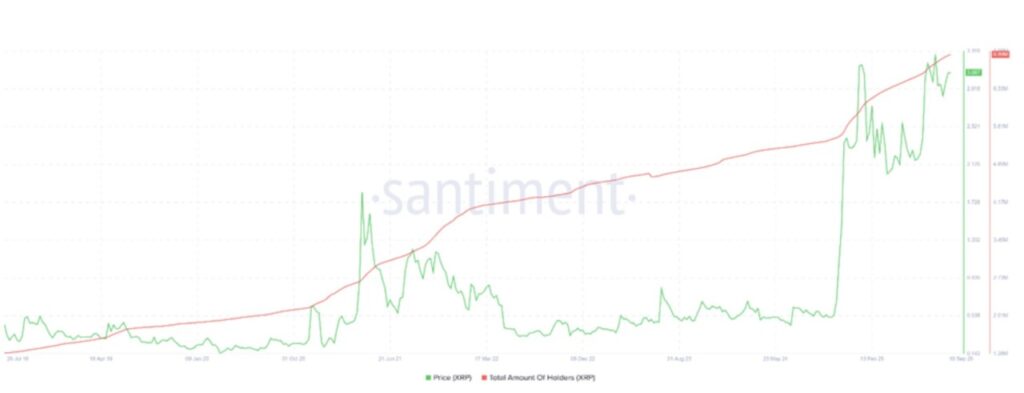

This transfer coincides with another important milestone for XRP, which is the number of token holders reaching 6.99 million in September 2025 – an all-time high (ATH).

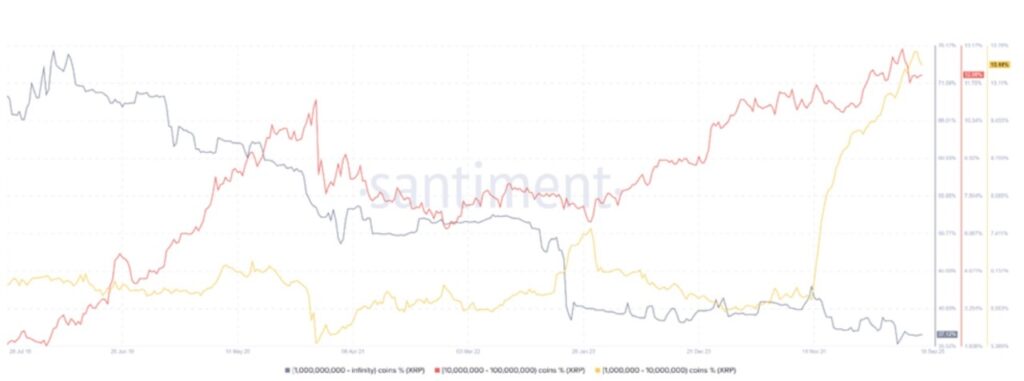

However, on the back of these achievements, there have been changes in distribution patterns. The share of supply held in wallets with holdings of more than 1 billion XRP decreased, while the number of mid-range holders (1 million to 1 billion XRP) increased sharply.

This indicates a structural shift – from concentrated ownership in the hands of whales to wider participation from retail investors.

XRP’s Institutional Profile Grows Stronger

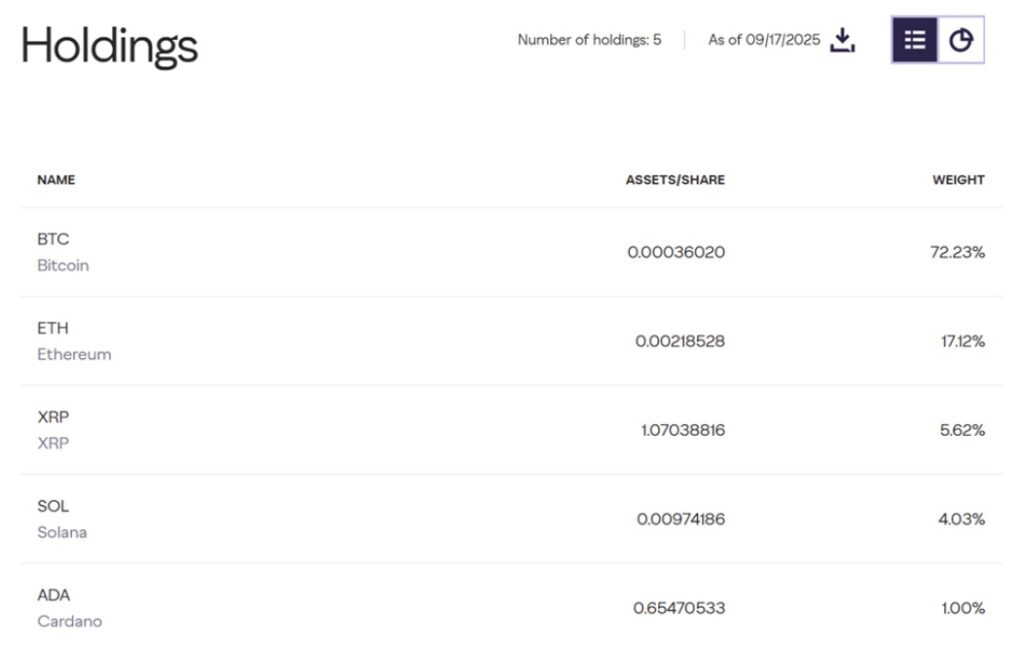

Despite lagging behind, XRP is now showing strong performance in the institutional market. It is now the third largest allocation in the Grayscale Digital Large Cap Fund, which was recently approved under the SEC’s generic ETF listing standards.

“Grayscale Digital Large Cap Fund ($GDLC) has just been approved to trade in accordance with the Generic Listing Standards. The Grayscale team is working quickly to bring the FIRST crypto multi-asset ETP to market, which includes Bitcoin, Ethereum, XRP, Solana, and Cardano,” wrote Grayscale CEO, Peter Mintzberg.

In parallel, CME (Chicago Mercantile Exchange) is also planning to launch XRP futures contracts, with the launch of options scheduled for October 13 – pending regulatory approval.

The launch is backed by major companies such as FalconX and DRW, which is expected to open up access to deeper hedging tools as well as increase demand from institutions. Currently alone, theopen interest in XRP futures has reached $1 billion, reflecting strong liquidity.

The combination of whale repositioning, changing supply distribution, and expanding derivatives access creates a positive outlook for the medium term.

Although the price of XRP in the short term is still likely to stagnate, the market structure suggests that the foundations are being built for wider adoption and increased investor confidence.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. What ETH, SOL, and XRP Whales Did After the Fed’s 0.25% Rate Cut. Accessed on September 19, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.