Ethereum (ETH) Close to a Local Bottom? Analysts Highlight the Decline in Open Interest on Binance

Jakarta, Pintu News – After failing to reach a new record high of $5,000 in August 2025, Ethereum (ETH) seems poised to break through an important psychological price level. A drop in open interest on Binance suggests that ETH may be close to a local bottom, ready for the next leg up.

Ethereum Open Interest Drops, Is a Local Bottom Near?

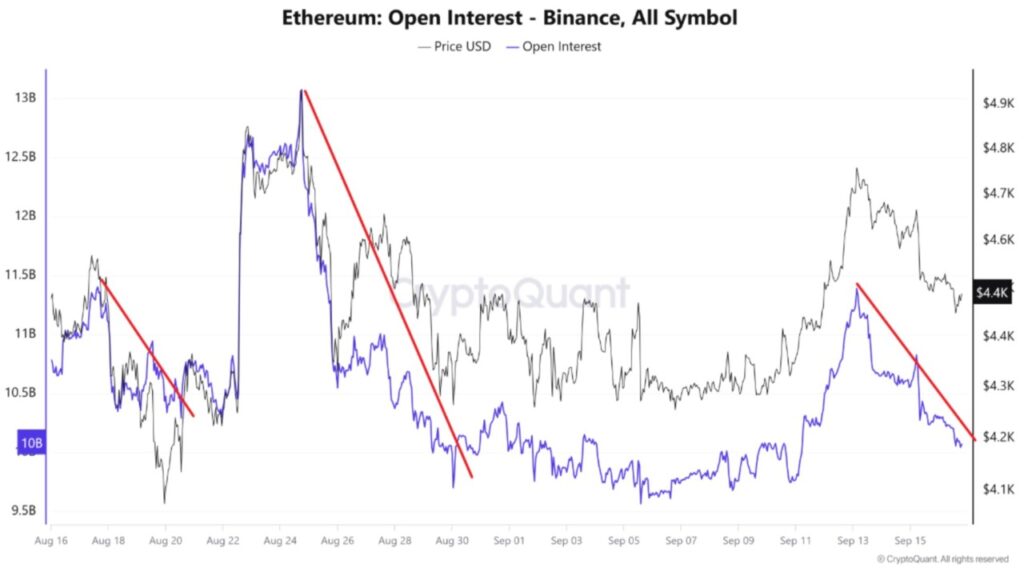

According to CryptoQuant’s Quicktake post by contributor burakkesmeci, Ethereum (ETH) may be nearing a local bottom. The analyst referred to Binance’s ETH open interest hourly time metric for his analysis.

In his analysis, burakkesmeci noted that based on the Binance ETH open interest metric, a local bottom has formed with an average decline of 14.9% over the past three months. On the spot market side, this correction typically results in an average decline of 10.7%.

Also Read: 5 Reasons Crypto Liquidation Risk Could Break Records in September 2025

Open Interest as an Indicator of Price Correction

The analyst stated that a decline in ETH open interest usually signals a correction in the previous spot price. For example, on August 17, Binance’s ETH open interest decreased from $11.4 billion to $10.2 billion, representing a 10.52% drop.

Similarly, on August 20, Binance ETH open interest fell from $13 billion to $9.7 billion, a correction of 25.38%. The last major drop in Binance ETH open interest was observed on September 13, when it fell from $11.39 billion to $10.4 billion. The analyst concluded:

Potential Ethereum Price Rise to $6,800?

Meanwhile, another analyst from CryptoQuant, PelinayPA, noted that the Fund Market Premium (FMP) remained neutral or positive between July and September 2025 – indicating renewed institutional demand. During the same period, Ethereum (ETH) has surged from $2,500 to $4,400.

For the uninitiated, FMP in the context of Ethereum measures the price difference between futures contracts and the spot market. Currently, with positive premiums dominating, the market is showing strong institutional support for Ethereum (ETH).

Also Read: 5 Reasons Crypto Liquidation Risk Could Break Records in September 2025

Stability and Potential of Ethereum

With strong institutional support and a rapid decline in exchange reserves, Ethereum (ETH) has the potential to touch $5,500 by September. However, the current pause in the Ethereum rally remains a point of concern. Currently, Ethereum is trading at $4,491, up 0.8% in the last 24 hours.

Also Read: 5 UK-US Crypto Cooperation Agenda that Could Accelerate Stablecoin Adoption

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Ethereum Bottom in Place, Analyst Says as Binance Open Interest Hits Record High. Accessed on September 19, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.