5 Facts on Hedera (HBAR) Price Pressure: Can it Survive Above IDR3,940?

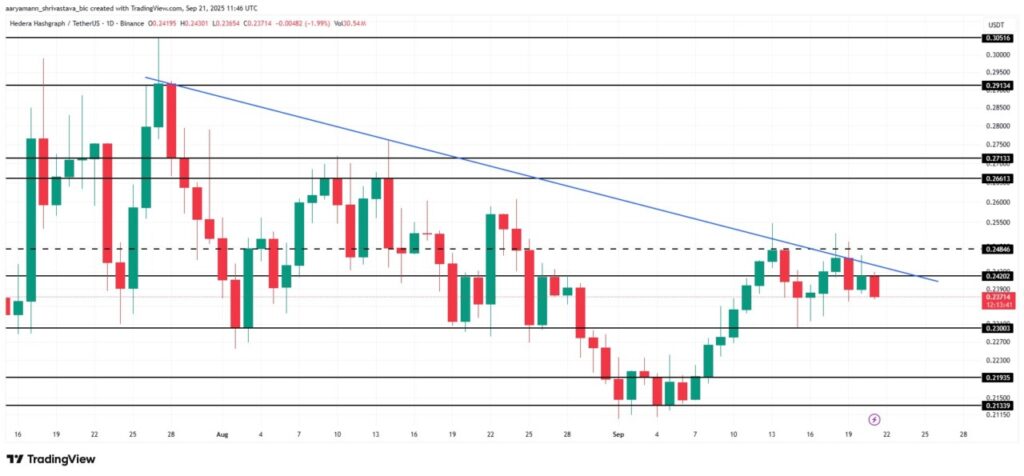

Jakarta, Pintu News – The price of Hedera (HBAR) is still stuck in the downtrend of the past two months. According to BeInCrypto analysis (21/9/2025), the token is trading at $0.237 (Rp3,940 at an exchange rate of Rp16,624/USD), failing to maintain the bullish momentum that had appeared earlier.

Technical indicators such as RSI and squeeze momentum are showing weakness, so the potential for an upward breakout is getting smaller. Investors are now watching key levels at $0.230 (IDR3,822) and $0.242 (IDR4,022) as short-term lower and upper limits.

Here are 5 major factors that influence the current HBAR price.

1. Two-Month Downtrend Limits HBAR’s Movement

HBAR has been moving in a downward pattern since July 2025. According to BeInCrypto, any attempt to break out of this trend failed due to the weak buying impulse.

If this trend continues, HBAR risks a return to the $0.230 (IDR3,822) level. Conversely, a recovery above $0.242 (IDR4,022) could pave the way towards $0.248 (IDR4,126).

Also Read: 3 Big Liquidation Risks in the Crypto Market in September 2025 that Traders Need to Be Aware of

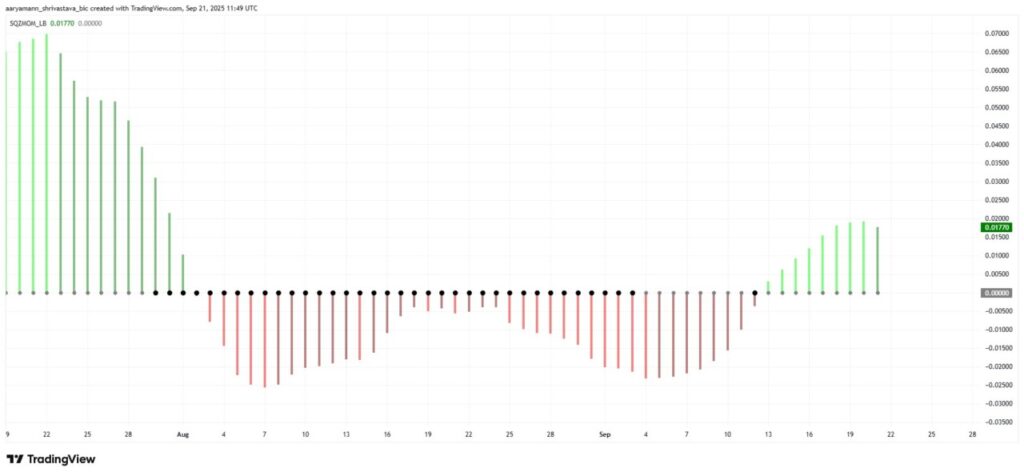

2. Squeeze Momentum Weakens, Bullish Signal Lost

The squeeze release momentum indicator that previously gave hope of a rally is now showing weakness. BeInCrypto believes that the weakening of this indicator reflects reduced speculative buying interest in Hedera.

Without new fund flows, tokens are likely to be vulnerable to selling pressure. This could also reinforce the skepticism of investors who were previously hoping for a rebound.

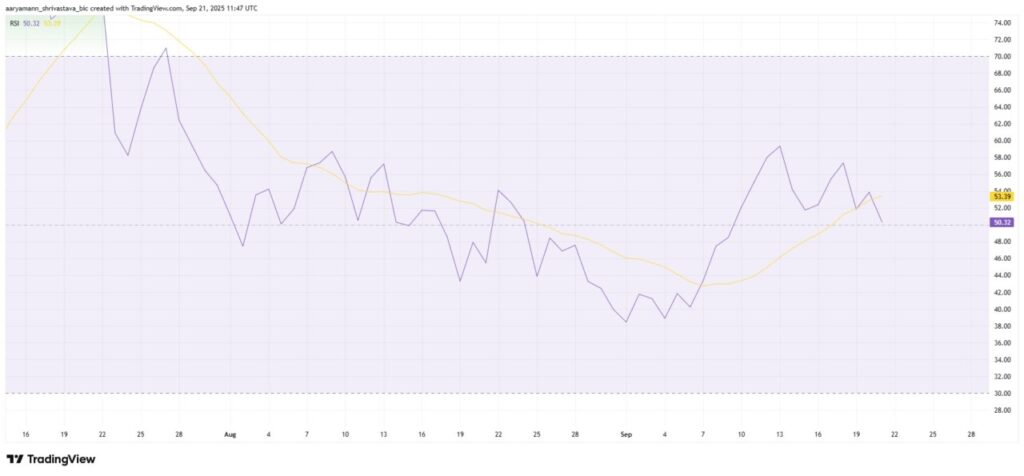

3. RSI Drops to Neutral, Beware of Additional Pressure

Technical data from TradingView quoted by BeInCrypto shows the Relative Strength Index (RSI) is approaching 50.0, signaling weakening bullish control.

If the RSI falls below 50, the bearish condition will get stronger. This situation could trigger additional sell-offs that make the price of HBAR even more difficult to hold.

4. Key Levels of $0.230 and $0.242 to Decide

HBAR’s price is currently at $0.237 (IDR 3,940), exactly between two important levels. According to BeInCrypto’s analysis, a drop below $0.230 could extend the bearish trend, while breaking $0.242 could potentially trigger a short rally to $0.248.

However, without strong volume support, the chances of a breakout remain limited. This makes HBAR more likely to have narrow consolidations rather than big rallies.

5. Crypto Market Sentiment Could Change Ara

Although technical indicators show weakness, the overall condition of the crypto market can still affect the direction of HBAR. BeInCrypto asserts that if the broader market, such as Bitcoin (BTC) or Ethereum (ETH), shows a bullish trend, HBAR could potentially rebound.

Conversely, if the crypto market becomes depressed again, investors may further lose interest in altcoins like Hedera. Macro factors remain key to medium-term price direction.

Conclusion: HBAR is vulnerable to pressure, but there are opportunities if the market recovers

Hedera (HBAR) price is currently at an important junction. With the downtrend, momentum indicator weakening, and RSI approaching the neutral zone, the short-term outlook is still bearish.

However, if the $0.242 level can be turned into support, the opportunity to head towards $0.248 opens up again. For cryptocurrency investors, this moment emphasizes the importance of technical analysis before taking positions in high-risk assets.

Also Read: Uniswap Price Prediction 2025-2031: Will UNI Remain Stable?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Aaryamann Shrivastava / BeInCrypto. HBAR Price Breakout Unlikely As Bullish Momentum Fades. Accessed September 22, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.