Bitcoin’s Strength Fades: 3 Signals Point to Weakness in Late September

Jakarta, Pintu News – Bitcoin (BTC) price continues to hold above $110,000, but started to show selling pressure in the last week of September.

A number of on-chain metrics and macroeconomic signals are now warning that the BTC rally may have lost its momentum. What are the warning signs? Check out the details below, based on BeInCrypto’s report.

3 Warning Signals for Bitcoin Price in the Last Week of September

Historical data shows that September carries a “curse” that has lasted more than a decade. It has consistently been the weakest period of the year.

Read also: Bitcoin Price Outlook: Analysts See Breakout Potential as Coinbase CEO Backs Crypto Bill

With about a week left, this pattern has the potential to reoccur as negative signals emerge.

1. On-Chain Signals: SOPR Shows Profitability Starting to Shrink

Analyst Joao Wedson, founder of Alphractal, highlights that the Spent Output Profit Ratio (SOPR) indicator is issuing bearish signals.

SOPR measures whether Bitcoin transactions on the network are still making a profit or losing money.

- A value above 1 indicates the seller is still in profit (selling BTC higher than the purchase price).

- A value below 1 means that the seller is at a loss (selling below the purchase price).

Currently, SOPR is still above 1, but the trend is starting to decline. This indicates that the profitability of on-chain transactions is starting to weaken.

Historically, the red area on the chart marks the peak of Bitcoin’s price in previous cycles. Wedson explains that during periods like these, investors tend to buy too late and at too high a price.

“The SOPR Trend Signal is great at showing when profitability on the blockchain starts to dry up. Never in Bitcoin’s history have investors accumulated BTC so late and at such a high price,” Wedson explained.

Wedson also added that the short-term holder realized price (STH realized price) is currently at around $111,400, which is almost the same as the current market level. If the price falls below this threshold, there is a potential trigger for stop-loss selling. Worryingly, BTC had already fallen below this level in the last week of September.

In addition, while the current Bitcoin price is higher than in previous cycles, the Sharpe ratio is weaker. This means that the risk-adjusted returns are lower, as are the potential gains.

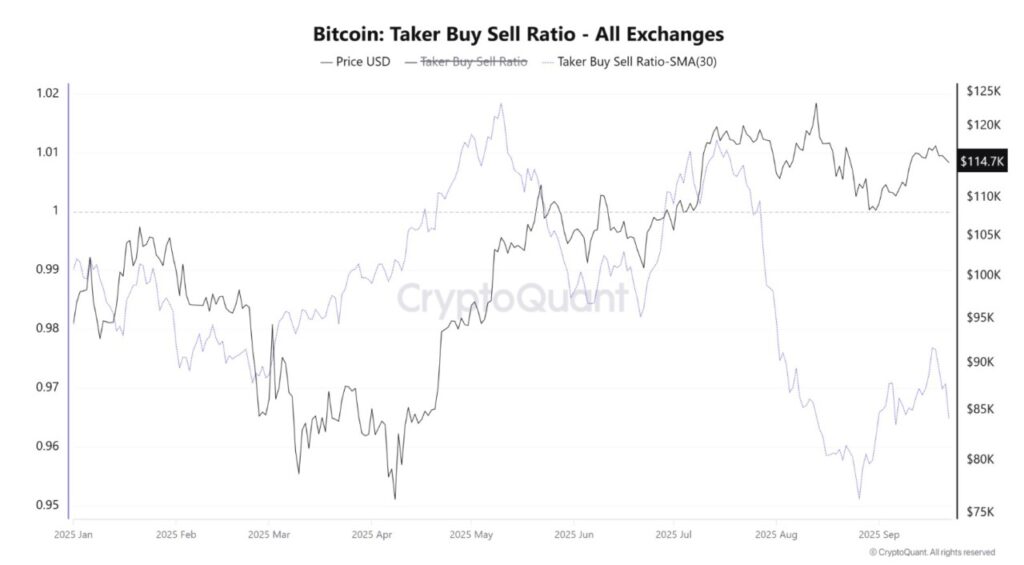

2. Signals from the Exchange: Taker Buy/Sell Ratio Drops Sharply, Selling Pressure Dominates

Data from CryptoQuant shows that the buy/sell taker ratio across exchanges has dropped below the 1 mark in recent weeks. This pattern is also reinforced by the SMA30 (30-day simple moving average) which follows the downward trend.

This indicates that active sell volume (taker sell) is now greater than buy volume, reflecting a negative sentiment among traders. Historically, when this ratio stays below 1, Bitcoin often faces downward pressure – especially if the price is already near its highs.

Read also: Arthur Hayes Sells $5.1 Million in HYPE Weeks After Bold 126x Forecast — Buys a Ferrari Instead

This signal clearly shows that the bullish momentum is starting to weaken. Without any new capital flows, the last week of September risks being a point of reversal.

3. Macro Signals of DXY

Since the Federal Reserve’s latest decision to cut interest rates, the US Dollar Index (DXY) has rebounded. Its value rose from 96.2 points to 97.8 points.

Some analysts warn that the inverse correlation between DXY and BTC could reappear, meaning there is a downside risk to Bitcoin prices.

Killa analysts present a broader scenario: if the DXY continues to recover, then Bitcoin has the potential to reverse course-as it did in 2014, 2018, and 2021.

Taken together, these three signals-on-chain (SOPR declining), exchange-based (taker buy/sell ratio weakening), and macro (DXY rebounding)-further reinforce Bitcoin’s “September curse”. If history repeats itself, the last days of this month could be a real confirmation.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Warning Signs of Bitcoin Exhaustion in the Final Week of September. Accessed on September 23, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.