Big Changes at DEX Solana: Stablecoins Replace Meme Coin Speculation

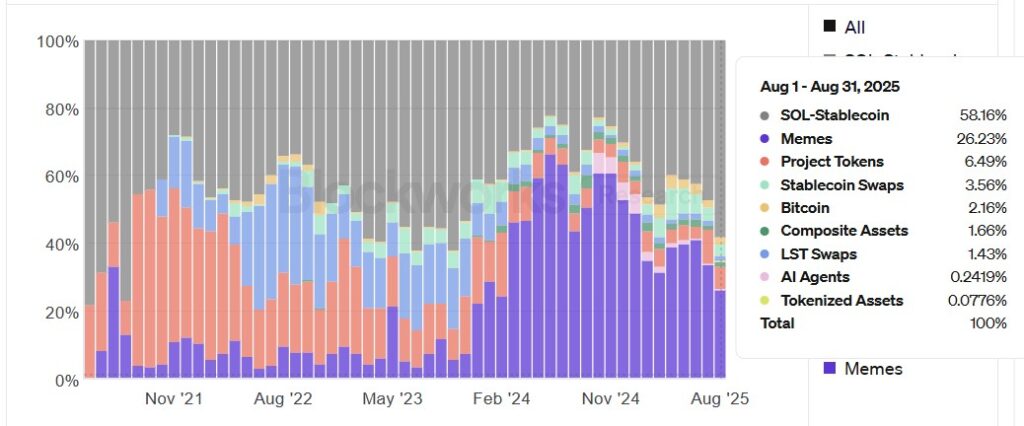

Jakarta, Pintu News – The decentralized exchange (DEX) market on the Solana (SOL) network is experiencing a significant shift. Trading activity that was previously dominated by meme coin speculation is now shifting to more stable stablecoin transactions.

Meme Coin’s Decline in Dominance

The meme coin that was the belle of the ball on Solana’s DEX is now starting to lose its luster. At the beginning of the year, tokens such as TRUMP and MELANIA sparked a wave of high speculation, but a series of scandals such as the LIBRA crash have undermined investor confidence.

As a result, in September, the contribution of meme coins to Solana’s DEX trading volume fell below 30%, the lowest figure since February 2024. This decline was also followed by a reduction in the number of active traders, from a peak of 4.8 million daily users in January to less than 800,000 in September.

The repeated failures and scams that have occurred in the launch of several tokens have reduced the interest of retail investors. Data from Dune Analytics shows that this fragile market confidence is forcing many traders to seek safer and more stable investment alternatives.

Also Read: 3 Big Liquidation Risks in the Crypto Market in September 2025 that Traders Need to Be Aware of

Increased Stablecoin Trading

In response to market volatility, traders are now favoring stablecoins as a primary trading instrument. Data from Blockworks shows that transactions between Solana (SOL) and stablecoins like Tether (USDT) accounted for nearly 58% of total DEX volume, the highest figure since November 2023.

In addition, stablecoin-to-stablecoin trading has also increased, now accounting for around 4% of trading activity. This shift signals that the Solana ecosystem is moving from a speculative phase to a more mature and stable one.

With the total value of stablecoins in the ecosystem increasing from $5 billion at the beginning of the year to over $12 billion, it’s clear that there is an increased trust and need for liquid and less volatile assets.

Solana’s Future Prospects

While the hype cycle of speculative tokens may still continue, the Solana network seems to be building a stronger foundation with a focus on stable and widely used assets.

Market observations show that this transition is not just a phase, but rather an evolution of the Solana ecosystem that shows maturity and adaptation to changing market needs.

With stablecoins as the primary choice, Solana has the potential to become more attractive for institutional strategies and cross-border payments. This signals a new era for Solana, where stability is key to long-term growth.

Conclusion

The changes taking place in Solana’s DEX mark a new era in crypto, where security and stability are top priorities. The shift from meme coin speculation to stablecoin trading demonstrates the market’s adaptation to the needs of today’s investors. With a stronger foundation, Solana is ready to face future challenges and meet the expectations of the global market.

Also Read: Uniswap Price Prediction 2025-2031: Will UNI Remain Stable?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Solana DEX Traders Abandon Meme Coins. Accessed on September 22, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.