With DOGE Down 3% Today, What Does Its Long-Term Future Hold?

Jakarta, Pintu News – Dogecoin’s (DOGE) rise in September, which broke through long-term resistance levels, was short-lived.

After a sharp 20% drop, the token is now at risk of falling through a rising wedge pattern, which could reduce confidence in the strength of this rally.

However, the charts tell a different story. Technical calculations indicate that the current weakness is likely only a short-term correction, while opening up opportunities for the next upward movement.

Let’s take a closer look at the reasons behind the pressure Dogecoin has been under, and whether it can recover before the month is out.

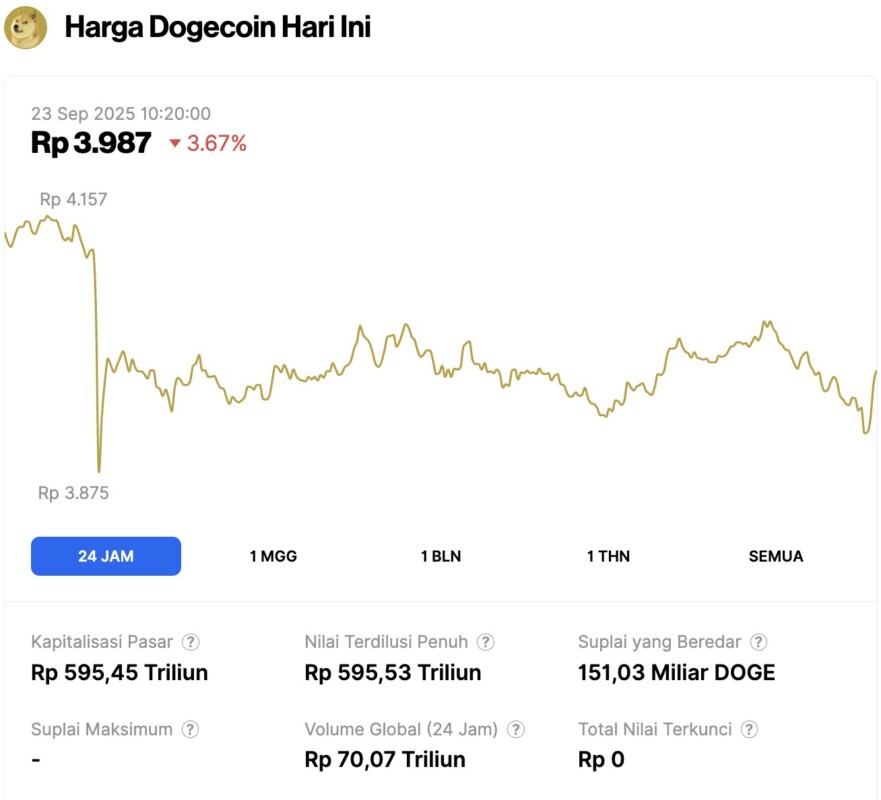

Dogecoin Price Drops 3.67% in 24 Hours

On September 23, 2025, Dogecoin’s price slipped 3.67% over the past 24 hours, settling at $0.2404 (around IDR 3,987). During the day, DOGE traded within a range of IDR 4,157 to IDR 3,875.

At the time of writing, Dogecoin holds a market capitalization of roughly IDR 595.45 trillion, with a 24-hour trading volume of about IDR 70.07 trillion.

Read also: Bitcoin’s Strength Fades: 3 Signals Point to Weakness in Late September

Dogecoin Price Analysis

On the weekly chart, the price of DOGE is seen moving up following an ascending support trend line since October 2023. The price has bounced off the trend line several times, with the most recent touch occurring in June 2025 (green icon).

Although Dogecoin managed to form a higher high and higher low pattern, there is no certainty whether this movement was impulsive.

In August, DOGE briefly peaked at $0.306, but failed to hold.

The subsequent decline confirmed the 0.5 Fibonacci retracement resistance area at $0.307 as a key level to break if the uptrend is to continue.

Although Dogecoin has not been able to breakout, momentum indicators are giving positive signals. The Relative Strength Index (RSI) is above 50, and the Moving Average Convergence/Divergence (MACD) is showing positive values.

Overall, the weekly chart is still displaying conflicting signals, so the direction of the long-term trend is yet to be confirmed, whether bullish or bearish.

Why is the Dogecoin price falling?

Unlike the weekly chart, the daily chart (22/9) of DOGE shows a clearer bearish signal for several reasons. First, the price of DOGE is moving inside an ascending wedge pattern, which is generally considered a bearish pattern.

Dogecoin has also completed a five-wave upward movement (green) within this wedge, confirming the formation of a leading diagonal. In addition, the symmetrical triangle pattern in the fourth wave reinforces the validity of this count.

When combined with the condition of RSI and MACD (black circles) which have just dropped past their bullish boundaries at 50 and 0 respectively, the short-term trend of DOGE can be said to be bearish.

Read also: Dogecoin (DOGE) Breakout to $0.41 Still Possible? Here are 3 Reasons

In the event of a downward breakout of the wedge, DOGE prices could potentially find a support area between the 0.5-0.618 Fibonacci retracement level, which is around $0.197 – $0.218.

Dogecoin Long Term Prediction

Although the short-term wave count shows a bearish trend, the long-term projection is still bullish. Based on wave analysis, the Dogecoin price has completed five (green) upward waves that started in June 2022.

If this count is correct, the ongoing rise is the start of the next five waves of the rally (green), which could potentially take Dogecoin towards new cycle highs.

The possible correction of the current wedge pattern could be the second wave in the five-wave series of the bull run.

Once the correction phase is over, the Dogecoin price is expected to start a new rally that could potentially push it to the $1 level.

Dogecoin Outlook in September

Dogecoin’s short-term structure looks fragile, with an ascending wedge pattern signaling bearish momentum and technical indicators confirming downward pressure.

However, the long-term Elliott Wave count still supports the continuation of the bullish trend, so the correction is likely to be temporary.

If DOGE is able to hold at the current Fibonacci support area, the opportunity for another strong rally remains open, potentially paving the way towards the $1 level in the next major cycle.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

- Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Dogecoin’s (DOGE) September Crash Explained – Why DOGE’s Next Move Could Be Bullish. Accessed on September 23, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.