5 RippleX Strategies to Attract Institutional Investors: DeFi, Credit, and Tokenization at XRPL

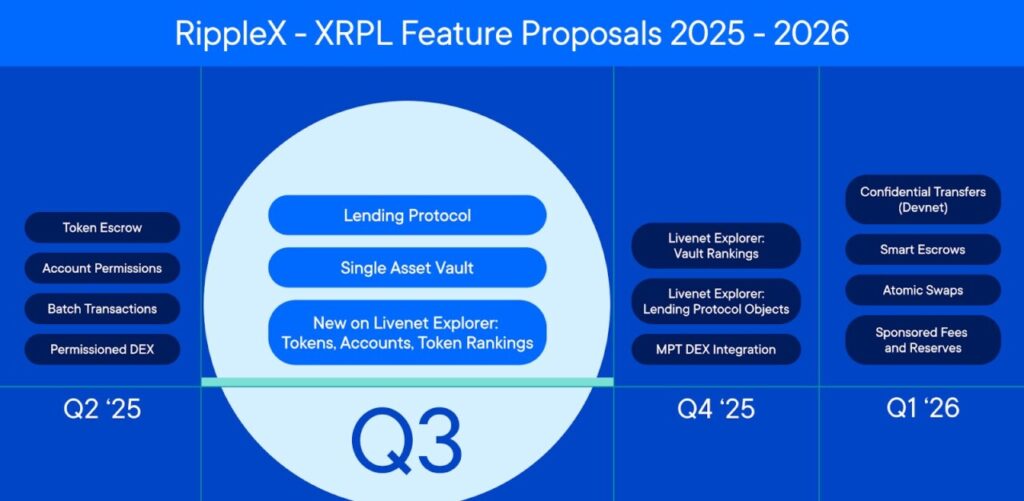

Jakarta, Pintu News – RippleX, the innovation division of Ripple, has just launched their latest XRPL Institutional DeFi Roadmap on September 22, 2025. The initiative is designed to attract institutional capital into the XRP Ledger (XRPL) ecosystem, with a primary focus on compliance, lending, and privacy based on blockchain technology.

In its official release quoted from BeInCrypto RippleX stated that they are ready to welcome global regulation with various features that are already active and new features that will be launched in the XRPL 3.0.0 version.

1. Compliance Feature is On: “Credentials” and “Deep Freeze”

Two important compliance features that are already live are Credentials and Deep Freeze. These features allow institutional actors to comply with the rules while still operating on the public blockchain.

RippleX asserts that this compliance-based approach is a key requirement to attract big players in the global financial sector, such as banks and asset managers.

Also Read: 5 Shocking Facts About AVAX: Up 10.52% in 24 Hours, Price Breaks IDR 583,000!

2. XRPL 3.0.0 Will Bring Native Lending Protocol

The XRPL 3.0.0 version to be released this year will include a native lending protocol. The aim is to build a low-cost, regulation-compliant credit market, provided there is liquidity support.

According to RippleX, the success of this feature will largely determine whether institutions are willing to step in and provide capital on a large scale.

3. ZKP & MPT Technology Available in 2026

RippleX is also developing a zero-knowledge proof (ZKP) integration to deliver private yet compliant transactions. This ZKP will be integrated with new tokens called Confidential Multi-Purpose Tokens (MPTs), which are scheduled to launch in early 2026.

MPT will allow token issuers to have dedicated compliance tools to run legally compliant decentralized finance (DeFi).

4. Stabilcoin Volume Reaches $1 Billion & Enters RWA Top 10

XRPL currently has a stablecoin transaction volume of $1 billion per month, and is in the top 10 blockchains with the highest real-world assets (RWA) activity.

RippleX cites this as proof that institutional DeFi on XRPL is already thriving, and is no longer just a concept.

“XRPL is now poised to become the premier platform for stablecoin payments and collateral management,” RippleX said in an official statement.

5. Challenges: Competing with Ethereum, Solana, and Avalanche

Despite its strong roadmap, XRPL still has to face competition from ecosystems like Ethereum and its layer-2, as well as fast blockchains like Solana and Avalanche that are also eyeing the tokenization market and institutional investors.

The success of this roadmap is highly dependent on attracting liquidity and investor confidence, as well as the effective integration of new features on a global scale.

Conclusion

RippleX’s latest roadmap emphasizes its strong commitment to integrating the traditional financial world with blockchain-based DeFi technology. Features such as compliance tools, lending protocols, and ZKP-based tokenization make XRPL appear as a platform that is ready to face regulatory demands without losing the essence of decentralization.

The year 2026 could be a watershed moment for XRPL, not just as a blockchain network for XRP, but as a digital finance backbone connected to global institutions.

Also Read: 5 Facts on Hedera (HBAR) Price Pressure: Can it Survive Above IDR3,940?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Harsh Notariya, BeInCrypto. RippleX Unveils XRPL Institutional DeFi Roadmap: Will it Attract Institutional Capital?

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.