Discovering Aster Crypto: Could It Rise to Challenge Hyperliquid?

Jakarta, Pintu News – Less than a year old, the decentralized exchange (DEX) Aster has gone from newcomer to serious contender in the highly competitive derivatives market.

What makes Aster crypto different from other DEXs?

Getting to know Aster Crypto

On September 17, Aster officially launched the $ASTER token, followed by a listing on Binance a day later. The debut immediately created a big buzz.

Read also: PancakeSwap Now Comes with Crosschain Swap Feature on Solana, Rivals Aster Crypto!

Within 24 hours of the token generation event (TGE), $ASTER had surged by 1,650% at its peak, generating $310 million worth of trading volume and pushing total transactions on the platform beyond $1.5 billion.

The launch was also reinforced by ambitious community initiatives. Aster allocated 53.5% of the total token supply to one of the world’s largest airdrops DeFi – a strategic move to reward early supporters while maintaining growth momentum.

In just one day, nearly 330,000 new wallets joined the network, making the total value locked (TVL) break the $1 billion mark. These figures show how quickly Aster is developing into a real challenger in an industry that has been dominated by giants like Hyperliquid (HYPE).

What Makes Aster Crypto Different?

Aster is not a project that came out of nowhere. It was born from the merger of Astherus, a multi-asset liquidity protocol, with APX Finance, a perpetual trading platform.

With support from YZi Labs (formerly known as Binance Labs), Aster entered the market with a strong reputation. Since then, Aster has processed over $500 billion in cumulative trading volume, collected 1.8 million user addresses, and generated up to $49 million in revenue.

Aster’s strength lies in its innovation. The platform operates on various blockchains such as Ethereum (ETH), BNB Chain, Arbitrum (ARB), and Solana (SOL), thus offering broad access. Aster also introduces a privacy order feature that hides traders’ positions – something rarely seen in decentralized trading.

From a cost perspective, Aster is highly competitive: transaction execution in milliseconds with no gas fees, making it able to rival centralized exchanges in terms of speed and efficiency.

Read also: 4 New Crypto Airdrops Catching the Community’s Attention Right Now

More than just crypto, Aster is also expanding the boundaries by introducing perpetual contracts based on US stocks such as Tesla (TSLAX) and Apple (APPLX). These “stock perpetuals” products allow traders to gain 24-hour exposure without having to rely on traditional brokers.

To improve security and reliability, Aster is integrated with Pyth Network (PYTH) to provide accurate price data.

Way Forward

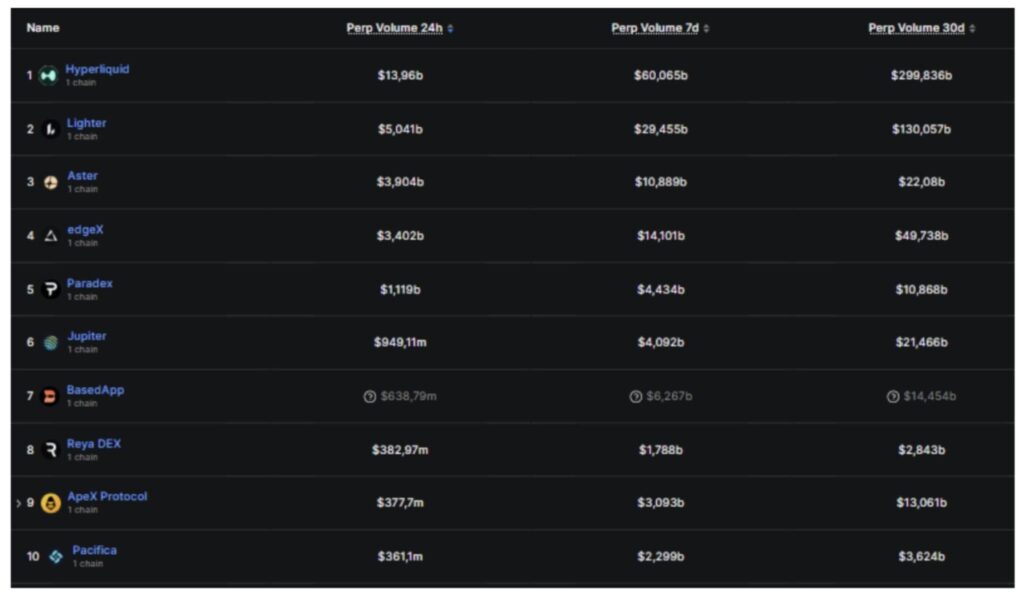

The decentralized derivatives market is growing rapidly, with monthly trading volumes reaching nearly $630 billion last August, according to DeFiLlama data.

While Hyperliquid still reigns supreme, Aster’s surge in growth begs the question: can it become the next leader? With a combination of strong ecosystem support, innovative features, and competitive costs, Aster is well positioned to capture more market share.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AltcoinBuzz. Why Aster Can Be the next Hyperliquid? Accessed on September 23, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.