21Shares Officially Launches Dogecoin ETF on DTCC!

Jakarta, Pintu News – The cryptocurrency market continues to evolve with the latest innovation from 21Shares which launched the Dogecoin (DOGE) ETF listed on the Depository Trust & Clearing Corporation (DTCC).

This move marks a new era in digital asset investment, attracting the attention of both institutional and retail investors.

Launch of Dogecoin ETF by 21Shares

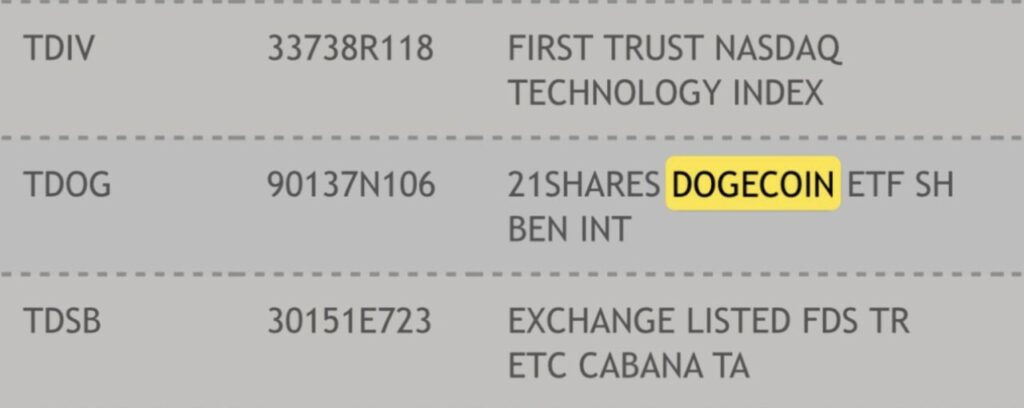

21Shares, a Swiss-based asset management company, has announced the launch of a Dogecoin ETF with the code TDOG on the DTCC platform.

Read also: Pepe Coin Price Prediction: Analyst Ali Martinez Says Large Triangle Pattern Indicates a Spike

While this is a first step, the SEC still has to give final approval before ETFs can be officially traded. This process involves a public comment period and feedback rounds from the agency, with a final decision scheduled for early 2026.

This ETF, if approved, will hold Dogecoin (DOGE) directly, as opposed to futures-based products. This allows investors to gain regulated access to the actual Dogecoin (DOGE) market price, without having to manage the token directly.

Coinbase Custody Trust Company will act as the custodian of the assets, ensuring the safety of the investment.

Institutional Acceptance and its Impact on Dogecoin Price

Dogecoin’s acceptance by financial institutions is growing, as demonstrated by the massive purchase by CleanCore Solutions who added 100 million Dogecoin tokens to their coffers. This increased their total holdings to over 600 million tokens, with a cash value of over $160 million.

In addition, Alex Spiro, a lawyer for Tesla CEO Elon Musk, is leading a company that manages Dogecoin’s cash, with plans to raise $200 million. This rise shows that Dogecoin is not just a speculative asset, but is also gaining acceptance as part of mainstream investment portfolios.

This trust may encourage more institutional investors to include Dogecoin (DOGE) in their investment strategies, potentially boosting demand and the token’s price.

Read also: PancakeSwap Adds Cross-Chain Swap Support for Solana as Rivalry with Aster Heats Up

Broader Implications for Crypto ETF Market

The launch of the Dogecoin ETF by 21Shares marks a continuation of the company’s efforts to expand their crypto investment product range. It demonstrates a growing trend where more diverse and niche-oriented digital assets such as meme coins are starting to be recognized in regulated investment products.

This ETF offers an alternative for investors seeking exposure to digital assets with high liquidity and broad social attention, without having to face the complexities of owning digital assets directly.

This ETF structure also reduces concerns about storage and security, allowing investors to focus on trading strategies. This paves the way for further integration between traditional finance and the growing crypto ecosystem, bridging the gap that may have previously deterred some investors.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 21Shares Launches Dogecoin ETF on DTCC. Accessed on September 24, 2025

- Coingape. 21Shares’ Spot DOGE ETF Secures DTCC Listing as Expert Predicts Dogecoin Rally. Accessed on September 24, 2025

- TheCryptoBasic. 21Shares Dogecoin (DOGE) ETF Listed on DTCC. Accessed on September 24, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.