Altcoin Season Index Hits 100: What It Could Signal for the Crypto Market in Q4 2025

Jakarta, Pintu News – A week before the end of Q4, the market moved back to early September levels. The Fear & Greed index dropped back into the “fear” zone.

Bitcoin (BTC) is only 3% above its monthly opening price of $108,000. Similarly, the total market capitalization (TOTAL) is holding about 3% above its monthly base level of $3.70 trillion.

Market Almost Erased 97% of Gains

Citing AMB Crypto’s report (24/9), the market has erased nearly 97% of September’s gains. However, altcoins have been the hardest hit, with TOTAL2 (market capitalization without BTC) plummeting 4.43% – double BTC’s loss – after being rejected at an important resistance level.

Read also: Bitcoin Holds Steady at $112K (Sept 25): Will It Slip Under $110K or Rebound Toward $115K?

Even so, this time there is quite a difference. Unlike in late Q2 and early Q3, when ETH’s (ETH.D) dominance almost doubled to 15% and TOTAL2 jumped 30% (adding $510 billion to altcoins), this time ETH.D went the opposite way, signaling a weak rotation to altcoins.

To give you an idea, since its mid-August peak of 15%, ETH.D has been on a downward trend, while TOTAL2 is stuck at $1.73 trillion. This means that altcoins are no longer getting the boost from ETH that they used to, so capital remains locked up elsewhere.

Altcoin market weakens, while BTC remains strong

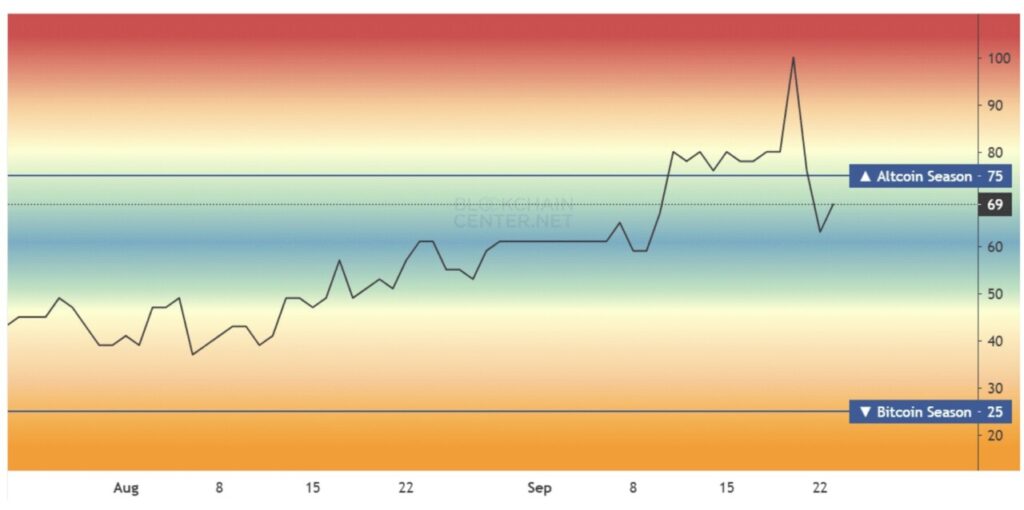

Despite the weakening dominance of ETH (ETH.D), the Altcoin Season Index actually surged. The index, which was previously stuck around the 80 level, finally broke the 100 mark on September 19.

The trigger? A large capital inflow into altcoins after the launch of Aster (ASTER), which pushed the index to a seven-year high.

Read also: ASTER Token Soars 30% as Analysts Forecast Further Upside

However, the rally did not last long. As of September 24, the index had fallen back to 69 – only 10% above the September opening level. In conclusion, this is no longer “Altcoin Season”, but rather more speculative capital flows.

In short, capital rotation into altcoins is starting to weaken. This is reinforced by Bitcoin’s (BTC.D) 1.01% week-on-week rise in dominance (the only metric still holding above September levels), while ETH.D actually fell 2.86%. This signals a capital backflow towards BTC.

With TOTAL2 on hold, the fading ETH/BTC rotation, and increasing speculation on smaller altcoins, the altcoin market seems poised for a deeper correction – making it an important divergence to watch for in Q4 strategies.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Altcoin Season Index hits 100: What this means for Q4 2025. Accessed on September 25, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.