Avantis (AVNT): Can the Bulls Stage a Comeback After a 30% Drop?

Jakarta, Pintu News – Avantis (AVNT), a perpetual DEX exchange, has doubled in price in recent days. The platform received backing from Peter Thiel’s Founders Fund and Base.

AVNT’s price jumped from $1 to $2.4 as traders jumped on the bandwagon of rotation to perpetual DEX fueled by Aster (ASTER), a project backed by Changpeng Zhao (CZ).

As of September 24, the DEX perpetual sector is up around 20% – signaling a high risk appetite in the market. However, this also begs the question: is this trend of high interest strong enough to reverse the 30% correction AVNT just experienced?

Assessing AVNT Recovery Opportunities

Read also: XRP Price Could Soar to $9.6 or $33, Analyst Suggests Based on Chart Patterns

The latest AVNT price increase that started on September 19 was also driven by Binance’s airdrop to its users. Around 10 million AVNT, or 1% of the total supply (1 billion), were distributed through the airdrop and triggered a surge in interest.

However, trading of the DEX perpetual token lost steam after most assets recorded gains of more than 8 times the initial listing price. AVNT was also dragged down by profit-taking, dropping more than 30% from $2.6 to $1.7, before finally breaking back through the $2 level at the time of writing.

Can the bulls regain control? The $1.5-$1.7 zone seems to double as a gold ratio as well as an important support area, which could potentially be the foundation for a bullish trend reversal.

In fact, the latest rebound above $1.7 came after centralized exchanges like OKX announced the listing of AVNT.

If the momentum continues, the $2.5-$2.6 target could provide an additional profit potential of around 30% for late-entry bulls. However, a sustained drop below $1.5 will invalidate the bullish scenario and risks accelerating selling pressure down to the $1 level.

New Support at $1.7?

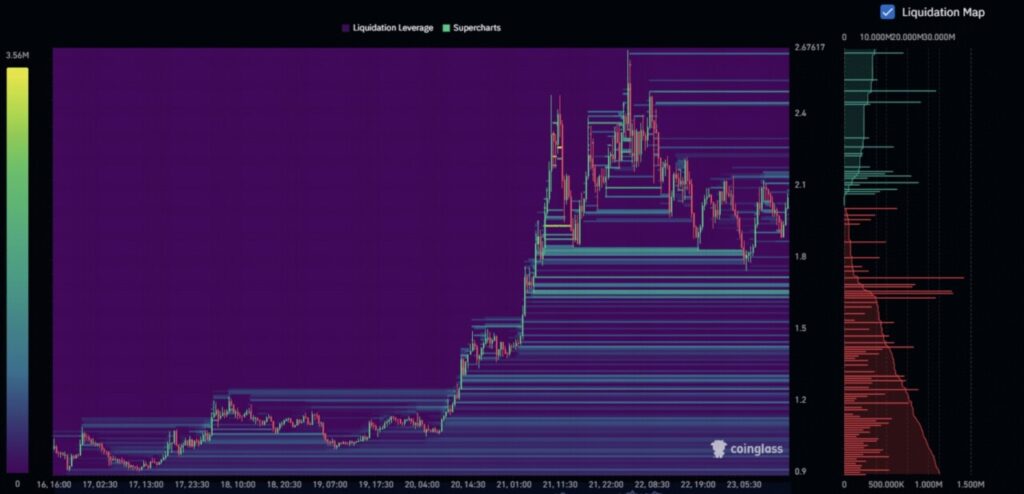

The previous analysis was also reinforced by the weekly liquidation heatmap data. In fact, the data shows that there is considerable long leveraged liquidity around $1.7, which could potentially become a “price magnet” in the near future.

Read also: Can Shiba Inu Really Hit $1? The Math Tells a Different Story

Meanwhile, on the upside, there are important liquidity pools as well as price targets at the $2.1 and $2.5 levels, making it a key target for a bullish move.

Simply put, the area of lower liquidity appears to align with the golden zone on the price chart. This makes the $1.5-$1.7 range an important support level in the short term.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Avantis (AVNT) – Can AVNT bulls reverse the 30% correction?. Accessed on September 25, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.