7 Strategies for Finding Potential Coin Memes on Pump.fun According to ChatGPT

Jakarta, Pintu News – Meme coins on Pump.fun appear every day, but most quickly disappear from the market. This begs the question: how to find tokens that really have potential? The prompt posed to ChatGPT was: “how to find potential meme coins on Pump.fun?”

This article summarizes 7 key strategies from ChatGPT’s answers – from reading social media signals to being disciplined in risk management. Read the full article here!

Coin Meme Trends in the Crypto World

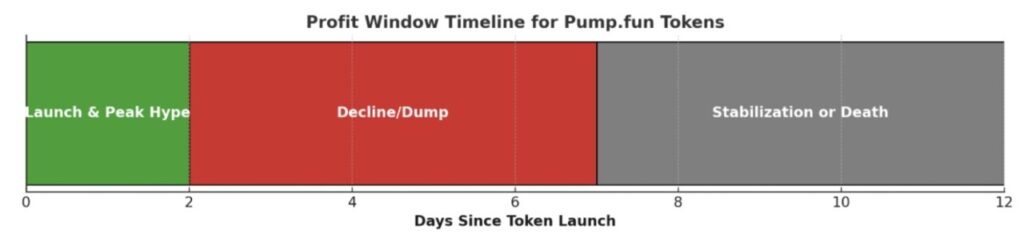

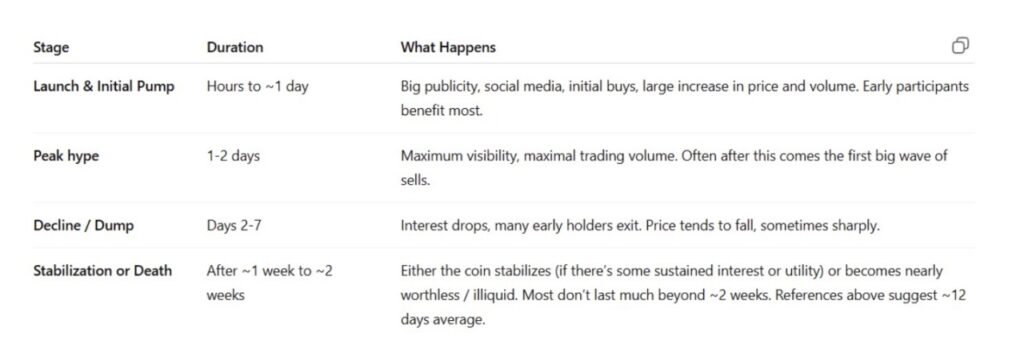

Pump.fun has become one of the most interesting phenomena in the cryptocurrency world. The platform launches thousands of meme coins every day, but most of them only last a few hours. While the risks are high, there is also the potential for huge returns for some investors who are able to read the momentum correctly.

The main challenge is to find tokens that have a chance to thrive for longer than just a momentary trend. Here, artificial intelligence (AI) can help provide data analysis and early signals, although it certainly cannot guarantee success.

Early Signals to Watch Out for

Many coin memes on Pump.fun die before they have a chance to grow. Therefore, early indicators such as spikes in conversations on social media can be important signals. A rise in interactions on X (Twitter), Telegram or Discord often precedes an increase in trading volume.

For example, Moo Deng (MOODENG) originally appeared as a joke, but it quickly caught the attention of the community. After gaining the support of sufficient trading volume, the coin lasted longer than the majority of other tokens.

Also read: 5 Coin Memes That Have a Bright Future According to ChatGPT

Relationship between Volume and Hype

Analysis shows that the hype on social media does not always align with trading volume movements on the blockchain. There are coins that are talked about but not heavily traded, and conversely, there are coins that have high volumes without community support.

Ideally, these two factors go hand in hand. For example, if in a short period of time a token increases from 50 SOL to 5,000 SOL and is accompanied by a spike in social media conversation, this could be an indication of more real market interest.

Potential Risks and Red Flags

Pump.fun also has a number of risks to be aware of. One of them is the concentration of tokens in a few wallets, which could increase the potential for a rug pull. If a large portion of the supply is controlled by a particular party, they could potentially sell in bulk and push down the price.

The case of Gen Z Quant (QUANT) can serve as an example. The token’s capitalization spiked to around Rp1.17 trillion ($70 million), but soon fell after its creator sold most of the tokens. Checking the distribution of holders early on can help avoid a similar situation.

Also read: Tom Lee’s Prediction: Ethereum (ETH) Could Reach$12,000 by the End of the Year!

The Role of Memes and Virality Factors

Unlike Bitcoin (BTC) or Ethereum (ETH) which have technical utility, meme coins rely heavily on the virality factor. A simple or funny idea can trigger early adoption, though it doesn’t always last in the long run.

However, virality is hard to predict. A meme that is deemed interesting does not always gain community support. MOODENG survives because it enjoys a combination of community appeal and market liquidity, something that most other tokens lack.

The Importance of Exit Plans and Risk Management

In addition to determining when to enter, investors also need to plan an exit strategy from the start. Setting a profit target, such as 5x or 10x, can help maintain discipline. Taking a portion of the profits at the beginning can be a wise move to reduce the risk if the trend reverses.

As in the case of Gen Z Quant, capitalization briefly exceeded Rp1.42 trillion ($85 million) but then fell sharply. Those who took early profits were able to protect their capital, while those who waited too long ended up incurring losses.

Read also: 3 Cryptos that were Most Wanted in the 4th Week of September 2025

Data and Analysis Tools

The use of real-time data is one of the keys to following the Pump.fun trend. On-chain monitoring tools to see wallet distribution, liquidity, and new token launches can provide additional information.

On the other hand, monitoring social media sentiment is also important to see if community interest is truly organic or just a short-term boost. The combination of the two can help investors assess opportunities more rationally and reduce reliance on speculation alone.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. What ChatGPT Says About Finding the Next Big Pump.fun Meme Coin. Accessed September 27, 2025.

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.