Celestia’s Upgrade and Proof-of-Governance: Could This Be the Turning Point for TIA’s Price?

Jakarta, Pintu News – Celestia (TIA) is entering an important stage with two fundamental changes: the Matcha upgrade and the proposed Proof-of-Governance (PoG). These technical improvements, coupled with a tokenomic restructuring, have the potential to transform TIA from a highly inflationary token to a possibly deflationary asset.

As community expectations rise and the ecosystem rapidly evolves, the question arises: will TIA be able to grow and push boundaries strongly in the coming years?

Matcha: Technical Improvement and Supply Tightening

According to Celestia’s official announcement, the Matcha upgrade will increase the block size to 128MB, optimize block propagation, and improve performance through the CIP-38 proposal.

Read also: Trader James Wynn Predicts Hyperliquid’s Slow Demise Following ASTER’s Massive Crypto Rally

More importantly, the CIP-41 proposal lowers the annual inflation rate from around 5% to 2.5%, which directly tightens the supply of TIA in circulation. These changes make TIA more attractive to long-term investors while strengthening its role as a potential collateral asset in the DeFi space.

Aside from the supply side, Matcha is also expanding the blockspace available for rollups, removing token filter barriers for IBC/Hyperlane, and positioning Celestia as a key data availability (DA) layer for other chains.

This provides the foundation for a new revenue stream, where DA fees from the rollup can be redirected to support the future value of TIA.

PoG: The Road to Deflationary Tokens?

The next highlight is the Proof-of-Governance (PoG) proposal. According to Kairos Research’s analysis, PoG has the potential to lower the annual issuance rate to just 0.25% – or a 20-fold decrease from current levels.

With such a sharp decline, the income threshold required for the TIA to become deflationary is very low.

“Our review shows that TIA has the potential to transition from an inflationary token to a deflationary asset, or at least close to zero inflation, under the right conditions,” Kairos Research said.

Some experts argue that even DA fees alone may be enough to push TIA into deflationary territory. Coupled with new revenue sources, such as ecosystem stablecoins or revenue-generating DATs, this could “completely flip the TIA tokenomic narrative”. This perspective reinforces the community’s belief that Celestia could be an ideal model of aligning token value with real business performance.

Even Mustafa Al-Bassam, one of Celestia’s co-founders who was initially skeptical of PoG, has now changed his view. He compares the system to robust decentralized structures like ICANN and IANA, which are able to outlast centralized applications without having to centralize power.

Read also: Pi Network Price Prediction: PI Remains Stable Amid AI-Based KYC Launch & CEX Outflows

“This view is in line with Celestia’s vision: by enabling verifiable light nodes, the network ensures that validators do not need to be fully trusted in terms of veracity, thus maintaining security without centralizing power,” Mustafa Al-Bassam explained.

If Celestia manages to make it happen, PoG could be a very positive step for the entire network.

TIA: Expectations Are High, But Risks Remain

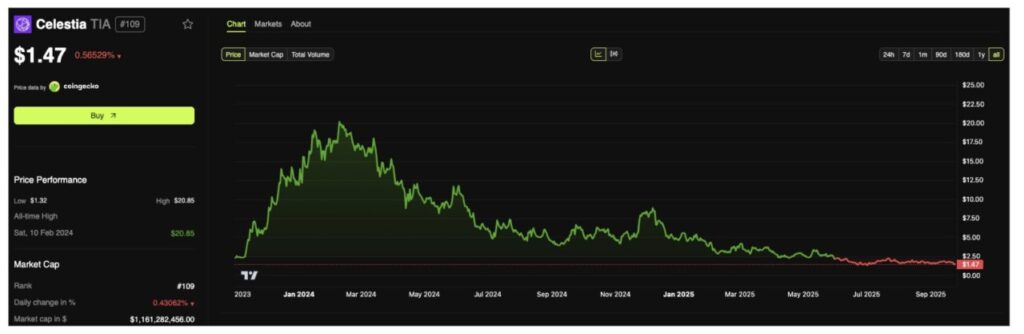

In terms of price, TIA has recently experienced a downward correction, in line with short-term technical signals that tend to be bearish such as RSI, MACD, as well as net capital outflows. Based on BeInCrypto data (25/9), the price of TIA is currently trading more than 93% below its highest level in February 2024.

With volatility this high, market sentiment is still dominated by pessimism. Some investors see TIA as a living example of the saying, “don’t fall in love with your assets.”

The euphoria of the 18-24 airdrop last month, coupled with the unlocking of tokens by venture investors that continued to depress their value, further weighed on TIA’s movement. Some have even described TIA’s chart as “agony and pain.”

As such, a new proposal and $100 million in cash support could be a lifeline for the project. However, the key remains in the execution. PoG requires community approval, a clear revenue distribution mechanism, and a transparent buyback/burn system.

In addition, the number of rollups using Celestia must be large enough to generate sustainable DA fee revenue. If DA revenue growth slows down, or competitors such as EigenDA take off, then the deflationary scenario could be delayed.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Celestia Upgrade and Proof of Governance: A Turning Point for TIA. Accessed on September 26, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.