5 Pressure Signals Behind BTC’s Drop to Under Rp1.8 Billion: Is a Big Correction Awaiting?

Jakarta, Pintu News – After rallying in the past few months, Bitcoin (BTC) has come under great pressure with a price drop to a four-week low of $108,700 or around Rp1.82 billion (USD 1 = Rp16,763). This drop is not just a technical correction, but also holds important signals aboutmarket exhaustion and the potential for a deeper correction.

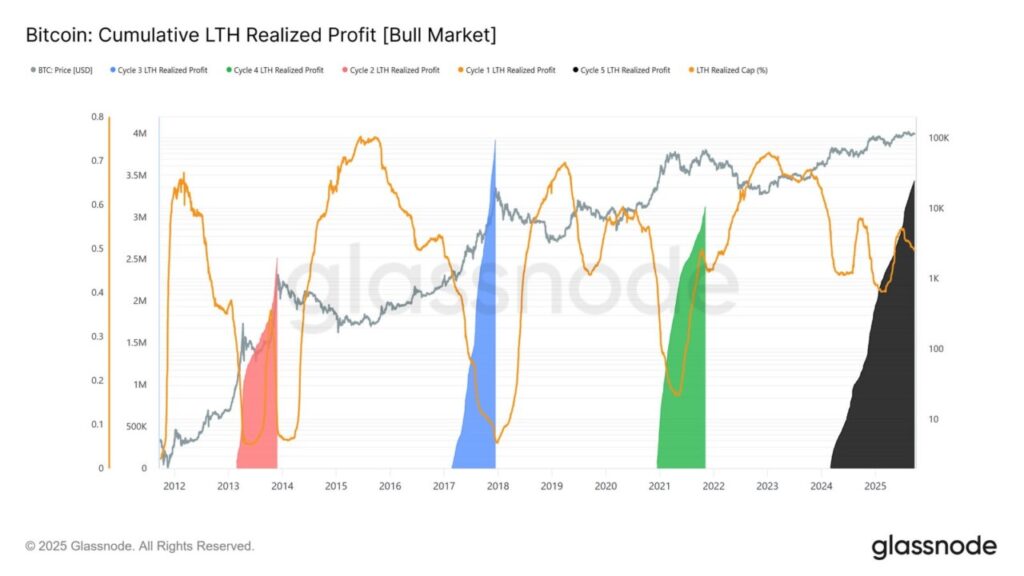

1. Large Profit-Taking by Long-Term Investors

According to Glassnode data cited by Cointelegraph (September 26, 2025), long-term investors have realized gains of 3.4 million BTC-asignificant amountthat usually only occurs at the peak of market cycles.

This large-scale profit-taking is a classic indicator that the accumulation phase is over and the market is entering the distribution phase. Historically, when profit accumulation hits extreme levels like this, markets tend to enter a cooling phase or major correction.

Also Read: 5 Big Impacts of US Crypto Regulation: Novogratz Predicts Market Cycles Will Change Forever

2. Fund Flows to Bitcoin ETFs Slow Down

One of the drivers of BTC’s rise this year has been the inflow of funds into spot Bitcoin ETFs. But currently, data shows a significant slowdown in inflows into ETFs, which reinforces the signal of market fatigue.

The combination of heavy profit-taking and weak ETF flows suggests that institutional buying interest is weakening, while selling pressure is increasing.

3. Support Level Breached, Stop-Loss Risk Increases

The price of BTC has now broken the important support level of $112,000, and touched $108,700 on Coinbase. Analyst from 10x Research, Markus Thielen, warns that if the price drops below $107,500, then the wave of stop-losses from traders will be even greater.

Thielen noted that many investors had placed expectations on a Q4 rally. However, the reality on the ground suggests that a major correction is more likely than a price surge.

4. On-Chain Indicators: SOPR and NUPL Show Selling Pressure

The Spent Output Profit Ratio (SOPR) indicator is currently at 1.01, which suggests that some investors are starting to sell at a loss. In a bull market, an SOPR below 1 could signal a rebound, but in the current conditions, it could signal continued pressure.

Furthermore, the Short-Term Holder Net Unrealized Profit/Loss (NUPL) indicator is now close to zero. This means that short-term investors have almost lost all their profits, which could trigger further liquidation if the selling pressure continues.

5. Potential for Deeper Correction if it Doesn’t Return to $115,000

Glassnode analysts concluded that the current market structure resembles the exhaustion pattern that previously preceded major corrections. Without strong support from institutional and retail buyers, the potential for further weakness is great.

Markus Thielen emphasized that his team remains neutral and will not take bullish positions unless Bitcoin manages to break $115,000 again.

Even so, Michael Saylor, Chairman of MicroStrategy, expressed optimism that BTC will rebound in the fourth quarter after macroeconomic pressures ease.

Conclusion

Bitcoin’s price drop below US$1.8 billion is not just a technical correction, but a strong signal that the market is experiencing cyclical fatigue. The combination of heavy profit-taking, reduced ETF fund flows, and weakening on-chain indicators is a warning that investors need to be wary of a potential deeper correction.

For long-term investors, this could be an opportunity for gradual accumulation. But for traders, it is important to closely monitor technical levels and sentiment indicators before taking the next position.

Also Read: 7 Astonishing Facts: Number of Crypto Billionaires to Rise 40% by 2025, Who Benefits?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Martin Young / Cointelegraph. Bitcoin at 4-week low in growing signs of ‘exhaustion’ – Glassnode

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.