5 facts about Solana (SOL) price drop below IDR3.3 million & Spot ETF impact

Jakarta, Pintu News – The price of Solana (SOL) was under pressure again, dropping below the psychological level of $200 (around Rp3.35 million at an exchange rate of Rp16,763/USD) on Thursday, September 25, 2025. This correction came after a brief rally that had pushed SOL to $253, its highest level in eight months.

While short-term sentiment looks negative, the upcoming spot ETF decision could be an important catalyst for institutional adoption. Here are five important facts to note.

1. SOL Down 19% in a Week

According to a report by Cointelegraph, the price of SOL fell to $192 (±Rp3.21 million), erasing its entire previous rally in less than a week. This correction casts doubt on the strength of the altcoin’s short-term momentum. However, in the daily time frame, the price structure still shows a bullish trend with a pattern of higher highs and higher lows.

Also Read: 5 Big Impacts of US Crypto Regulation: Novogratz Predicts Market Cycles Will Change Forever

2. Spot ETFs are a Potential Catalyst

Grayscale is awaiting a ruling on Solana’s spot ETF with the first due on October 10, 2025. This ruling could open up greater institutional capital flows, just like spot ETFs for Bitcoin (BTC) and Ethereum (ETH). Besides Grayscale, the SEC will also review five other ETF proposals from Bitwise, 21Shares, VanEck, and Canary with a deadline of October 16, 2025.

3. Institutional Sentiment Still Low

According to Pantera Capital, institutional ownership of Solana is currently under 1% of the total supply. In comparison, institutions hold around 16% of Bitcoin and 7% of Ethereum. If the spot ETF is approved, Solana could potentially accelerate institutional adoption and expand its liquidity base.

4. RSI Signaling a Potential Bottom

Solana’s Relative Strength Index (RSI) indicator fell below the 30 level again on the four-hour chart. Cointelegraph notes that since April 2025, this pattern has occurred five times, and four of them were followed by a quick price recovery. This could be a short-term signal of an oversold point and a possible relief rally.

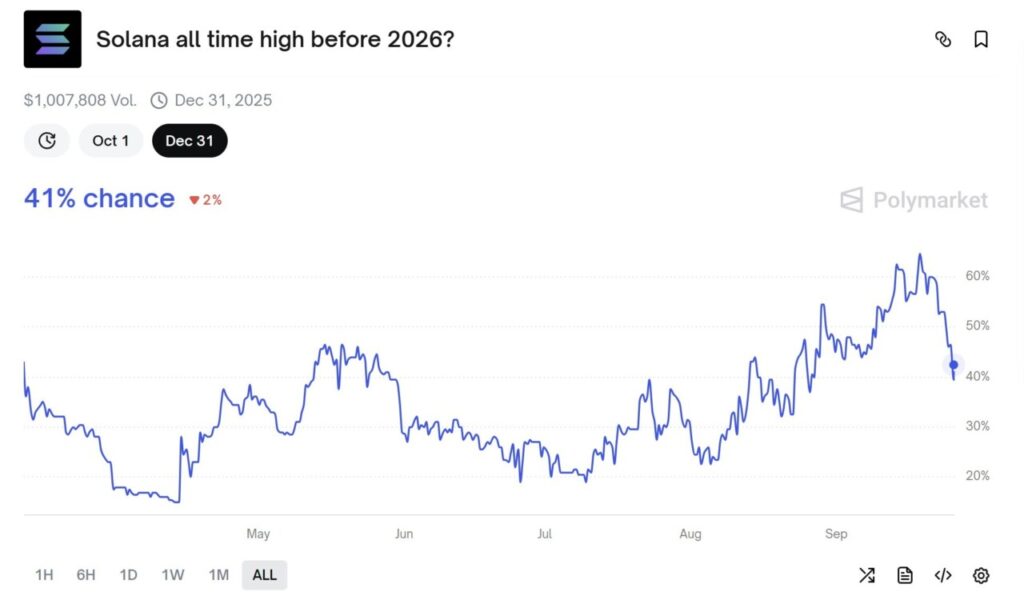

5. Market Still Wary of New All-Time High

Prediction platform Polymarket gives a probability of only 41% that SOL will reach a new price record in 2025. This suggests that despite the ETF’s high optimism, the market is still cautious about the possibility of a major rally. If the price loses support in the $185-$200 zone, the focus will shift to the next demand area at $170-$156.

Conclusion

Solana’s price correction below $200 raises short-term concerns, but the long-term technical structure remains positive. Solana’s spot ETF decision in October 2025 could be a turning point, especially if it opens the door to institutional investors. However, the probability of a new all-time high is debatable, so investors should manage risk wisely amid crypto market volatility.

Also Read: 7 Astonishing Facts: Number of Crypto Billionaires to Rise 40% by 2025, Who Benefits?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Biraajmaan Tamuly. SOL slips below $200, but ETF verdict could trigger ‘institutional moment,’ new highs. Accessed September 26, 2025.

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.