Antam Gold Price Chart Today September 29, 2025: Up or Down?

Jakarta, Pintu News – On September 29, 2025 at 08:11 WIB, official data states that the LM Safe Gold Physical Purchase Price reached Rp 2,198,000 per gram, while the Corporate Safe Gold Purchase Price (safe / stored) was at the level of Rp 2,138,600 per gram (difference of Rp 7,000), according to data presented by the LM Safe platform.

These data form the main basis of this educational article, which will also discuss how they relate to cryptocurrency trends and aspects of financial literacy.

1. Physical Gold vs Corporate Gold Price – What’s the Difference?

As of September 29, 2025, physical gold sold for IDR 2,198,000/gram, while corporate gold (gold stored in a vault) stood at IDR 2,138,600/gram, based on the platform’s data. This price difference (IDR 7,000) reflects the cost or premium for physical ownership versus digital ownership or vault deposits, as quoted from Brankas LM’s official price report.

The price difference is important as a parameter in choosing a gold investment instrument: whether to withdraw physical gold, or utilize digital storage services (vaults). This information is important for investors who are also interested in diversifying into assets such as crypto.

Also Read: 5 Cryptos with the Tightest Ranking Spreads on the Futures Market – Save on Trading Costs!

2. Trend of Gold Price Movement in the Last 6 Months

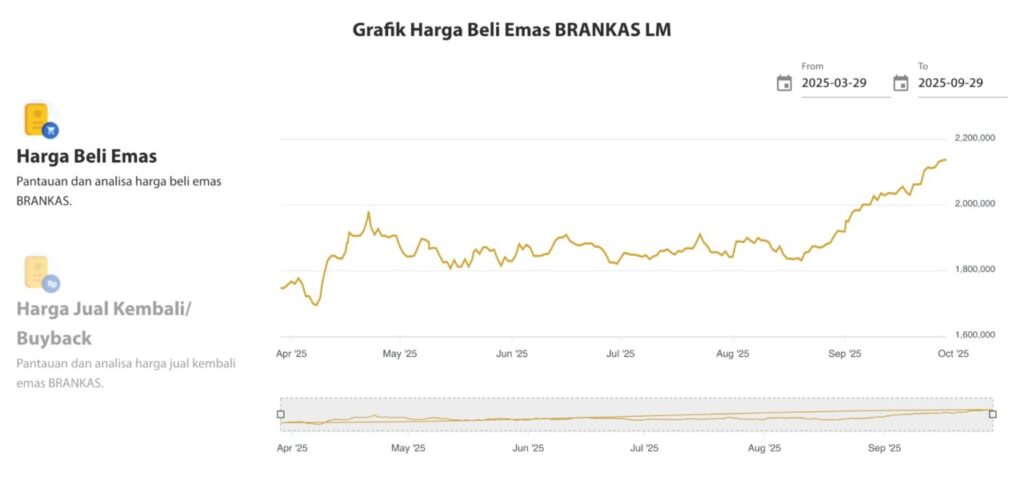

The official graph from the Brankas LM platform shows a graph of gold purchase prices from March 2025 to the end of September 2025. Based on the graph, gold prices have shown an upward trend especially since August, reaching a range of more than IDR 2,200,000/gram at the end of the period.

The beginning of the period (March-May) saw more moderate fluctuations, with prices moving within a range of IDR 1,700,000 – IDR 2,100,000/gram, based on observations of official buying price charts. A significant spike occurred in the third quarter of 2025, reflecting macroeconomic factors and global demand.

3. Factors Driving the Rise in Gold Prices

One of the main factors fueling the rise in gold prices is the state of uncertainty in global financial markets, including turmoil in cryptocurrency markets and global interest rate movements. Investors often seek safe-haven assets like gold when crypto volatility increases.

In addition, institutional investor demand and monetary policy from central banks also influence gold prices. Official LM vault data indicates that during the period September 2025, the upward price trend was consistent, supported by demand factors and global macro conditions.

4. Comparison with Crypto Trends (Bitcoin, Ethereum, etc.)

The stable and rising price of gold contrasts with the sharp volatility in the market for cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH) or other altcoins. Daily changes in crypto value can reach tens of percent, while gold is slower to move.

Investors often see gold as a diversifying asset to “balance” their crypto portfolio. For example, when BTC or ETH prices drop dramatically, gold can be a safer buffer against the extreme risks of the crypto market.

5. Gold + Crypto Investment Combination Strategy

Combining gold and crypto can help reduce portfolio risk. A simple strategy: allocate a small portion (e.g. 10-20%) of the total investment to physical gold or vaults, and the rest to crypto, depending on risk tolerance.

When crypto experiences a surge, profits can be large – but when crypto experiences a sharp decline, a portion of gold can cushion the total loss. This approach is based on the negative or low correlation between gold and crypto assets under most market conditions.

6. Practical Tips for Utilizing LM Safe Price Data

- Monitor regular updates: Brankas LM gold price data is updated in real time (latest at 08:11 WIB September 29, 2025) by their own platform.

- Compare physical and corporate gold premiums: The premium difference of ± Rp 7,000/gram can be a benchmark for storage efficiency.

- Use long-term charts: Observe 3-6 month trends to read momentum – such as the uptrend since August.

- Incorporate other indicators: For example, global gold prices, USD to IDR exchange rate, and crypto market conditions.

7. Conclusion: Why is this gold data important for crypto investors?

The official LM vault gold price data provides a concrete view of the market price of gold in Indonesia, both physical and in vaults. By knowing the price gap, medium-term trends, and triggering factors, crypto investors can design a more informed diversification strategy.

Since crypto volatility is so high, having some assets in gold can be a portfolio buffer. Historical data and charts also help investors spot patterns-whether gold’s bullish momentum looks more attractive versus the huge risk in short-term crypto.

Also Read: 5 Crypto with the Highest Futures Open Interest Last Week of September 2025!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- LM vaults. “LM Vault Gold Price – Chart & Data.” Accessed September 29, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.