Bitcoin Climbs to $111,000 on Sept 29: Could Investor and Miner Withdrawals Put BTC at Risk?

Jakarta, Pintu News – This month, Bitcoin’s (BTC) lackluster price performance has triggered a wave of bearish sentiment among institutional investors. This raises the possibility that the digital asset will close September with negative results.

In addition, on-chain data shows a decline in accumulation by miners, further depressing the already struggling cryptocurrency. Then, how is the current Bitcoin price movement?

Bitcoin Price Rises 1.38% in 24 Hours

On September 29, 2025, Bitcoin was trading at $111,789, equivalent to IDR 1,866,077,678, marking a 1.38% gain over the past 24 hours. Within that period, BTC dipped to a low of IDR 1,836,924,073 and climbed to a high of IDR 1,889,166,922.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 37,084 trillion, while its 24-hour trading volume has surged 39% to IDR 570.98 trillion.

Read also: Ethereum Climbs to $4,100 on Sept 29, 2025: Whale Activity Signals Potential Rebound

ETF Outflows and Miner Sales Could Push Bitcoin Lower

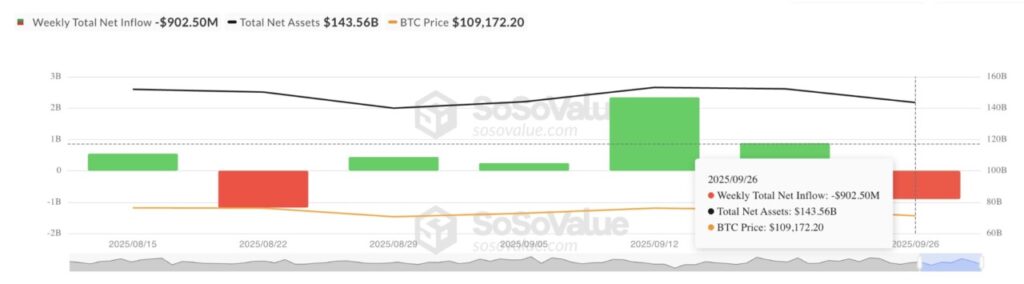

The steady liquidity outflow from spot Bitcoin ETFs reflects weakening institutional interest. According to Sosovalue, capital outflows from these funds between September 22 and 26 reached $903 million, signaling a massive withdrawal from the market.

Historically, ETF fund flows have a strong correlation with BTC prices. Back in July, the coin’s price briefly surpassed $120,000, driven by monthly ETF inflows of more than $5 billion. However, the current outflows show a sharp contrast, indicating that the strong institutional interest and participation in the middle of the year is starting to fade. This trend increases the risk of further downside for Bitcoin if institutional investors continue to withdraw capital.

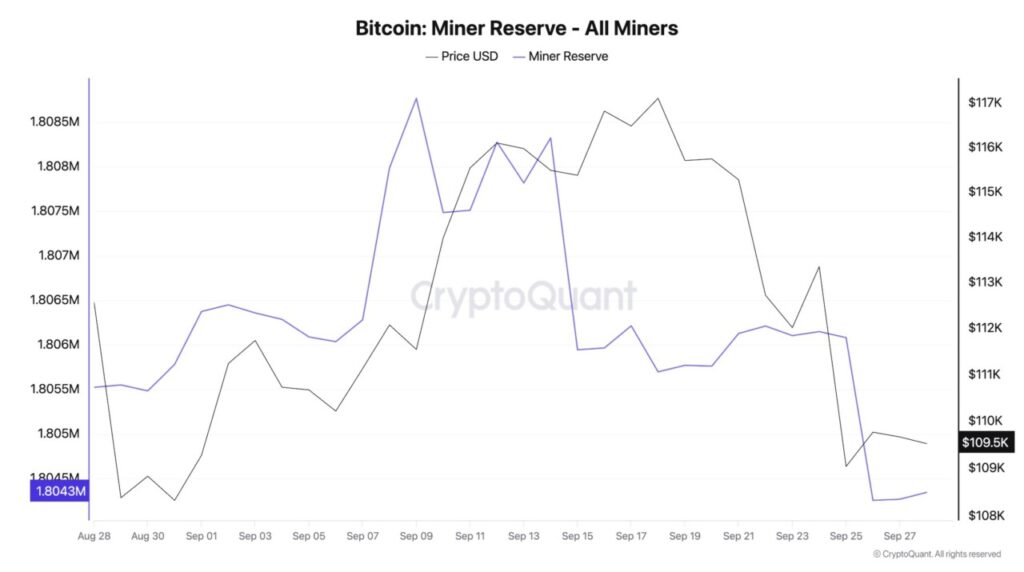

Additionally, on-chain data shows declining miner reserves, signaling that miners are selling more rather than accumulating BTC. Based on CryptoQuant data, these reserves currently contain 1.8 million BTC and have shrunk by 0.24% since September 9.

Miners’ reserves track the total amount of BTC that miners keep in their wallets before selling to the market. When these reserves decrease, it signifies miners are liquidating to realize profits or cover operational costs.

Read also: Here Are the Top 5 Crypto RWAs Everyone’s Talking About in October 2025

This behavior usually increases the supply of BTC in the market, thus adding downward pressure on Bitcoin’s price.

Massive Sales Could Trigger New Lows

If the spot Bitcoin ETF continues to record outflows and miners on the BTC network keep selling, the price of the coin could potentially extend its decline to touch levels around $107,557.

However, if demand increases sharply and market sentiment improves, BTC prices could break above $110,034 and have a chance to rise further towards $111,961.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. BeInCrypto. BTC Price Drop: ETF Outflows, Miners Pullback. Accessed on September 29, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.