Pi Network Price Sees Modest Uptick Today — But Is a Steeper Decline Looming?

Jakarta, Pintu News – PI Network’s native token, PI, continues to move sideways after previously dropping to an all-time low of $0.1842 on September 22.

Since then, the crypto asset has fluctuated within a horizontal range, with support at $0.2565 and resistance around $0.2917. With the crypto market trending bearish, PI is at risk of testing its lows again.

Then, how will the Pi Network price move today?

Pi Network Price Rises 1% within 24 Hours

On September 29, 2025, the price of Pi Network was recorded at $0.266, having risen 1% in 24 hours. If converted to the current rupiah ($1 = IDR 16,681), then 1 Pi Network is IDR 4,437.

Read also: Ethereum Climbs to $4,100 on Sept 29, 2025: Whale Activity Signals Potential Rebound

Daily price movements show a trading range between $0.2609 to $0.2721, with the trend briefly climbing above $0.27 before correcting back to the $0.266 area.

In terms of fundamentals, Pi Network’s market capitalization stood at around $2.19 billion and the trading volume in the last 24 hours stood at $30.55 million, indicating a fairly dynamic activity in the market.

Weak Momentum Keeps PI Under Pressure

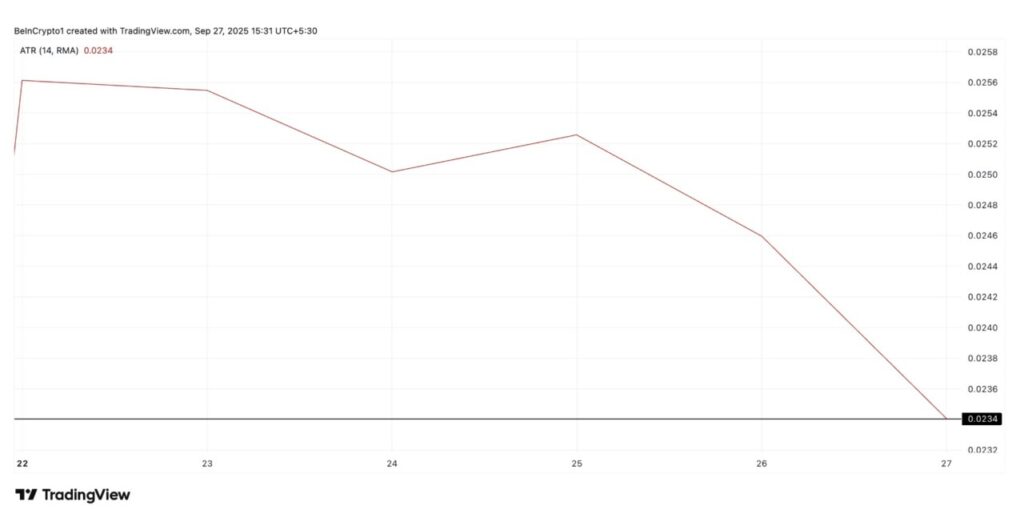

PI’s steadily declining Average True Range (ATR) reflects the weak momentum of spot market participants. Based on the PI/USD daily chart (Sep 27), the indicator has been moving down consistently since the flat trend started on September 23, until it reached the level of 0.0234 at the time of writing.

ATR itself measures the rate of price movement within a certain period. If it moves down as it is now, it indicates that price volatility is narrowing and market momentum is weakening.

This drop shows reduced trader participation in the spot market as well as minimal new capital flow into the PI token, increasing the likelihood that support at $0.2565 will be broken in the near future.

Additionally, PI is also trading well below the 20-day Exponential Moving Average (EMA), which reinforces the bearish outlook. Currently, the 20-day EMA is a dynamic resistance around $0.3185, higher than the current PI price.

The 20-day EMA itself calculates the average price of the asset in the last 20 trading days with greater weight on the most recent price. If the price is below it, it means that sellers are more dominant and the market momentum is tending towards the downside.

This signal suggests that the PI is struggling to build an upward impulse, so it could potentially continue its sideways movement, or even face renewed downward pressure if market sentiment does not improve.

Read also: Dogecoin Price Jumps 2% Today: Is DOGE Poised for a Big Q4 Rally?

Downside Risk Continues to Rise

With trading momentum weakening, PI price action looks increasingly vulnerable to further downside. Selling pressure could push the price down below the $0.2565 support and retest the all-time low.

Conversely, if market sentiment improves, PI could potentially try to break the resistance at $0.2919. If this level is successfully passed, it could be an early signal of recovery and open up opportunities for PI to move back above the 20-day EMA.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Market Indicators Signal Another Crash For Pi Network Price. Accessed on September 29, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.