4 US Job Data Predicted to Shake Bitcoin & Cryptocurrency Markets This Week

Jakarta, Pintu News – The crypto market is waiting for important economic signals from the United States. Four jobs reports from the US released this week are predicted to determine the direction of market sentiment for Bitcoin (BTC) and other cryptocurrencies.

Based on a report from BeInCrypto on September 29, 2025, these reports could trigger a significant change in the Fed’s interest rate policy, ultimately affecting the movement of the dollar exchange rate and liquidity in the digital asset market.

1. JOLTS: Four-Month Drop Could Boost Bitcoin Price

The Job Openings and Labor Turnover Survey (JOLTS) report is the first important indicator that crypto market participants keep an eye on. According to the US Bureau of Labor Statistics, this data provides a snapshot of the number of job openings, hires, and layoffs each month.

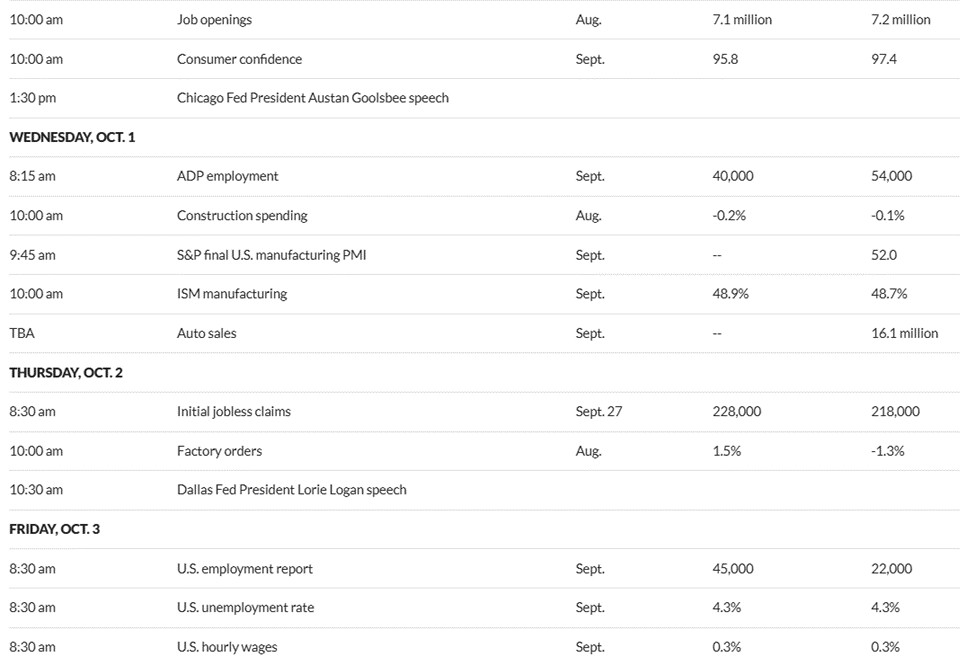

Based on data compiled by MarketWatch, job openings declined from 7.8 million in May to 7.2 million in July, and are predicted to fall back to 7.1 million in August. If this trend continues, it will be the fourth consecutive month of decline.

According to BeInCrypto analysts, the decline in the number of job openings indicates a slowing labor market, which could potentially prompt the Fed to cut interest rates. This rate cut could increase liquidity and support the price rise of Bitcoin and other cryptos.

Also Read: 5 Facts About Bitcoin Adoption Countries: Driving BTC Price to New Levels – Says Samson Mow

2. ADP Report: Private Hiring Data Gets Weaker

The ADP employment report is another important indicator scheduled for release on Wednesday, October 1, 2025. The report is based on payroll data from the private sector and is often used as a measure of the strength of the non-government labor market.

Current estimates show private job growth of only 40,000 in September, down from 54,000 in August and much lower than July’s 104,000. This indicates a consistent slowdown in labor recruitment.

According to analysts quoted by BeInCrypto, a weakening private labor market is usually positive for crypto assets as it weakens the US dollar and lowers bond yields, two factors that increase interest in riskier assets such as Bitcoin and other cryptocurrencies.

3. Initial Unemployment Benefit Claims: Small Spike Could Be Early Sign of Recession

Weekly initial jobless claims, due Thursday, are also a key focus for markets. This data shows the number of US citizens who first applied for unemployment benefits, and is a sensitive indicator of economic change.

Last week, the claims figure reached 218,000 and is expected to increase to 228,000 this week. According to BeInCrypto, this small spike could be interpreted as an early signal of economic weakness, although it remains within a range that is considered healthy.

If the upward trend continues, analysts predict the Fed may be quicker to adopt accommodative policies such as interest rate cuts. This move is considered to boost the crypto market, especially Bitcoin, due to the increased demand for alternative non-inflationary assets.

4. Jobs and Unemployment Report: A Strange Balance that Could Be Neutral for Crypto

The most anticipated key data this week is the jobs and unemployment rate report released on Friday. An additional 45,000 new jobs are expected, up from 22,000 in the previous month. The unemployment rate is predicted to remain stable at 4.3%.

According to a report by BeInCrypto, these job gains indicate the resilience of the labor market, while a stagnant unemployment rate could signal more job seekers than the number of jobs available. This creates a picture of a strong but not fully stabilized market.

This is considered neutral to dovish by analysts, where expectations for monetary policy easing remain high. This could drive positive sentiment towards Bitcoin and crypto, although not strong enough to trigger a major rally.

Conclusion: Beware of Volatility, Opportunities Remain Open

With these four jobs reports, crypto market participants should be prepared for potential price volatility, especially Bitcoin (BTC) and Ethereum (ETH). If the data shows a significant weakening of the economy, the market could respond positively as expectations of interest rate cuts will increase, potentially increasing the flow of funds into digital assets.

However, if the data shows economic resilience, then the potential delay in monetary easing could limit cryptocurrency price growth in the short term.

Also Read: 5 Major Corrections Before Bitcoin Breaks the New ATH: This is Analyst’s Prediction!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Lockridge Okoth/BeInCrypto. 4 US Jobs Reports That Could Sway Bitcoin Market Sentiment This Week. Accessed September 30, 2025.

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.