Ethereum Jumps 5% Today: Could ETH’s Rally Signal a Run Toward $4.5K Again?

Jakarta, Pintu News – Ethereum (ETH) has the potential to post another strong performance in October if historical patterns repeat themselves. On average, ETH records a gain of around 4.77% every October, potentially pushing its price through $4,500 by the end of the month.

Supported by on-chain data showing reduced sell-offs and increased network activity, Ethereum has the opportunity to continue its positive trend and gain in the next few weeks. Then, how will Ethereum price move today?

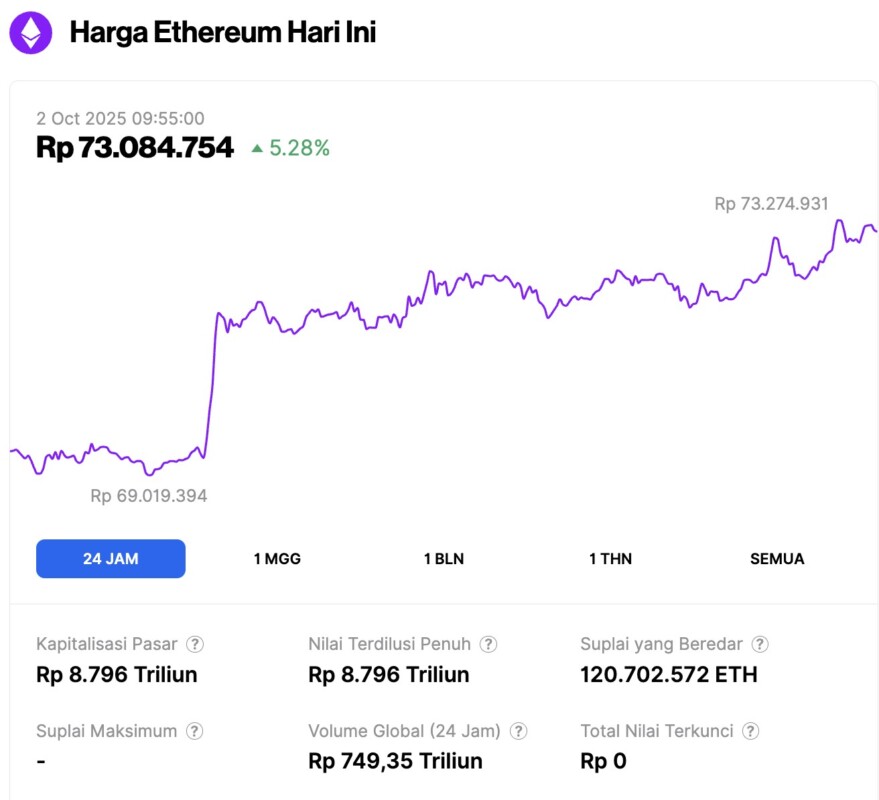

Ethereum Price Up 5.28% in 24 Hours

On October 2, 2025, Ethereum was trading at around $4,395, equivalent to IDR 73,084,754, marking a 5.28% increase over the past 24 hours. Within this timeframe, ETH dipped to a low of IDR 69,019,394 and climbed to a high of IDR 73,274,931.

At the time of writing, Ethereum’s market capitalization is valued at approximately IDR 8,796 trillion, while its daily trading volume has surged 33% to IDR 749.35 trillion over the last 24 hours.

Read also: Bitcoin Surges to $118,000 Today — Will BTC Make History This “Uptober”?

Ethereum investors move coins off exchanges, confidence grows

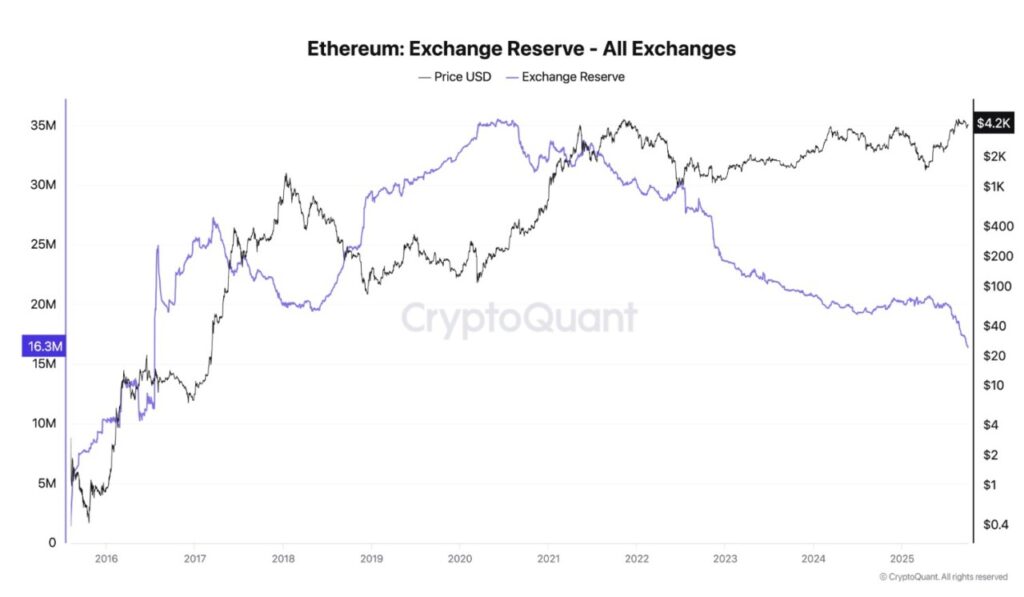

According to data from CryptoQuant, ETH reserves on exchanges have been steadily declining in recent months. Currently, they are at a nine-year low of 16.38 million ETH, indicating that fewer and fewer coins are stored on centralized platforms for sales purposes.

ETH reserves on exchanges track the total amount of coins held in wallets belonging to centralized exchanges. If the number rises, it usually indicates that ETH holders are moving their assets to exchanges, possibly for sale or trade.

Conversely, a decrease in reserves indicates that investors are moving more of their coins to cold storage or long-term storage, reflecting lower selling intentions.

In the case of ETH, the downward trend of reserves on these exchanges confirms both increased investor confidence and long-term holding behavior. Much of this trend is fueled by increased accumulation from institutions. Based on SosoValue data, monthly net inflows into ETH spot ETFs reached $286 million in September.

If this trend continues, ETH supply in the market could tighten further and short-term selling pressure could potentially ease.

Ethereum Daily Transactions Surge-What it Means for Price

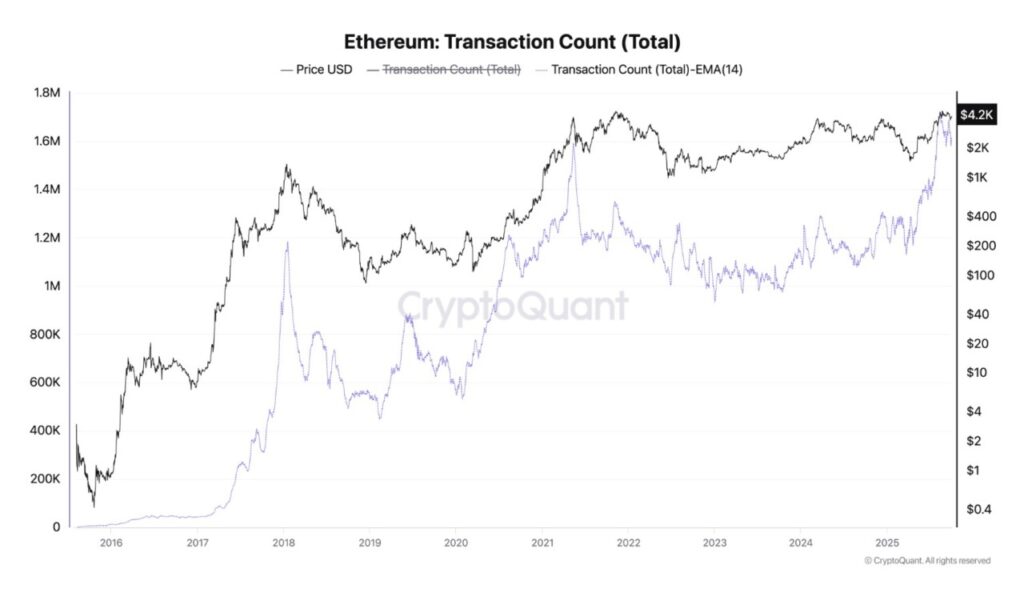

Ethereum is starting to register an increase in network activity, a factor that could favor an ETH rally in the coming weeks.

In a recent report, CryptoQuant analyst under the pseudonym Darkfost explained that the current expansion of decentralized finance (DeFi) activity is driving a significant uptick in Ethereum’ s on-chain activity.

According to the report, the number of daily transactions on Ethereum’s Layer-1 (L1) network has broken the four-year barrier, reaching an unprecedented 1.6-1.7 million transactions per day.

Darkfost asserts, this is “the highest level ever recorded on Ethereum.”

Such a spike in transaction volume usually results in increased demand for Ethereum’s native coin, ETH, which is used to settle transactions on the L1 network. If this growth trend continues, the demand for ETH will continue to rise and potentially push the price even higher.

Read also: MrBeast and Crypto Whales Pile Into ASTER After 20% Drop – What’s Next?

Ethereum aims for $4,500 in October, but risks lurk at $3,875

If the historical trend repeats – reinforced by the current bullish momentum – and the coin records an average gain of 4.77%, then ETH prices could potentially close October around $4,500.

Although this level is still below the all-time high of $4,957, it is still a positive growth, especially amidst the weak momentum of the crypto market as a whole.

However, if the bullish trend reverses and the sell-off intensifies, the price of ETH could drop to around $4,211 and potentially even extend the decline to $3,875.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum’s October Record Says $4,500 Is in Sight-Will History Repeat? Accessed on October 2, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.