Ripple (XRP) Shows New Bullish Signals Amid Funding Rate Futures Spike

Jakarta, Pintu News – Reporting from FX Street (1/10), Ripple (XRP) maintained intraday bullish sentiment by trading above the $2.93 level on Wednesday (1/10). In general, the crypto market started the beginning of October with a positive trend, giving an idea of the direction of trading movements in the coming weeks.

XRP on the Verge of Breakout as Funding Rate Surges

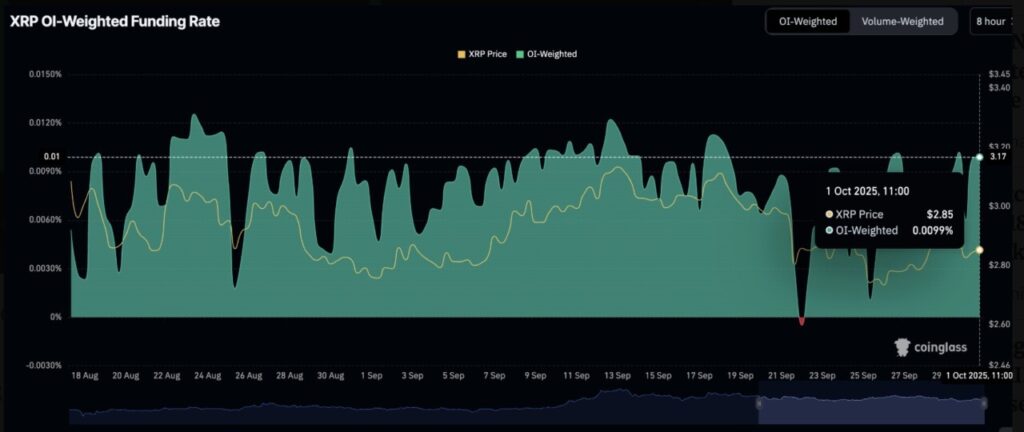

The price of XRP is showing signs of being ready to break through important levels, along with a surge in funding rates and increased interest from retail investors. CoinGlass data notes that XRP futures traders are increasingly opening long positions.

Read also: Pi Network Price Drops 2% on Oct 2, 2025: Can Pi Coin Bounce Back?

The Open Interest (OI)-Weighted Funding Rate stood at 0.0099%, up sharply from just 0.0011% last Friday.

The OI-Weighted Funding Rate is a composite metric of XRP perpetual contracts across multiple exchanges, which calculates a weighted average of the funding rate. A high positive value indicates that traders are aggressively going long.

At the beginning of XRP’s upward trend, a steadily rising funding rate is considered a positive signal. However, if the rate crosses 0.1%, this could be a warning for traders to reduce risk.

Currently, XRP’s OI-Weighted Funding Rate is still in the healthy zone, further encouraging traders to increase their exposure in the hope that the price can break the psychological level of $3.00.

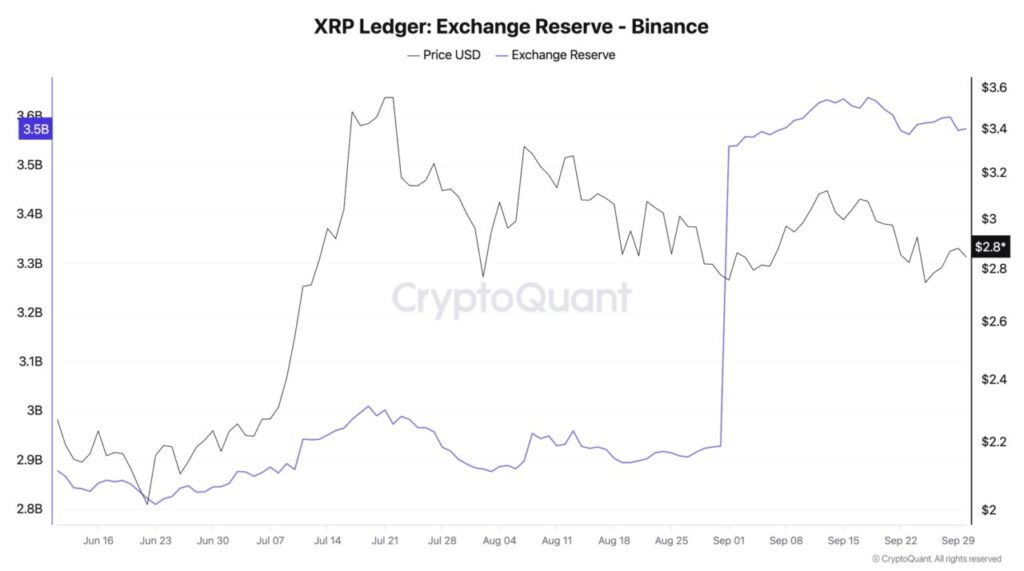

On the other hand, activity on Binance saw a slowdown in asset inflows. CryptoQuant data shows the balance of XRP tokens on Binance hovering around 3.57 billion, stable after previously surging from 2.92 billion XRP on August 31.

Typically, an increase in reserves on exchanges signals potential volatility as traders plan to sell or trade the asset. Conversely, a decrease in the balance on exchanges could indicate improved investor confidence in the token and its ecosystem, potentially strengthening XRP’s bullish outlook going forward.

Technical Outlook: XRP Shows Short-Term Bullish Signals

XRP rallied back above some important moving average levels. On the 4-hour chart (1/10), the price managed to stay above the 200-period Exponential Moving Average (EMA) at $2.91, the 100-period EMA at $2.88, and the 50-period EMA at $2.86. This momentum is also supported by bullish sentiment that is still dominant in the overall crypto market.

Read also: 3 Altcoins to Watch While the US Government Is Shut Down

The Relative Strength Index (RSI) indicator is at 62, up significantly from last week’s oversold condition. This confirms the presence of stronger buying pressure. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator has also confirmed a buy signal on the daily chart, encouraging investors to take more risk exposure.

For traders, the technical area of focus is the descending trendline formed since mid-July, when XRP set a new record high of $3.66. In addition, the supply zone around $3.18 that was tested as resistance on September 13 is also an important level to watch.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FXStreet. Ripple price prediction: XRP futures funding rate surges as bulls eye $300 breakout. Accessed on October 2, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.