3 Altcoins Whale Investors Are Accumulating in Early October 2025

Jakarta, Pintu News – Bitcoin’s (BTC) continued price decline throughout this week, finally falling below the crucial $110,000 level yesterday, has severely weakened overall market sentiment. The correction has slowly pushed many altcoins to their lowest points in recent weeks, thus opening up strategic accumulation opportunities for large investors.

Amidst this, crypto “whales” have started buying up certain altcoins, signaling a renewed confidence in these tokens. Here are 3 altcoins that whales have accumulated recently, based on a report by BeInCrypto.

World Liberty Financial (WLFI)

WLFI, an altcoin associated with Donald Trump, has been one of the main crypto assets to attract whale interest this week. This comes amid a 13% decline in the value of WLFI in the last seven days.

Read also: Will Shiba Inu Skyrocket? Whale Accumulation and Team Commitment May Be the Key Drivers

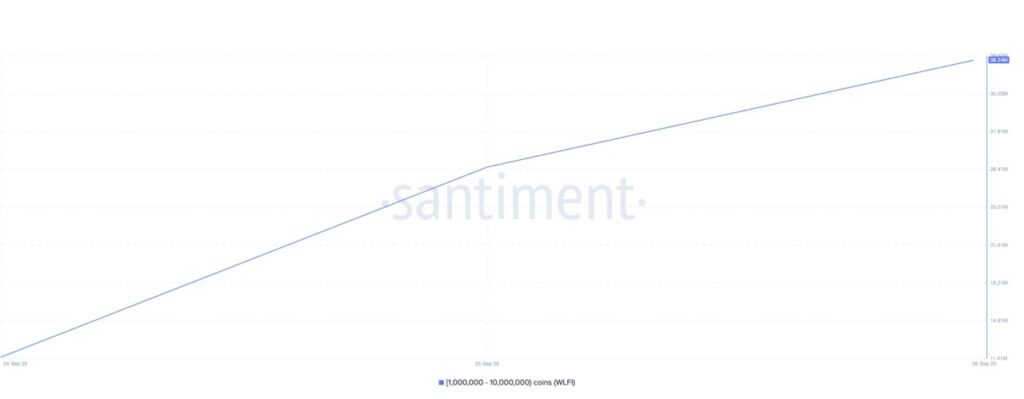

Based on on-chain data from Santiment, whale addresses holding between 1 million and 10 million WLFI tokens increased their holdings by 26.72 million tokens throughout the week under review.

As of September 26, World Liberty Finance announced that its team will implement a token buyback and burn mechanism this week.

If this move is able to reignite bullish momentum, coupled with increased demand from whales, WLFI prices could potentially rise to $0.2059.

Conversely, if demand weakens, the token price could correct back towards $0.1814.

PEPE

The Solana (SOL) based meme coin, Pepe PEPE (PEPE), also received significant attention from crypto whales.

According to Nansen’s data, large investors holding more than $1 million worth of PEPE tokens increased their holdings by 1.36%. They took advantage of weak market conditions to strengthen their positions.

This accumulation reflects growing confidence among investors with large assets, who see the current market downturn as a strategic entry opportunity.

If the whale activity continues, it could support further gains for PEPE and push its price towards $0.00000984.

On the other hand, if whale buying slows down, the token is at risk of a further short-term drop to as low as $0.00000830.

Read also: 3 Altcoins to Watch While the US Government Is Shut Down

Polygon (POL)

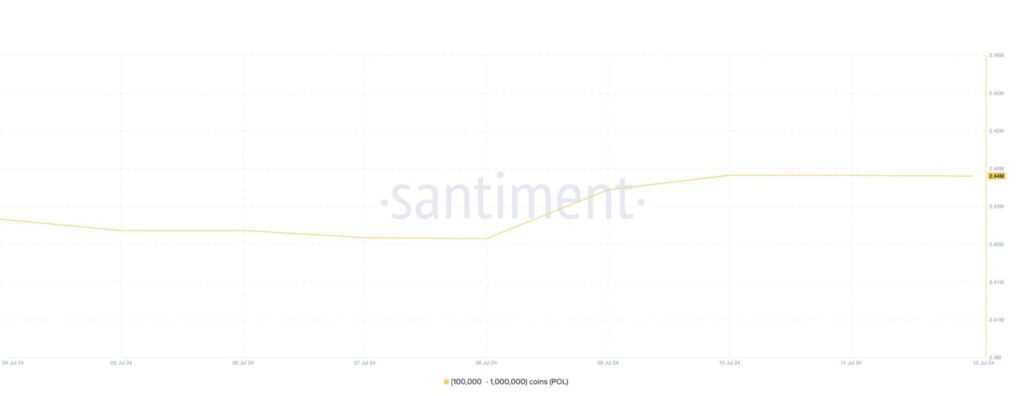

The price of Polygon (POL) has slumped 16% in the last seven days. Amid this decline, large wallet addresses holding between 100,000 to 1 million tokens are actively accumulating, capitalizing on lower price levels in the overall crypto market.

According to Santiment data, during the week under review, supply from this group of investors increased by 220,000 POL tokens.

This trend suggests that POL whales are taking advantage of the sluggish performance to prepare for a potential market recovery.

If accumulation continues, POL has a chance to reverse the downtrend and rise up to $0.2308. However, in case of a fresh sell-off, the token price could be pressured down to the $0.1092 range.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Altcoins: Crypto Whales Buying Last Week of September. Accessed on October 3, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.