Ethereum Hits $4,500 Today as Crypto Whale Snaps Up 840,000 ETH!

Jakarta, Pintu News – Reporting from FX Street, Ethereum (ETH) continued its upward trend since Thursday (2/10), testing the resistance level at $4,500 after sustained buying activity from whales and accumulation addresses. Then, how is Ethereum’s current price movement?

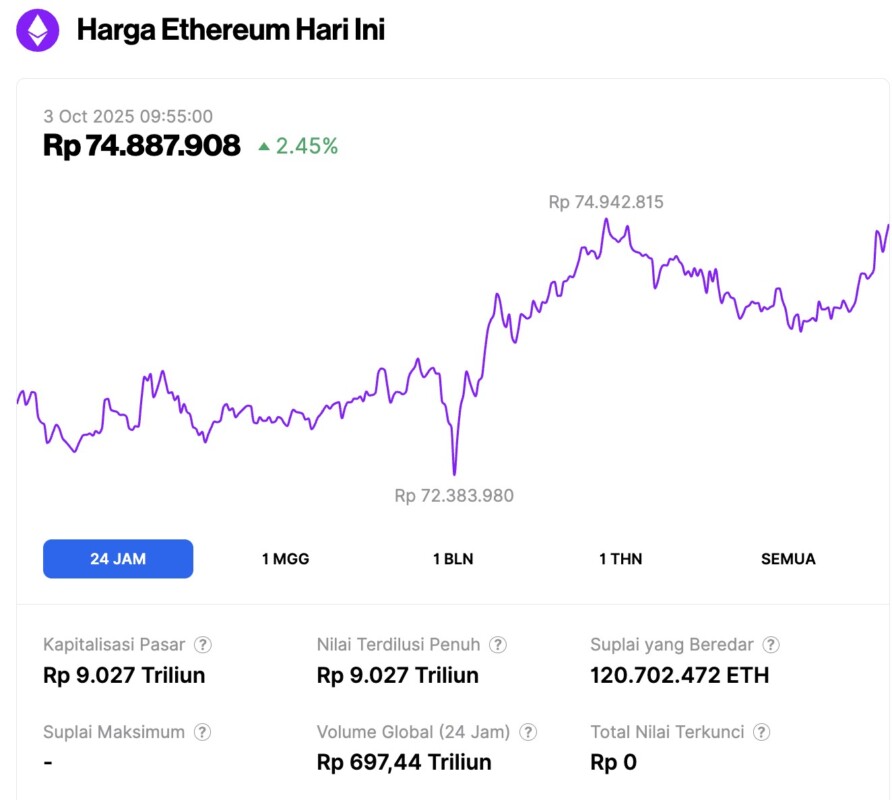

Ethereum Price Up 2.45% in 24 Hours

On October 3, 2025, Ethereum was trading at around $4,514, or approximately IDR 74,887,908, marking a 2.45% gain over the past 24 hours. During the same period, ETH hit a low of IDR 72,383,980 and a high of IDR 74,942,815.

At the time of writing, Ethereum’s market capitalization is valued at roughly IDR 9,027 trillion, while its 24-hour trading volume has climbed 2% to IDR 697.44 trillion.

Read also: Telegram Founder Pavel Durov Predicts Bitcoin Will Soar Past $1 Million

Ethereum Whale Buys 840,000 ETH, Address Accumulation Sets New Record

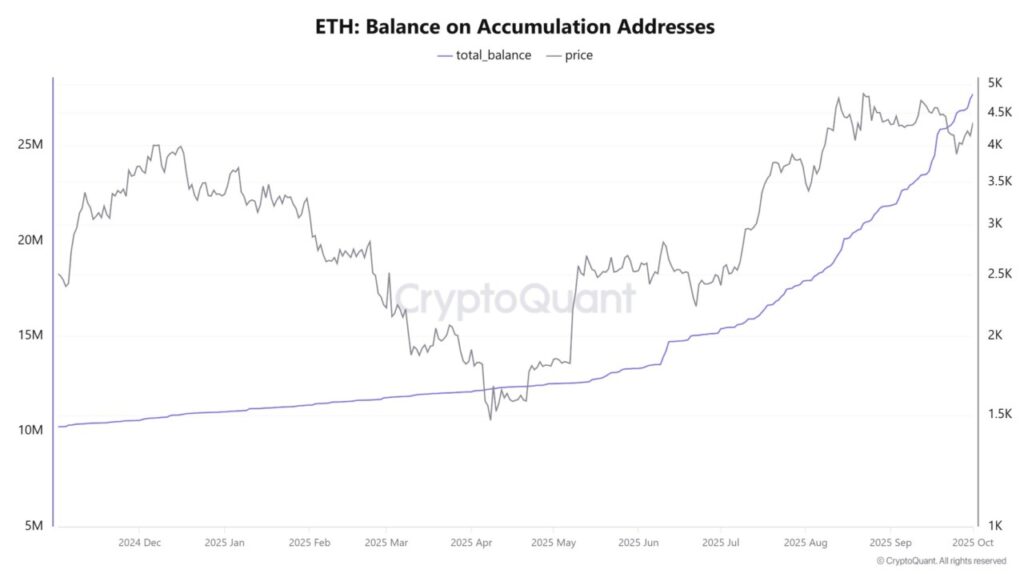

Ethereum whales (whales) increased their buying pressure in the past two weeks after the ETH price had dropped, and the trend is still continuing even though the price is recovering.

Since September 18, investors with holdings between 10,000 and 100,000 ETH have added a total of 840,000 ETH to their portfolios, according to CryptoQuant data. Aggressive buying activity from whales during price weakness is usually a signal of confidence in a potential price recovery, which was evident in ETH’s movement in the past week.

A similar trend was seen in accumulation addresses – wallets that never make sales – which added 5.6 million ETH throughout September. This was a record-high monthly purchase for the third time in a row.

Institutional interest in the second-largest altcoin has also picked up again. ETH spot ETFs in the United States recorded three consecutive days of net inflows totaling $755.2 million on Wednesday, according to SoSoValue data.

However, despite the expanding base demand, some whales chose to realize profits after the latest price recovery, based on Lookonchain data.

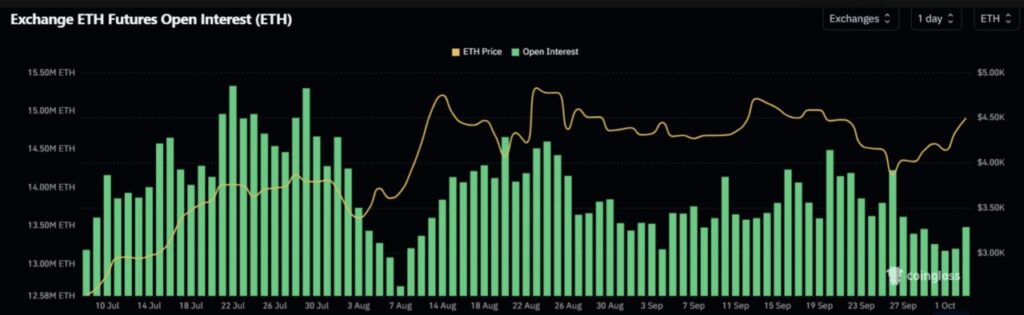

On the derivatives side, open interest (OI) remains relatively calm despite ETH prices recovering in the past week. Even so, signs of increased risk appetite emerged on Thursday, after OI jumped by 280,000 ETH according to Coinglass data.

This slow growth in OI indicates that the recent ETH price rally has been driven more by spot purchases than leverage.

Read also: 3 Altcoins to Watch While the US Government Is Shut Down

Ethereum Price Prediction: ETH Tests $4,500 Resistance After Breaking 50-Day SMA

Ethereum recorded futures liquidations of $129.9 million on October 2, with short positions accounting for $106.2 million of the total.

The second-largest crypto asset managed to break above its 50-day Simple Moving Average (SMA) and is now testing the $4,500 resistance level – an area that has been a pivotal point in the past two months. Just above $4,500, ETH still faces resistance in the form of a descending trendline before potentially resuming its rise to $4,835.

On the downside, the $4,100 level as well as the 100-day SMA are important support areas to watch if ETH fails to break $4,500.

Technical indicators show that bullish momentum is still dominant: The Relative Strength Index (RSI) is above the neutral level, while the Stochastic Oscillator (Stoch) is moving closer to overbought territory.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FX Street. Ethereum Price Forecast: ETH tackles $4,500 resistance following rising whale demand. Accessed on October 3, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.