Will the US Government Shutdown Lower the Country’s Credit Rating?

Jakarta, Pintu News – A potentially lengthy US federal government shutdown may trigger a downgrade of the country’s credit rating. This negative signal could shake up traditional financial markets, but also open up new opportunities for the Web3 ecosystem. Read this article for the full story!

Impact of Government Shutdown on Credit Rating

The recent US government shutdown following a failed vote in Congress has major implications for the crypto market. There are strong reasons to believe that the government shutdown could affect credit rating downgrades. In 2023, Fitch downgraded the US credit rating following the 2018 government shutdown and another standoff in Congress.

Moody’s followed a similar move in May 2025, with a warning that further downgrades are possible if similar conditions persist. The average government shutdown in the US lasts only eight days. However, the 35-day Trump-era shutdown was a significant exception, raising the overall average duration of shutdowns.

Also read: Making Stablecoins Just Got Easier, Stripe Launches New Developer Tool!

Long Impasse and Opportunities for Crypto

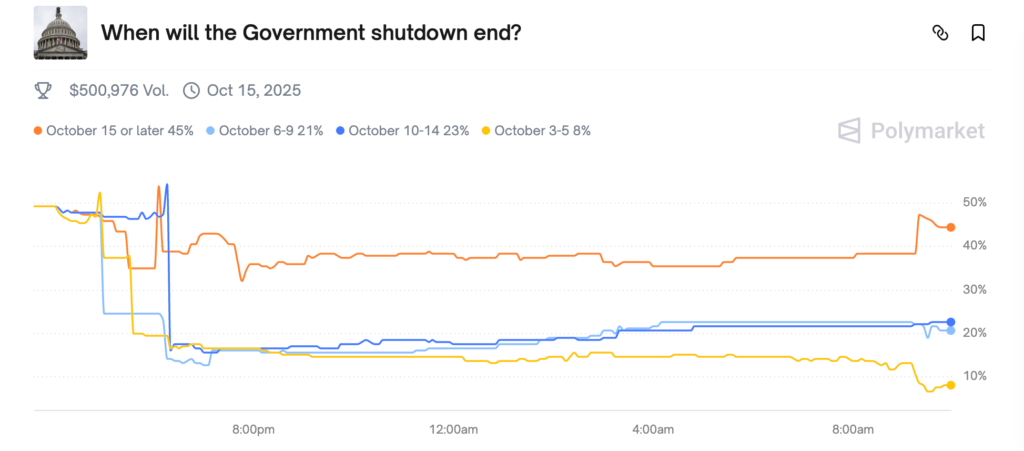

Currently, market predictions suggest that the shutdown will last for two weeks or more. This is cause for concern, but also opens up opportunities for the crypto market. Bitcoin’s (BTC) high performance on the first day of the shutdown is an important indicator.

While there is much controversy over how Bitcoin (BTC) will fare in a longer recession, the current situation provides an opportunity to gather valuable data. If the token market continues to rise during the shutdown and credit downgrade, it will be a strong signal that crypto can be a valuable hedge during a recession.

Also read: BNB Chain’s Official Account Hacked, CZ Gives This Warning!

Crypto Market Analysis and Predictions

On the first day of the close, the crypto market showed an impressive performance. This led to speculation that cryptocurrencies, such as Bitcoin (BTC) and Ethereum (ETH), might act as safe assets amid economic uncertainty. Market analysts suggest that if this trend continues, crypto could be considered a stable investment alternative in times of uncertainty.

Moreover, the increased interest in crypto during this period of instability indicates a shift in investor behavior from traditional to digital assets. This marks an important moment in the adoption of crypto as a key component in global investment portfolios.

Conclusion

The US government shutdown and the potential downgrade of its credit rating are worrying events for many. However, with every crisis comes opportunity, and crypto markets seem to be finding a new foothold as a reliable asset amidst uncertainty. Looking ahead, it will be interesting to see how the dynamic between traditional and digital financial markets will continue to evolve.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. US Shutdown & Credit Downgrade: Crypto Impact. Accessed on October 3, 2025

- Featured Image: Generated by Ai

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.