4 Altcoins Grayscale Is Buying—Could These Be the Next to Surge?

Jakarta, Pintu News – Grayscale Investments’ moves including new filing documents, product name changes, and asset accumulation trends signal that the company is expanding its investment reach into tokens such as Chainlink (LINK), Zcash (ZEC), Stellar Lumens (XLM), and Filecoin (FIL).

This development shows that the global digital asset management giant is not only focusing on Bitcoin (BTC) and Ethereum (ETH), but is also starting to set its sights on specific altcoins.

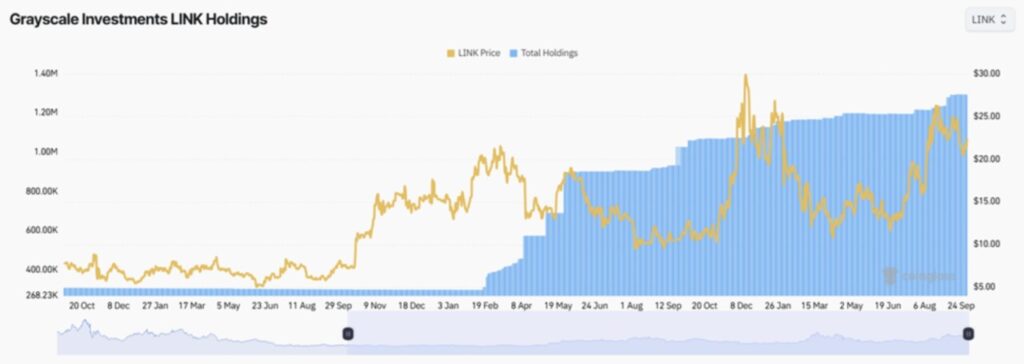

LINK: Momentum ETF Meets On-Chain Power

Data from the Grayscale proprietary chart shows that asset accumulation often occurs before the price rallies, raising the question of which assets are likely to experience the next spike.

Read also: Is Altcoin Season Here? Institutional Support Fuels Strong Moves in XRP and AVAX

In early September, Grayscale filed a spot ETF application for LINK in the US. The asset manager is seeking approval from the SEC to convert its existing Chainlink Trust product into an exchange-traded fund (ETF) and is listed on NYSE Arca under the stock code GLNK.

The filing also includes a possible staking feature, with Coinbase Custody acting as custodian. The move comes amid Chainlink’s impressive price resilience, even in times of broader market uncertainty, such as the US government shutdown.

Analysts from More Crypto Online also highlighted that LINK has one of the most solid macro structures among other altcoins.

Meanwhile, the accumulation chart for LINK shows consistent buying pressure throughout 2024, where the number of holdings increased before the price strengthening occurred.

This correspondence between Grayscale’s institutional products and market movements indicates that some investors may have started to profit.

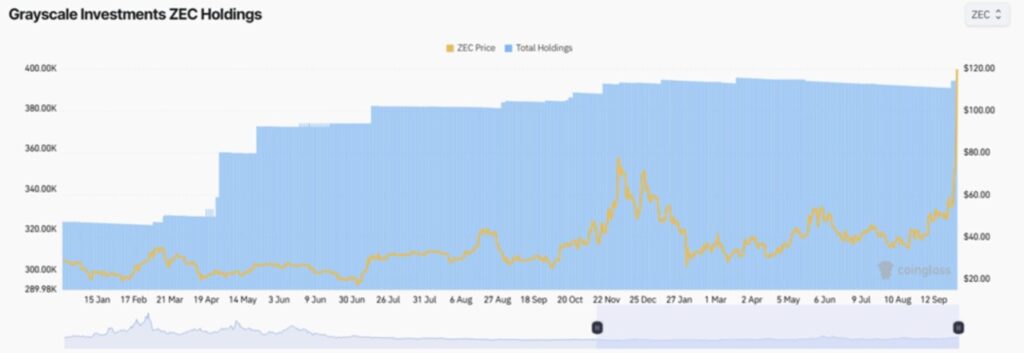

ZEC: Privacy Coins Back in the Spotlight

Zcash (ZEC), a privacy-focused crypto coin developed from Bitcoin’s base code, is again attracting interest from institutions.

Grayscale highlighted ZEC’s zk-SNARKs technology as a critical component in protecting transaction information amid increased global financial scrutiny. Grayscale’s Zcash Trust product is still open to accredited investors, fueling speculation about the possibility of wider exposure to the general market.

After Grayscale’s post, the price of ZEC surged by more than 110%, suggesting that signals from large institutions could have triggered the price rally.

“Grayscale adds ZEC – instantly up 110%+. Now privacy coin (Zero Knowledge) is getting hot & following the trend,” GA Crypto wrote.

Based on data from Coinglass, Grayscale’s ZEC holdings increased from 320,000 to 380,000 coins between January and August 2025. Along with that, the price of ZEC jumped from $20 to $120 between August to October 2025, with the number of holdings remaining stable despite increased market volatility.

Read also: Injective (INJ) Presents Leverage Feature for OpenAI Asset Trading

Thor Torrens, former Special Assistant to the US President and member of the Zcash Advisory Panel, again brought up Grayscale’s 2018 thesis on ZEC.

He stated that if just 10% of offshore wealth, estimated at $32 trillion, went into Zcash, then the price of the coin could theoretically reach $62,893 per coin.

While such projections are highly speculative, the latest on-chain data suggests there is upward momentum.

Analysts from Alphractal noted an increase in the number of wallet addresses holding more than $10 million in ZEC. They also point to positive growth in the Delta Growth Rate and an increase in the MVRV Z-Score, indicating new speculative fund flows into the asset.

Meanwhile, voices from the community such as Eric Van Tassel highlighted that ZEC has been consolidating in a wedge (narrowed triangle) pattern for the past nine years – with comparisons to price breakouts such as those that have occurred in XRP (XRP) and XLM after forming similar long-term technical patterns.

XLM: From Trust to ETF

Stellar Lumens (XLM) is one of the altcoins that has felt the positive impact of Grayscale’s change in strategy. This asset is now receiving renewed attention as Grayscale and 21Shares move to expand access for institutional investors.

According to data from Coinglass, Grayscale’s XLM holdings increased from 100 million to 120 million coins between July and October 2025.

During this period, XLM’s price experienced considerable volatility, but its steady accumulation demonstrates Grayscale’s confidence in XLM’s long-term prospects, despite market fluctuations.

In January 2025, Grayscale rebranded its Stellar Lumens Trust (GXLM) product into an ETF, providing wider access to both institutional and retail investors. The ETF offers features such as volume-weighted pricing, redemption mechanism, and listing on NYSE Arca – all aimed at reducing liquidity gaps and price premiums.

The move is part of a new wave of crypto ETFs that go beyond Bitcoin and Ethereum, following the approval of the Hashdex Nasdaq crypto index ETF in the US.

Lucas Machiavelli, a Cardano (ADA) ambassador, stated that this transition legitimizes XLM (and other altcoins) as a utility asset that can be integrated into mainstream investment portfolios.

Read also: After CZ’s Endorsement, ASTER Flows Into Binance Wallets — Is a Listing Around the Corner?

FIL: Accumulation Before Market Recognition?

While LINK, ZEC, and XLM have experienced price rallies as investors accumulate, Filecoin (FIL) remains an interesting exception. Grayscale’s Filecoin Trust product allows investors to gain exposure to FIL without having to hold the asset directly – simplifying the technical aspects of ownership.

Additionally, FIL’s presence in the Grayscale Decentralized AI Fund portfolio – alongside assets such as Bittensor (TAO), Near (NEAR), Render (RENDER), and The Graph (GRT) – highlights FIL’s strategic position at the intersection of artificial intelligence and decentralized storage technologies.

Although FIL’s price movement is still relatively flat, holdings data shows a gradual accumulation, indicating that Grayscale investors may be preparing early before the market realizes FIL’s potential.

With the growing need for decentralized storage going hand-in-hand with the surge in AI-based demand, FIL could potentially be the next asset to catch the market’s attention.

Notably, the expansion of Grayscale’s altcoin products – including accumulation against LINK, ZEC, XLM, and FIL before the market’s big move – signals that Grayscale is not only responding to the market, but also possibly shaping the future altcoin narrative.

Based on these developments, investors are advised to monitor Grayscale products as early indicators of altcoins that could potentially experience the next rally – of course, while still conducting their own research and analysis.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Altcoins: Grayscale’s Investment Accumulating. Accessed on October 3, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.