5 Popular & Boldest Crypto Whales of 2025: There’s a Coin Meme King!

Jakarta, Pintu News – The world of crypto and cryptocurrency is known for its extreme volatility, but amidst the wild price movements, a handful of traders emerge who are able to reap fantastic profits. These traders often barometer market sentiment, lead trends, or even trigger significant price movements through their highly leveraged positions.

With Bitcoin (BTC) and the altcoin market showing growth potential, understanding the strategies of these whales is important for retail investors. Here are five crypto traders whose strategies and movements are worth watching throughout 2025, based on analysis from Cointelegraph.

1. James Wynn: King of High Leverage Meme Coins

James Wynn (known as JamesWynnReal) is one of the most watched traders in 2025, not only for his headline-grabbing big wins, but also for his equally dramatic big losses. His trading style is very distinctive: high leverage (often up to 40x), bold swings on memecoins, and an appetite for chasing volatility on Bitcoin (BTC) and other macro-sensitive assets, as Cointelegraph notes.

In May 2025, Wynn reportedly opened a 40x leveraged long Bitcoin position worth approximately $1.1 billion to $1.25 billion. When the price of BTC slipped, the position (and several others) were liquidated, resulting in losses of tens of millions of dollars, demonstrating how bold positions can quickly deplete capital. To observers, Wynn epitomizes both sides of speculative trading: the potential for lucrative profits and the speed with which capital can be lost in a matter of minutes.

Also Read: 3 Coins with the Biggest Futures Volume This Week According to GPT Chat

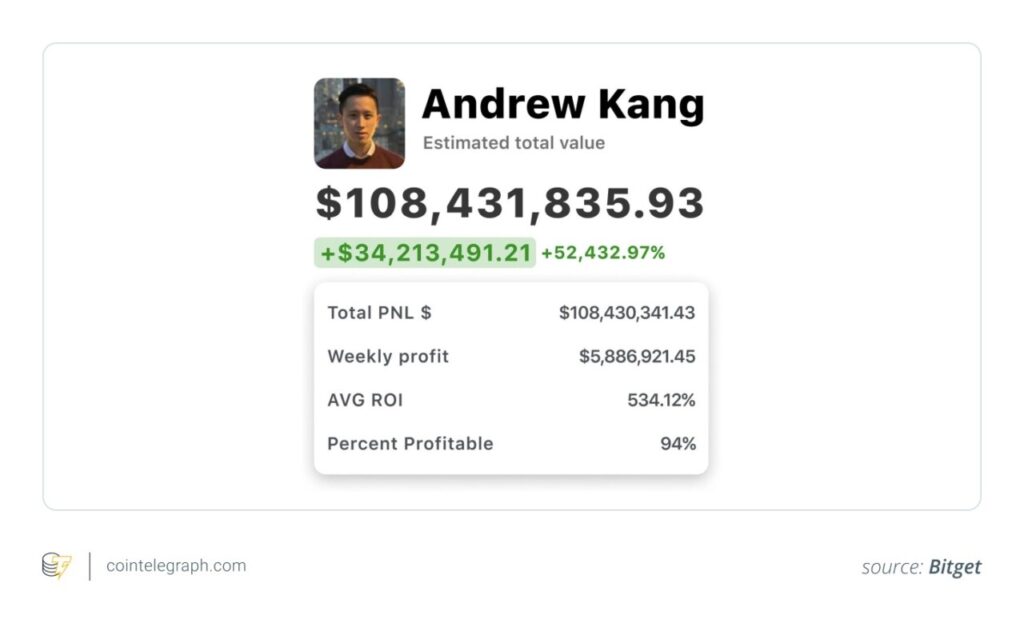

2. Andrew Kang: Thesis-Driven & Macro Strategies

Andrew Kang, co-founder of Mechanism Capital, is notable for histhesis-driven approach, which he openly publicizes and translates into liquid asset trading. This approach seeks to combine macroeconomic views or clear policy shifts with conviction-leveraged trades, as Cointelegraph reviewed.

One of his most public trading moves took place in April 2025 on Hyperliquid’s perpetual exchange. Kang opened a long Bitcoin (BTC) position with 40x leverage worth up to $200 million (approximately Rp3.32 Trillion), coinciding with Donald Trump’s announcement of a US tariff policy pause. This action demonstrates his ability to link policy catalysts with crypto trading, but the success of this strategy is highly dependent on proper position sizing.

3. GCR(Gigantic Rebirth): Contrarian Altcoin with Timing

GCR (which stands for Gigantic Rebirth) is a semi-anonymous trader known for his high conviction and often contrarian (against market consensus) calls. GCR attracted global attention for successfully shorting LUNA (including $10 million) right before its collapse, according to Cointelegraph. Since then, he has been known for combining risky altcoins with a keen eye for reading macro shifts.

In 2025, GCR actively sold large altcoin positions, including the sale of approximately 174.9 million CULT tokens, converting them into Ether (ETH) and Tether’s USDt (USDT). At the same time, he issued bullish calls on ETH and attributed the prospects of meme coins such as Shiba Inu (SHIB) to macro factors such as inflation. GCR’ s trading is defined by a blend of bold altcoin exposure and quick exit capabilities when needed.

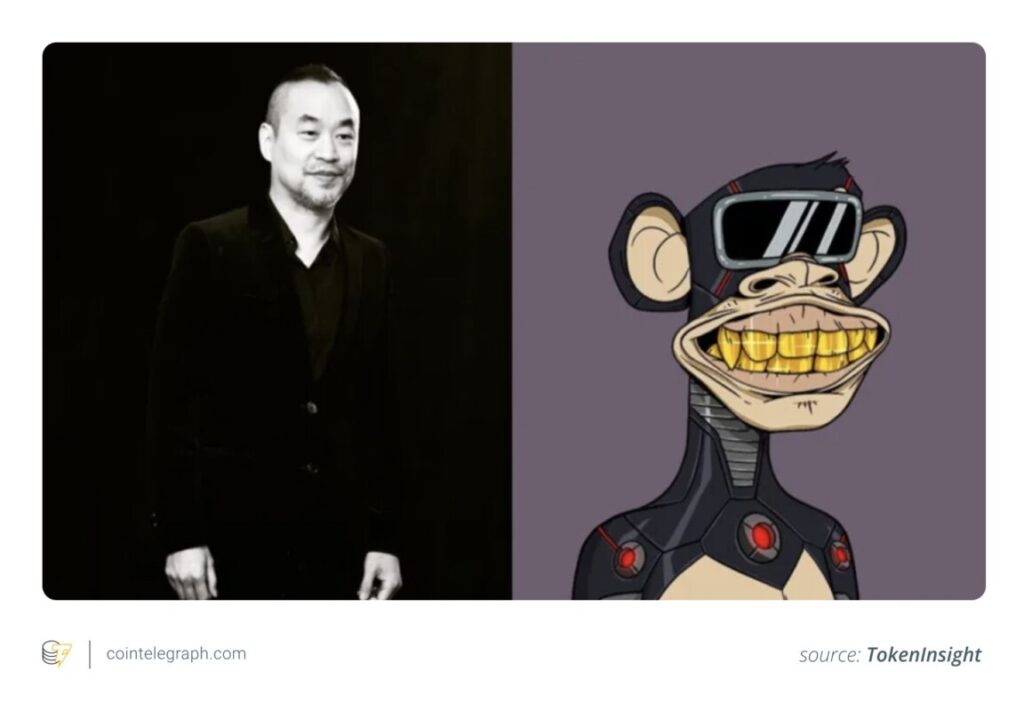

4. Machi Big Brother: Big Leverage Swing on Memes & NFTs

Jeffrey Huang, or Machi Big Brother, is an entertainment entrepreneur turned crypto personality best known for his NFT speculations and highly leveraged bold fiat plays. He continued his reputation in 2025 by going long Ethereum (ETH) for around $54 million with 25x leverage and a 5x leverage position on HYPE on Hyperliquid.

Machi’s trading strategy is characterized by bold swings, where profits can reverse in a matter of hours. Although his portfolio briefly showed unrealized gains of over $30 million, he reported a net loss of $4.3 million on one memecoin alone. Machi represents high volatility in a corner of the market driven by memes and NFTs, where the fate of fortunes can change overnight.

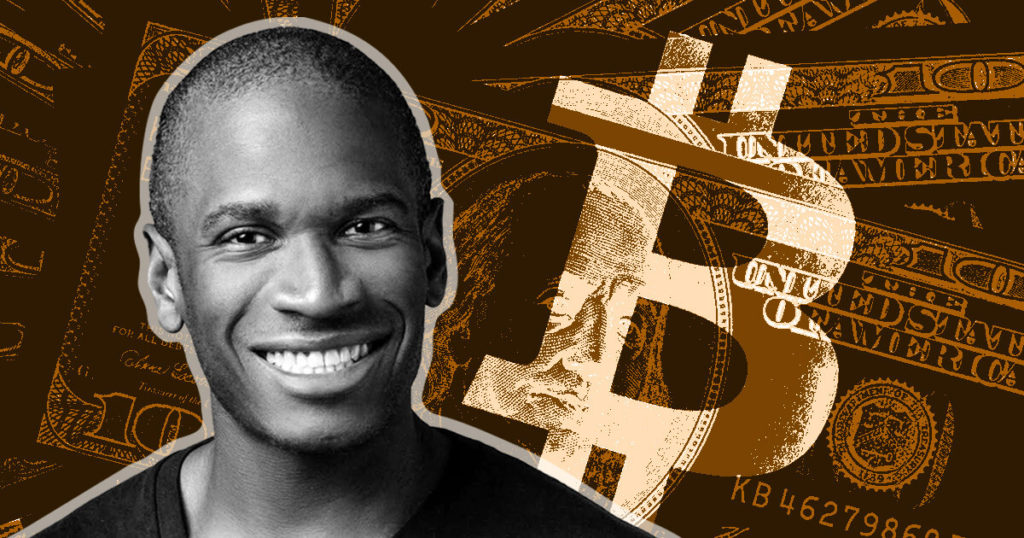

5. Arthur Hayes: Global Macro and Liquidity Forecaster

Arthur Hayes, co-founder of BitMEX, is respected as one of the leading macro voices in the crypto world. His essays and interviews regularly link central bank policy, liquidity flows, and the supply mechanisms of Bitcoin and Ether (ETH). Hayes’ views often shape how the market views macro-crypto dynamics as a whole, as Cointelegraph reviews.

In 2025, Hayes issued a series of predictions. On the bearish side, he warns of a correction that could drag Bitcoin back to the $70,000 to $75,000 range during a phase of monetary tightening. However, his long-term view is extremely bullish, predicting BTC could rise as high as $200,000 by the end of the year, driven by bond buybacks and a global flood of liquidity. Hayes offers dual value to his followers: as a macro thinker and a trader who dares to put his capital on the line.

Also Read: 5 Reasons XRP Could Hit IDR66,000 by the End of 2025: ETFs, Fed, & Crypto Market Momentum

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Top 5 crypto traders to watch in 2025: From James Wynn to Machi Big Brother. Accessed October 3, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.