Arkham Intelligence Explained: How It Works, Key Features, and ARKM Token Allocation

Jakarta, Pintu News – Arkham Intelligence has emerged as one of the most attention-grabbing crypto projects as it offers an on-chain analytics platform with a unique approach. Through blockchain intelligence technology, Arkham aims to uncover transaction data that was previously difficult to access, while bringing more transparency to the crypto ecosystem.

Not only that, the existence of ARKM native tokens is an important part of supporting its ecosystem, from governance to incentives for users. This article will discuss in full how Arkham Intelligence works, its excellent features, and the details of ARKM token allocation.

Get to Know Arkham Intelligence

Arkham Intelligence is an on-chain analytics platform that addresses a key challenge in the blockchain world: high data transparency, but confusing complexity. The platform provides a range of advanced analytics tools that allow anyone to dig deeper into the information available across the various supported blockchain networks.

Read also: Altcoin Watch: 3 Tokens Capturing Attention Amid Binance Listing Speculation

According to Arkham’s CEO, Miguel Morel, one of the company’s main focuses is to provide better access to market intelligence for investees, especially traders.

“Arkham’s main customers are hedge fund traders, and people looking to profit from information on who is buying or selling large amounts,” says Morel.

In the world of digital asset trading, each trader uses different types of information, such as:

- Asset fundamentals: Includes a thorough analysis of the project or company.

- Price data: Analyzing historical price movements to forecast future performance.

- Transaction data: Tracks the movement of funds in a distributed ledger, which greatly influences the direction of the market.

Not only traders, but regulators, policymakers, and security experts also rely on this data to maintain transparency, market integrity, and address potential threats.

Quoting the CoinGecko page, Arkham’s main focus is on transaction data. Although blockchains are open, transaction information such as entity identities and transaction volumes are often hidden behind rows of hexadecimal digits and long transaction records that are difficult to read. This makes pseudonymity (semi-identity anonymity) a built-in feature of blockchain, where individuals and organizations appear only as wallet addresses or ENS names on the screen-without a clear identity.

This means that while wallet activity can be seen, attributing it to real individuals or institutions is a challenge. Even if one manages to read the raw data, understanding the deeper context or reasoning behind the transaction remains difficult.

How does Arkham Intelligence Work?

The first step Arkham Intelligence takes is to collect data from various sources, both on-chain and off-chain. This data includes pseudonymized wallet addresses (not directly linked to real identities), transaction history, and details from smart contract code. Some data may be related to real-world identities, while others are completely anonymous.

Once the raw data is collected, the next challenge is to turn it into usable information. Arkham does this by combining expertise in software engineering, data science andmachine learning. Through this approach, the anonymized data is classified into more understandable entities, such as individuals, organizations, or specific groups.

This classification process involves analyzing various data points and gathering intelligence from multiple sources to identify who might be behind an address or blockchain activity. The accuracy of this classification is continuously refined using machine learning heuristics – algorithms that are able to recognize patterns, learn relationships between data, and gradually become smarter at matching anonymous entities with real-world identities.

As the end result, Arkham provides an intuitive dashboard interface, where all this consolidated data can be accessed, searched, and analyzed by users quickly and easily. With this tool, Arkham opens the door for anyone-traders, researchers, and regulators alike-to understand the blockchain ecosystem in a more transparent and structured way.

Features of Arkham Intelligence

Since its inception, Arkham Intelligence has introduced various advanced features that make it an excellent platform for analyzing and uncovering anonymous identities on blockchain networks. Here are the core features that Arkham is known for:

Read also: Sui Launches suiUSDe and USDi Stablecoins With Ethena & BlackRock-Backed Token Funds

1. Arkham Dashboard

Arkham Dashboard is a control center designed to provide a fully customizable user experience.

Different from standard dashboards, this feature allows users to handpick the metrics they want to monitor. With a simple drag-and-drop interface, you can customize your data display according to your needs-creating a unique dashboard that only you have.

2. Arkham Intel Exchange

Intel Exchange is a marketplace feature that is an important pillar in Arkham’s mission to deanonymize the blockchain. Here, users can provide bounties for information that links anonymous wallet addresses to real-world identities. The community can then try to provide proof-according to the platform’s rules, of course.

For example, there is currently a bounty of over 100,000 ARKM (~$33,500) for anyone who can identify the culprit behind the major hack in the November 2022 FTX collapse, which caused over $415 million in losses.

Although criticized and dubbed as “Snitch-to-Earn”, Arkham insists that only public information should be used in this evidence-seeking process.

3. Arkham Visualizer

For those of you who prefer a visual approach, the Arkham Visualizer is an interactive feature that presents data in the form of a transaction network. The visualizer converts raw data into a map of the relationship between wallet addresses and transaction flows, making it easier for users to:

- Track asset flows,

- Identify transaction patterns,

- Understand the relationship between entities,

- And get a comprehensive overview of asset inflows and outflows.

You can also use it to visually analyze the transactions of a particular token.

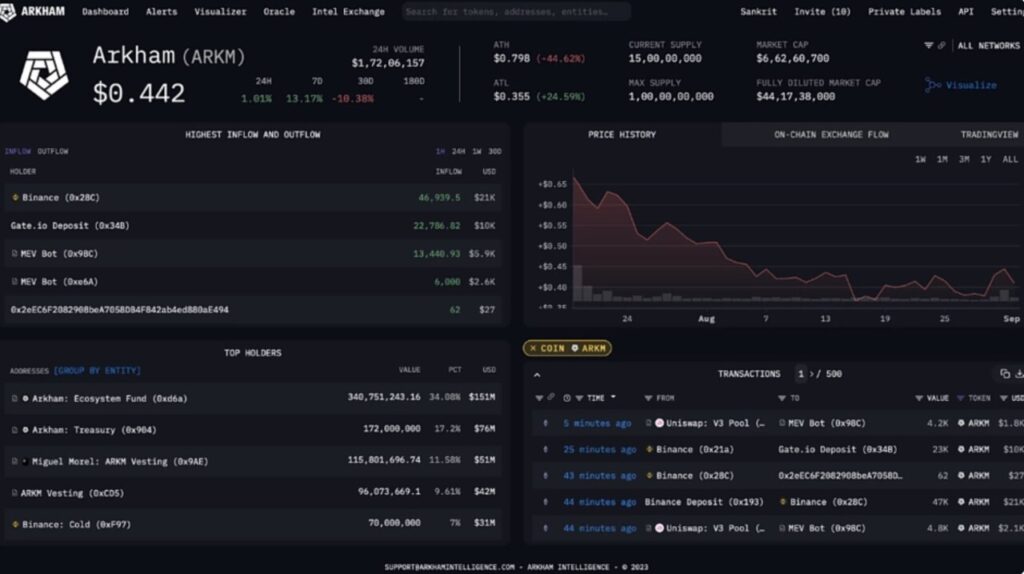

4. Arkham Token Pages

Token Pages provide a complete summary of a token, including:

- Top holders,

- Transaction history,

- The highest inflow and outflow in a given time period.

Users can also filter data by address, volume, and more. There is also a “Visualize” button to directly open a visual display of the token transaction through the Visualizer.

5. Arkham Private Labels

The Private Labels feature allows users to privately label specific wallet addresses or entities. You can:

- Group multiple addresses into one category,

- Labeling for easy tracking,

- Compile an analysis based on the entities you tagged yourself.

Most importantly, these labels are private-only you can see them, not other Arkham users.

6. Arkham Oracle (AI Assistant)

Arkham Oracle is an AI assistant that powers on-chain analysis using artificial intelligence. By entering commands in natural language, you can request specific data such as:

- The current balance of an entity,

- Token ownership history,

- Or analysis around specific wallet activity.

Oracle works like a personal chatbot that helps you browse blockchain information quickly and efficiently.

ARKM Token: The Foundation of the Arkham Intelligence Ecosystem

The ARKM token is the core of the Arkham Intelligence ecosystem, serving as both an incentive tool and a governance token. The total supply of ARKM is capped at 1,000,000,000 (1 billion) tokens, designed to protect holders from value dilution and maintain the long-term economic stability of the token.

Read also: Uptober 2025 Predictions: Bitcoin and Ethereum Ready to Rally After Initial Decline?

At launch, 15% of the total supply was circulated to ensure early liquidity, while minimizing price volatility. This phased distribution strategy was designed to balance the needs of early adopters and project sustainability.

Here are the details of the ARKM token allocation:

Ecosystem Incentives & Grants: 37,3%

The largest portion is allocated to support growth and participation in the Arkham network. This token is given as a reward to users who:

- Contributing intelligence,

- Participate in bug bounties,

- Drive platform adoption.

Distribution was phased in over five years, to maintain the interest of the developer and user communities.

Core Contributors (Team & Founders): 20%

Founders and team members will receive their allocations after a 1-year lock-up period. After that, their tokens will be linearly vested over 3 years, so that their incentives are aligned with Arkham’s long-term performance.

Early Investors: 17,5%

Investors who support the project from the start get the same treatment as the team: a 1-year lock, then vesting for 3 years. This prevents massive sell-offs that could destabilize prices.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinGecko. What Is Arkham Intelligence and How to Use It? Accessed on October 3, 2025

- Findas. The Tokenomics of Arkham (ARKM). Accessed on October 3, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.