Crypto Officially Part of the Global Financial System in the Third Quarter of 2025

Jakarta, Pintu News – In the third quarter of 2025, the world witnessed a milestone where cryptocurrencies officially became part of the global financial system. This event had a significant impact on the dynamics of the industry as a whole. This article will review the key events that have shaped the current landscape.

First Crypto Legislation in the US

After years of being in a gray zone, digital assets are finally gaining legal clarity that encourages wider institutional adoption. There are three key developments on the legislative front: GENIUS Act, CLARITY Act, and Anti-CBDC Surveillance State Act.

These three laws have paved the way for deeper integration between financial technology and government regulation. In particular, the CLARITY Act provides a clear framework for the operation and supervision of cryptocurrencies, which is highly anticipated by market participants.

This allows large financial institutions to more easily integrate crypto assets in their portfolios, reducing the legal uncertainty that has been a barrier.

Also Read: 3 Coins with the Biggest Futures Volume This Week According to GPT Chat

Global Market Dynamics

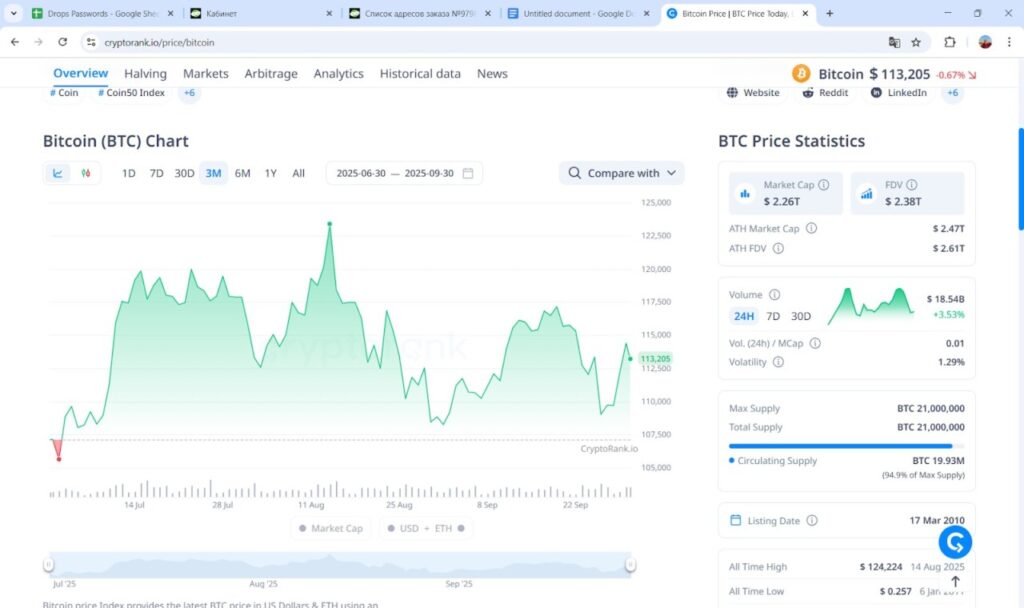

The S&P 500 Index, gold and Bitcoin (BTC) performed strongly in the third quarter of 2025. In addition, other metals such as silver and platinum also recorded significant growth, reaching multi-year peaks. This market dynamic shows a marked shift, although it is still difficult to predict its long-term direction.

This growth reflects increased investor confidence in risky assets amid stable global economic conditions. This confidence is reinforced by new regulatory clarity, which allows institutional investors to allocate larger amounts of funds into cryptocurrencies.

Institutional Adoption and Technological Innovation

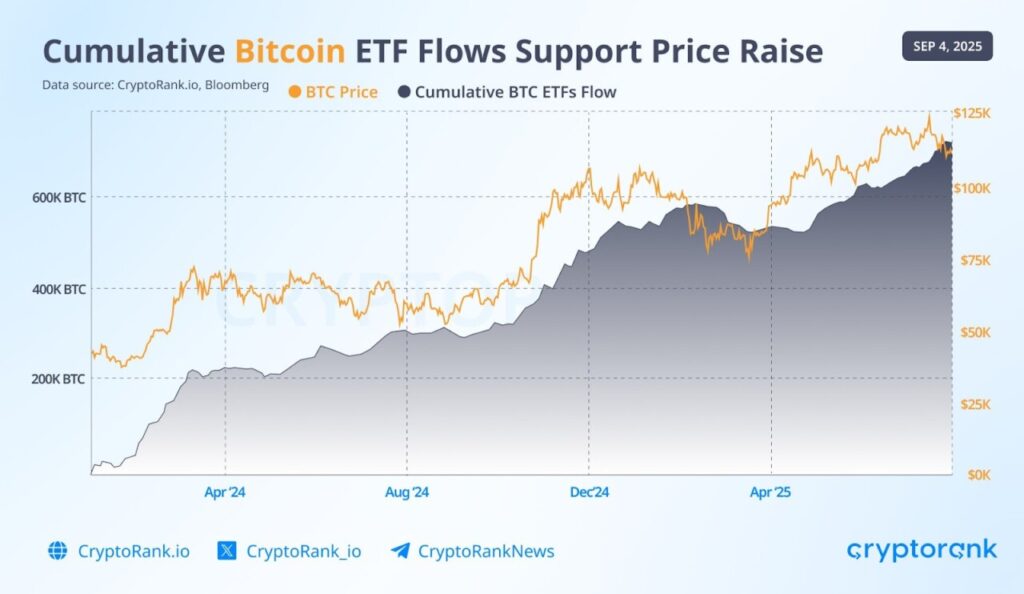

Bitcoin (BTC) continues to show positive dynamics with significant adoption from institutional investors, which contributes to a decrease in the volatility of the asset. Ethereum (ETH) also recorded a standout quarter by reaching new price highs, driven by legislative moves in the US in favor of stablecoins and DeFi (Decentralized Finance).

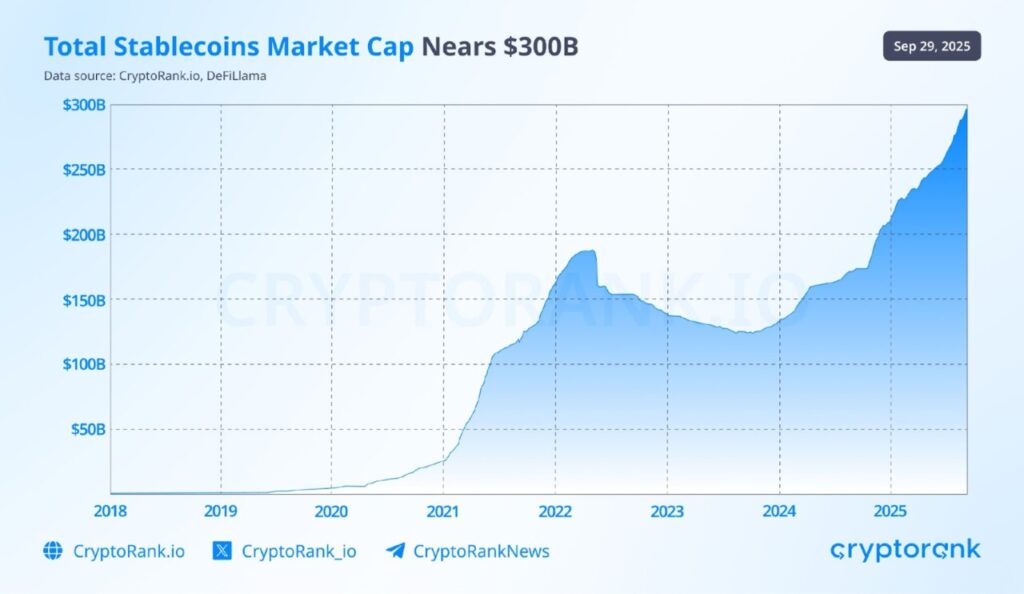

On the other hand, the ongoing DEX (Decentralized Exchange) battle has changed the competitive map in recent weeks. The growth of the total market capitalization of stablecoins close to $300 billion signifies a significant increase in net inflow, reflecting growth that is not only limited to traditional assets but also innovation in crypto financial products.

Conclusion

The third quarter of 2025 became a historical turning point for crypto, with the passage of the first federal crypto law in the US and a market that responded with record growth across sectors such as stablecoins, DeFi, prediction markets and onchain trading.

Accelerated institutional adoption, driven by regulatory clarity, ETF fund flows and the emergence of new infrastructure, shows that crypto is no longer on the fringe, but has been firmly integrated into the global financial system.

Also Read: 5 Reasons XRP Could Hit IDR66,000 by the End of 2025: ETFs, Fed, & Crypto Market Momentum

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Daily. Q3 Recap. Accessed on October 3, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.