Large XRP Holdings Shrink, Are Bearish Signals Starting to Show?

Jakarta, Pintu News – Ripple’s (XRP) recent price increase attempt has failed after it failed to break out of a descending wedge pattern. Currently, the cryptocurrency’s price is stagnant, with whale activity indicating a decline in confidence among large holders. This analysis will delve deeper into the current dynamics in the Ripple (XRP) market and the implications for future price trends.

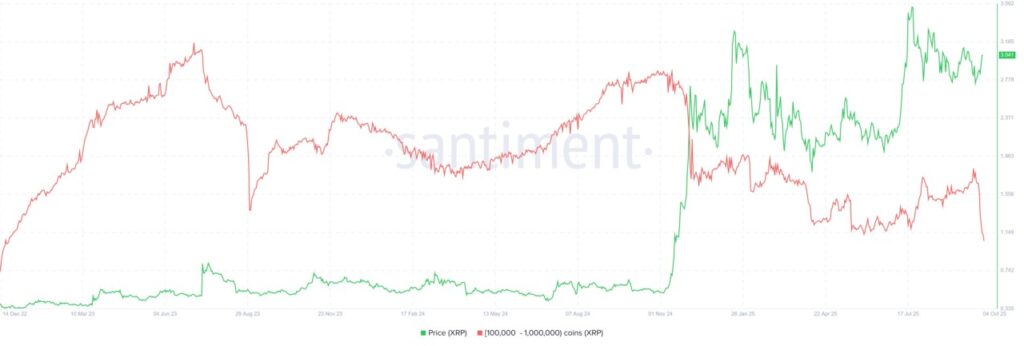

Sales by Whale Holders

In the past few days, large holders of Ripple (XRP) have started selling their assets in large numbers. This has seen the sale of over 100 million tokens by addresses holding between 100,000 and 1 million Ripple (XRP) in just 10 days.

This massive selling indicates a significant drop in confidence among large investors, which could be a response to the current market uncertainty. This selling has a direct impact on the price dynamics of Ripple (XRP).

When whales start to reduce their holdings, the supply in the market increases, which tends to depress prices. This phenomenon, if it continues, could exacerbate selling pressure and possibly trigger a broader chain reaction in the market.

Also read: 3 Examples of Phenomena that Rely on Narrative Crypto in 2025

Failure to Break Price Pattern

Ripple (XRP) is currently trading at $2.94, struggling to maintain this level as a floor of support. This drop comes after a failed attempt to break out of the descending wedge pattern that has formed. Initially, Ripple (XRP) showed signs that might lead to a bullish continuation, but did not have enough momentum to sustain it.

This failure raises questions about Ripple’s (XRP) short-term potential in the market. Without a significant buying push or a change in market sentiment, it is difficult to see how Ripple (XRP) can recover its position and start a sustained upward trend in the near future.

Implications for Ripple (XRP) Price

The decrease in whale activity and the failure of the price breakout suggest that there may be more selling pressure to come. Investors and market analysts should pay attention to these indicators as potential signals for future price movements. If the whales continue selling and no supportive factors emerge, Ripple (XRP) may face a longer bearish period.

However, the cryptocurrency market is often unpredictable. Changes in regulation, adoption of new technologies, or changes in the global macroeconomy can significantly affect the price of Ripple (XRP). Therefore, it is important for investors to remain vigilant and update their strategies according to market developments.

Conclusion

The current dynamics in the Ripple (XRP) market point to an uncertain period. Selling by whales and failure in price breakouts signal that there could be more challenges faced by Ripple (XRP) in the near future. Investors should consider these factors in making their investment decisions and prepare strategies accordingly with the changing market conditions.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. XRP Whale Holdings Fall to Multi-Year Low. Accessed on October 6, 2025

- Featured Image: U Today

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.