Ethereum Holds Steady at $4,500 as Whales Unload Massive Holdings — Here’s Why

Jakarta, Pintu News – Reporting from AMB Crypto, so far, Ethereum (ETH) is still showing strong resilience, trading around $4,500. If the selling pressure is successfully absorbed by the buyers(bulls), ETH has the potential to retest the $4,673 level and even target $4,800.

Since the market rebounded, Ethereum price has slowly shown a moderate increase. After touching a low of $3,800, ETH is now moving in an ascending channel pattern and has reached a peak around $4,619.

At the time of writing, ETH is trading at $4,540, up about 0.21% on the daily chart (6/10). However, the question remains – why does ETH still seem to be struggling to break the next price level?

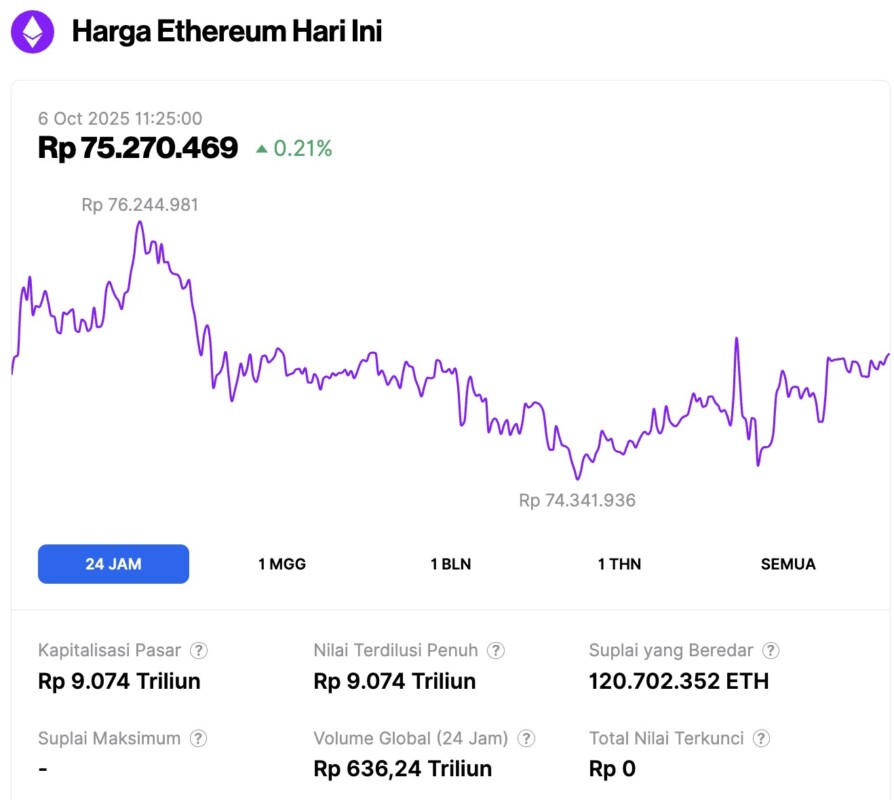

Ethereum Price Up 0.21% in 24 Hours

As of October 6, 2025, Ethereum was trading at around $4,540, or approximately IDR 75.27 million, marking a 0.21% increase over the past 24 hours. During this period, ETH fluctuated between a low of IDR 74.34 million and a high of IDR 76.24 million.

At the time of writing, Ethereum’s market capitalization stands at roughly IDR 9,074 trillion, while its daily trading volume has surged by 52% to reach IDR 636.24 trillion in the past day.

Read also: Bitcoin Hits $124K Today — Standard Chartered Says It Could Reach $200K

Whale Ethereum Makes a Big Sale

According to AMBCrypto’s report, Ethereum has not been able to record significant gains due to increased selling pressure from whales.

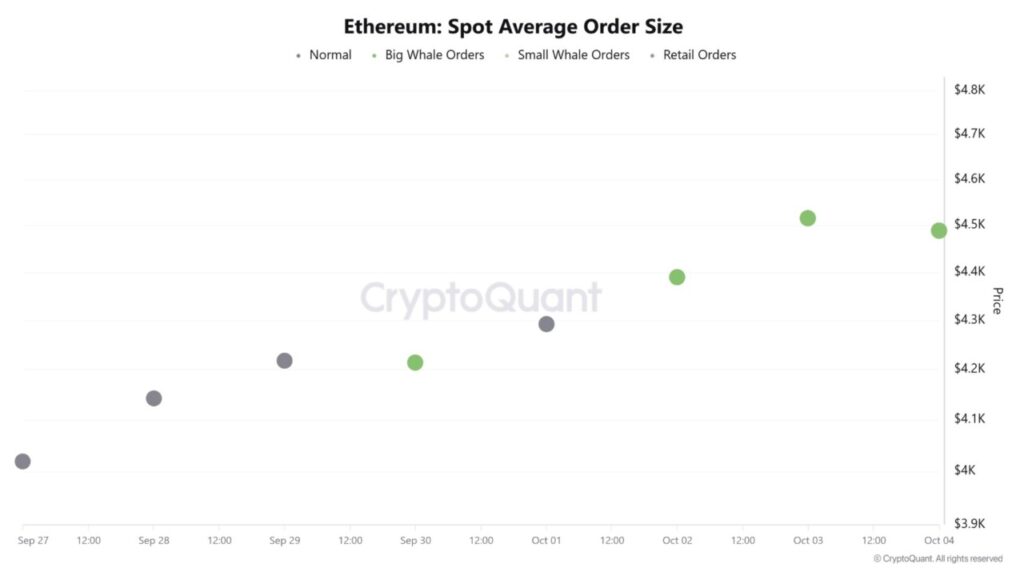

After the market had recovered, the whales immediately became active again. Spot Average Order Size data shows large orders from whales for three consecutive days. In the past week, Ethereum recorded large whale order activity on four out of seven trading days. Typically, increased whale activity signals higher involvement from institutional investors.

Interestingly, however, most of these orders were bulk sales, according to data from EmberCN. The on-chain monitor reported that Trend Research, one of the major entities, made an aggressive sell-off by offloading 41,421 ETH worth about $189 million on October 5.

Since starting the second wave of ETH sales on October 1, the entity has deposited a total of 102,355 ETH or approximately $455 million into the exchange.

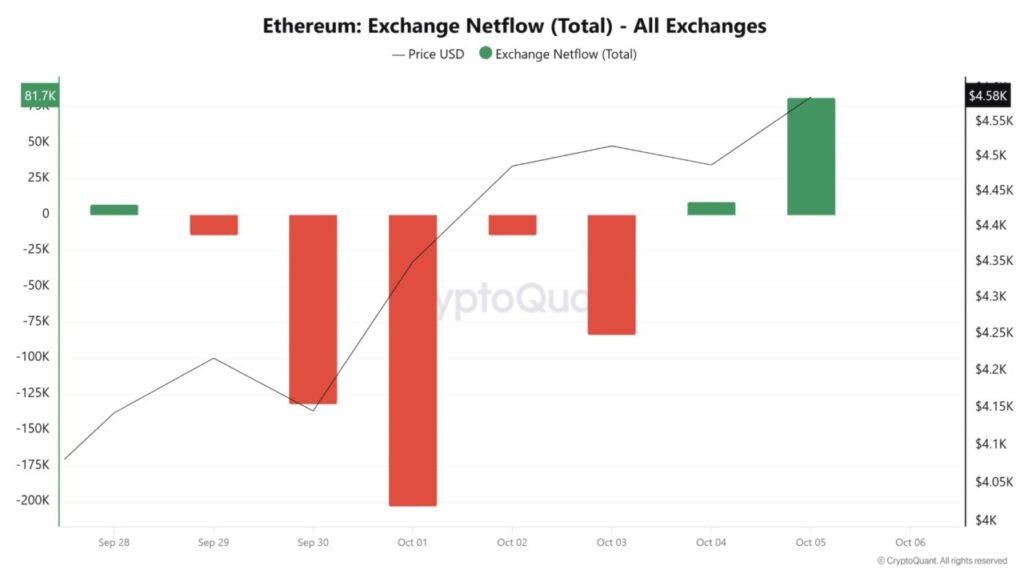

As a result of the increased selling pressure, Ethereum’s Exchange Netflow has remained in positive territory for two consecutive days – signaling a large inflow to the exchange for sale.

At the time of this report, Netflow stood at 81.7K ETH, a strong indication of a large spot sale.

Generally speaking, when big players like Trend Research go on an aggressive sell-off, it shows the market’s lack of confidence in short-term price gains – a bearish signal to watch out for.

Retail Traders Join in the Selling – Bearish Signals Grow Stronger

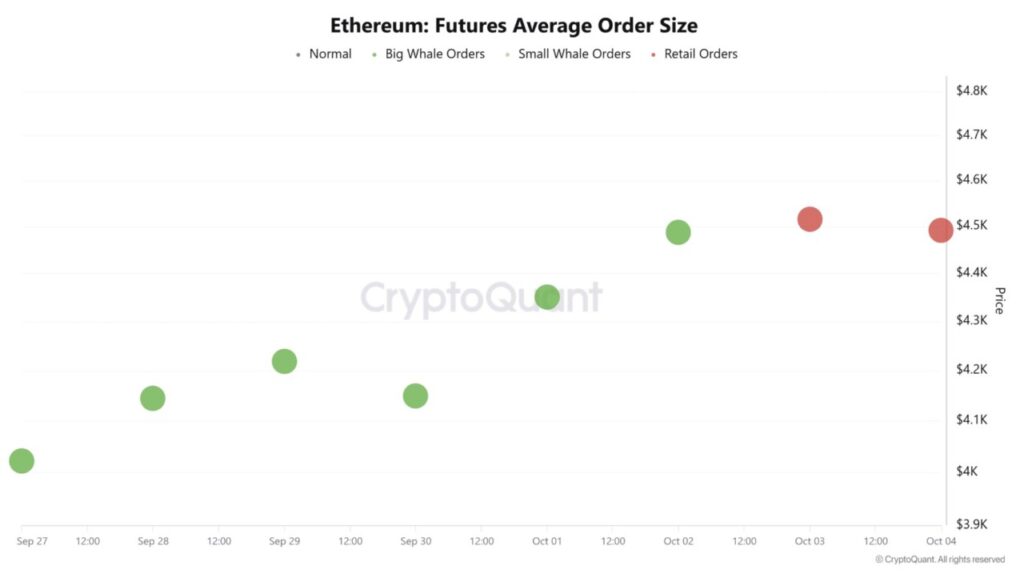

While the whales dominate the Spot market, AMBCrypto analysis shows that retail traders are now turning to the Futures market.

Read also: Shiba Inu Price Outlook: Analysts See SHIB Poised for a Rally After $4M Shibarium Hack Recovery

Data from CryptoQuant revealed that Futures Average Order Size was dominated by orders from retail traders for the second consecutive day. Interestingly, most of them were active on the sell side.

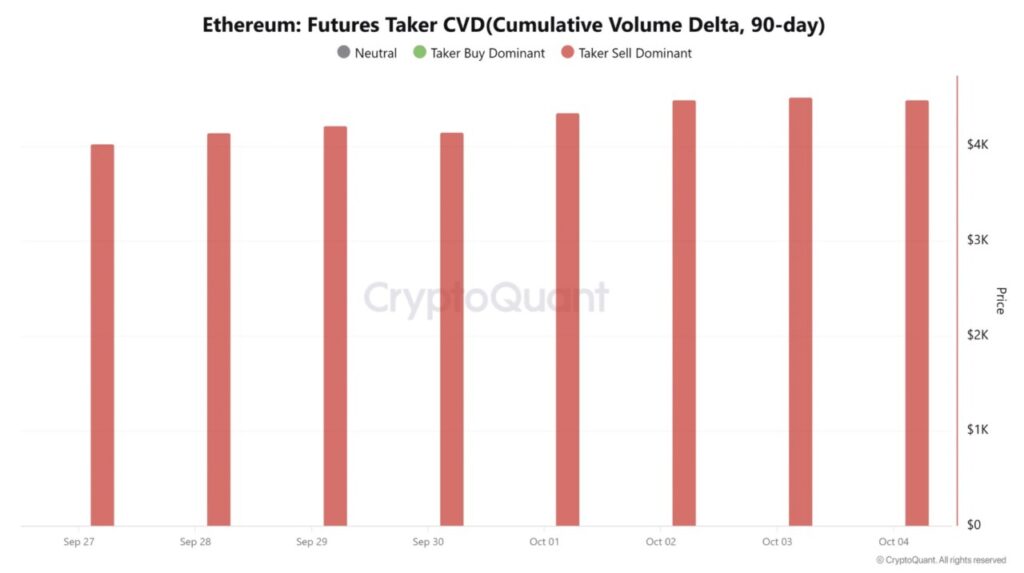

This is also reinforced by CryptoQuant’s Futures Taker CVD data which shows a “Taker Sell Dominant” condition, which is when selling pressure is higher than buying pressure.

When this metric is red, it means that many traders are closing their positions – a sign that retail market participants are derisking and opting out of market exposure.

This kind of market behavior signals declining confidence in the near-term outlook from both large and retail investors – a pretty clear bearish indication for Ethereum right now.

Can Ethereum (ETH) Withstand Market Pressure?

Despite the sharp increase in selling activity from whales and retail traders in the Futures market, ETH is still showing strong resilience. This indicates that the heavy selling pressure has not fully impacted the price, as the market is still able to absorb the selling flow.

Interestingly, Ethereum’s Directional Movement Index (DMI) indicator jumped from 20 to 28, signaling stronger upward momentum. Meanwhile, the Relative Vigor Index (RVGI) also increased to 0.22, reinforcing the upward movement signal.

Technically, when two momentum indicators show a pattern like this, it usually indicates a potential continuation of the uptrend if market conditions remain favorable.

If ETH manages to hold on and defy selling pressure, the asset has a chance to retest the $4,673 level and target resistance at $4,800. If that area is broken, ETH has the potential to break $5,000, as the resistance above that level is relatively weak.

However, if selling pressure from whales dominates the market again, ETH risks a correction to $4,415, with strong support around $4,248 as an important defense area for buyers.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Ethereum fights back as whales exit the market: What’s next? Accessed on October 6, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.