The Bull Theory analyst says BTC is ready to jump to $150,000 in October!

Jakarta, Pintu News – As the price of Bitcoin (BTC) approaches record highs, recently surpassing the $121,000 mark, analysts are increasingly optimistic about the cryptocurrency’s journey for October, often referred to as “Uptober”. A team of analysts from The Bull Theory predicts that the Bitcoin (BTC) price could reach up to $143,000, which translates to a potential surge of almost 20% for the rest of the month.

Projected Bitcoin Price Increase in October

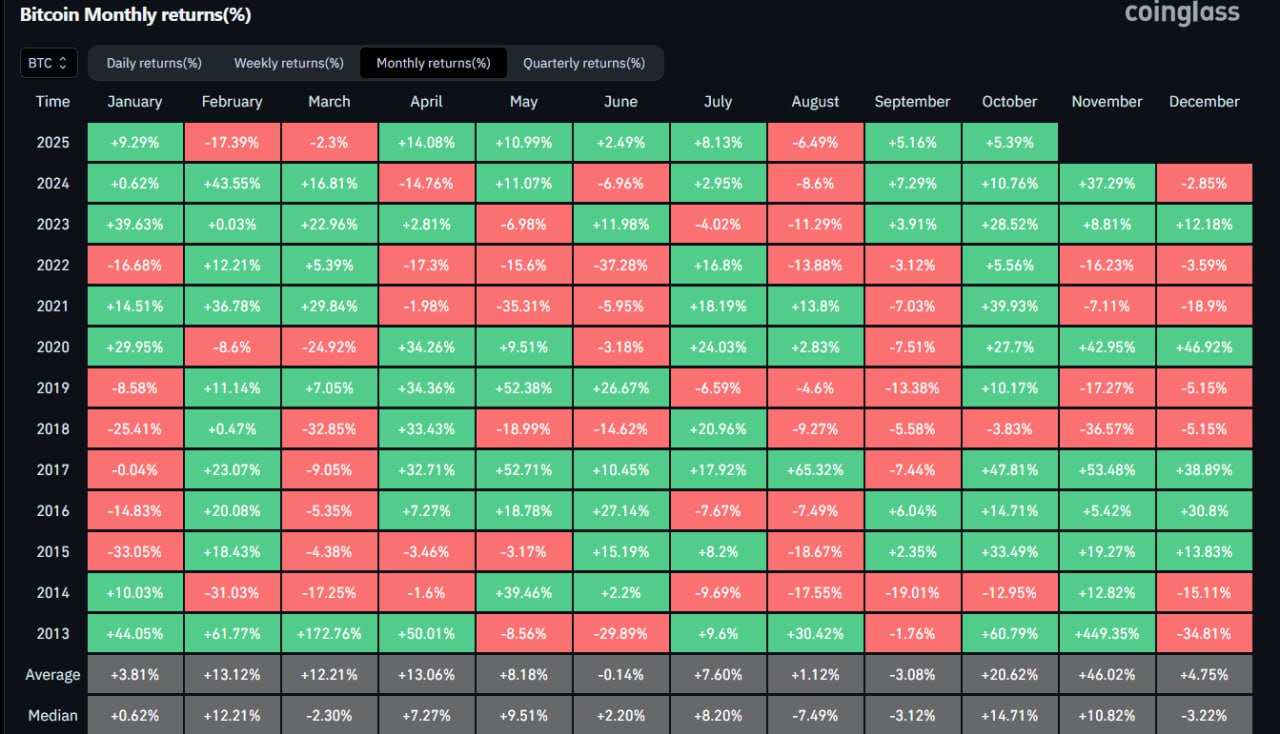

This projection may sound ambitious, but historical data supports the idea that October has consistently been one of the strongest months for Bitcoin (BTC). Over the past 12 years, Bitcoin (BTC) has closed October with gains in 10 of those years, and the correlation between strong performance in September and October is notable.

After a positive September-where Bitcoin (BTC) price recently posted a 3.91% gain-the stage seems to be set for another profitable October. Bitcoin (BTC) has an impressive October win rate of 83%, only recording a loss in the month twice since 2011.

Also Read: 10 Crypto Nearly Hit All-Time High Prices – October 2025 Update

History of the Favorable Month of October

In 2014, the cryptocurrency fell by 12.95%, and in 2018, it fell by 3.83%. This remarkable record highlights October as one of the most profitable months for Bitcoin (BTC) holders, with an average return of 20.62%. This pattern remains consistent: every time September closes positively, October follows in its footsteps. For example, in 2015, the price of Bitcoin (BTC) rose by 33.49% after September’s gain of 2.35%. Similarly, in 2023, a 3.91% gain in September turned into a substantial increase of 28.52% in October.

Potential Achievement $150,000

The bullish sentiment did not end there. In four out of four instances where September and October closed positively, November also continued the uptrend. The data shows consistent gains: in 2015, November saw an increase of 19.27% after a strong October.

If Bitcoin (BTC) manages to repeat its average return of 20.62% this October, a price point of around $143,539 could become a reality. Even if that’s in line with the median return of 14.71%, investors could see a new record reaching slightly above $136,000.

Conclusion

With the support of historical data and recent analysis, this October promises great potential for Bitcoin (BTC) to not only hit a new record but also possibly reach the $150,000 mark. Strong weekly gains and confidence from market experts add to the optimism that this month will be a very profitable one for Bitcoin (BTC) investors.

Also Read: Shocking Bitcoin Cash (BCH) Price Predictions for 2025 to 2030!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Top Analysts Predict Massive Bitcoin Price Rally, This October is $150,000 Within Reach. Accessed on October 6, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.