Bitcoin’s Big Selling Wave, Will the Price Be Affected?

Jakarta, Pintu News – The significant increase in Bitcoin (BTC) flows to exchanges by short-term holders indicates the potential for large profit-taking. Recent analysis of on-chain data reveals this trend, which may have an impact on Bitcoin’s (BTC) subsequent price movements.

Bitcoin (BTC) Short-Term Holders Start Selling

Bitcoin (BTC) short-term holders, defined as investors who purchased their coins in the last 155 days, have shown increased activity in transferring their Bitcoin (BTC) to exchanges. This group is often considered the “weak hands” who tend to sell their assets in the face of market volatility.

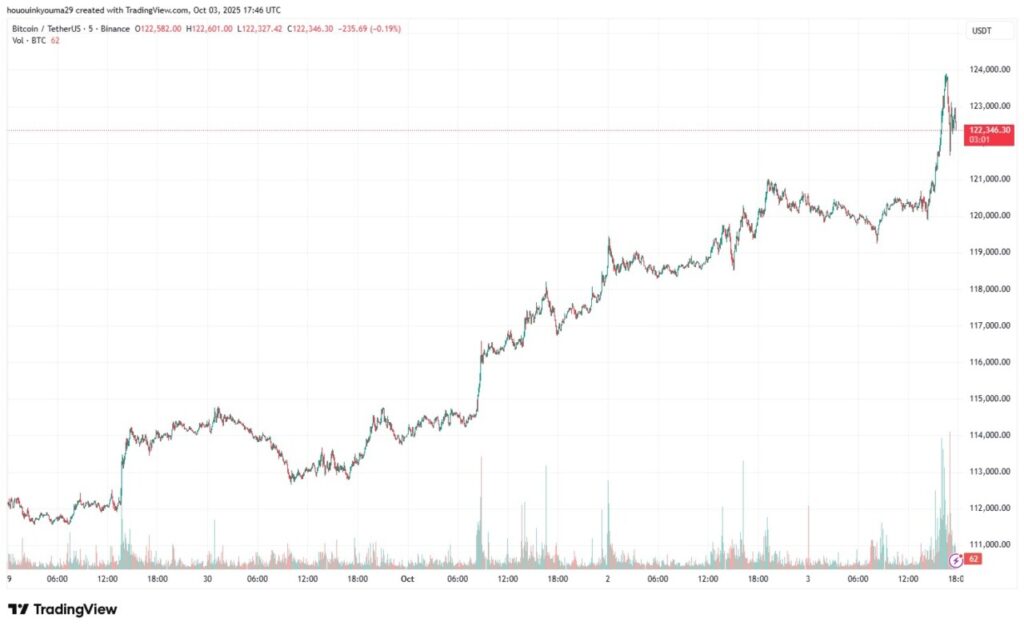

In recent days, Bitcoin (BTC) has seen a sharp rise in price, breaking through the $122,000 level. This has prompted speculation that short-term holders may start taking advantage of the price increase. Analysis from Maartunn, a community analyst at CryptoQuant, shows that there has been a large spike in deposits to exchanges made by this group.

Also Read: 10 Crypto Nearly Hit All-Time High Prices – October 2025 Update

Exchange Inflow Analysis

The chart shared by Maartunn shows a sharp increase in the amount of Bitcoin (BTC) being deposited into exchanges by short-term holders. In the 24-hour period during the last price spike, a total of 46,276 BTC, worth approximately $5.7 billion, was transferred to exchanges.

This is one of the largest spikes recorded recently. These deposits are generally interpreted as an indication of a desire to sell, given that exchanges are often used for trading purposes. The fact that this deposit occurred alongside a price rally suggests that short-term holders may be taking advantage of the increase in value.

Implications for Bitcoin (BTC) Price

The big question that remains is whether there will be enough demand in the market to absorb this selling pressure. If there is insufficient demand, this large sell-off could cause the price of Bitcoin (BTC) to stabilize or even drop, despite its recent significant gains.

Currently, the price of Bitcoin (BTC) is hovering around $122,700, with a gain of over 11% in the last seven days. The dynamics between supply and demand will largely determine the direction of Bitcoin (BTC) price in the near future.

Conclusion

The surge in deposits by short-term holders indicates the potential for significant profit-taking in the Bitcoin (BTC) market. While this could be an indicator of market health as it shows high activity and interest, it is also important to monitor whether the market can absorb this selling pressure without a major negative impact to the price.

Also Read: Shocking Bitcoin Cash (BCH) Price Predictions for 2025 to 2030!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin STHs 5.7B BTC Exchanges Profit Taking. Accessed on October 6, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.