Bitcoin Hits a New All-Time High of $126,000 as Markets Brace for a Prolonged US Government Shutdown

Jakarta, Pintu News – Bitcoin (BTC) has set another all-time high (ATH), continuing the upward trend that has been ongoing since early October. The rise comes amid market anticipation of a potential extension of the US government shutdown, which is expected to last up to three weeks.

Bitcoin Prints All-Time High on US Government Shutdown

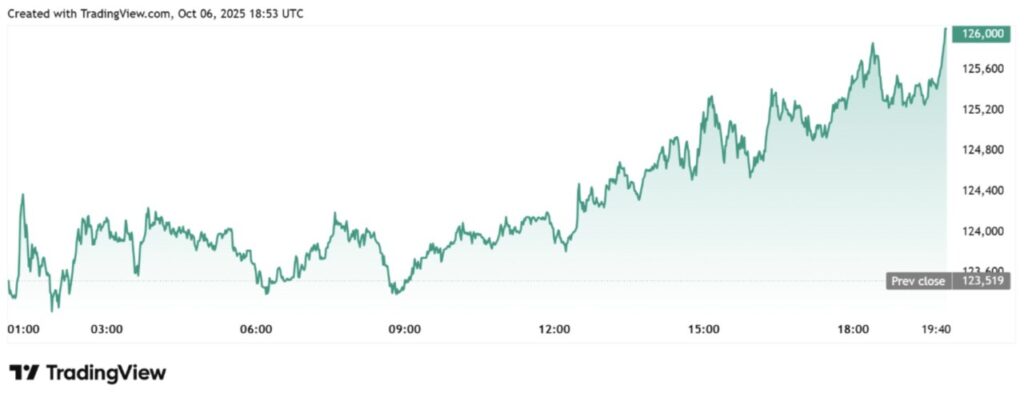

Data from TradingView shows that Bitcoin set another All-Time High (ATH) by breaking above $125,500, which it reached the day before.

Read also: 3 Crypto’s to Watch This Week, What’s Up?

As of October 6, BTC was trading around $126,000, up more than 2% in the last 24 hours.

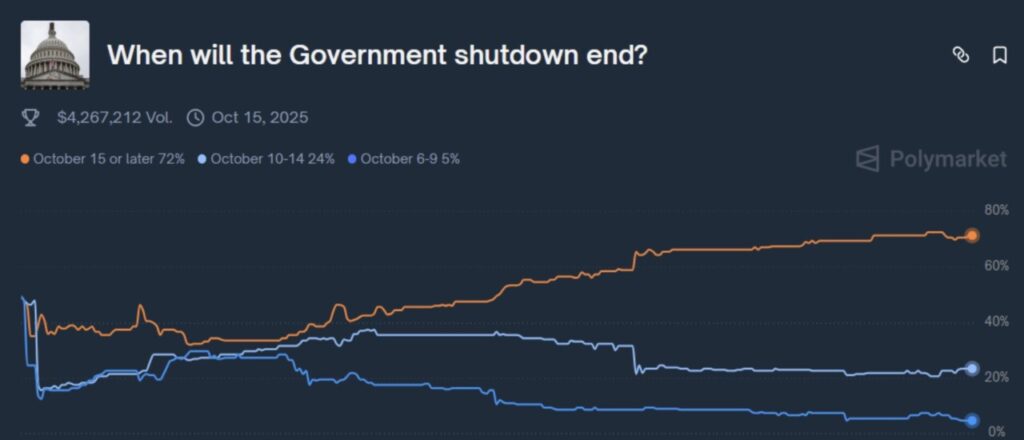

This increase in Bitcoin price comes amid market expectations of a continued U.S. government shutdown. Based on data from Polymarket, there is a 72% chance that the shutdown will end on or after October 15.

The US government shutdown itself began on October 1, coinciding with a surge in BTC prices from the $114,000 range. Since the beginning of this month, Bitcoin has gained almost 10%.

Many investors are believed to be turning to Bitcoin as a safe-haven asset in what is now known as the “debasement trade”, an attempt to protect wealth from economic uncertainty. The government shutdown has also delayed the release of important economic data, further heightening concerns in the market.

According to a report by CoinGape, thanks to the debasement trade phenomenon, the Bitcoin ETF recorded its second-largest weekly inflow last week, totaling $3.24 billion. This was a positive turning point, after the fund had experienced mixed inflows and outflows for some time.

How Far Can Bitcoin’s Rise Go?

Standard Chartered predicts that Bitcoin’s current rally has the potential to push the price to $135,000 in the near future, despite the ongoing US government shutdown.

Read also: XRP Update: Investors Dump $950 Million Worth of XRP as Bullish Setup Collapses

The global bank also predicted that BTC could break the $200,000 level before the end of 2025, driven by a surge in interest in Bitcoin ETFs.

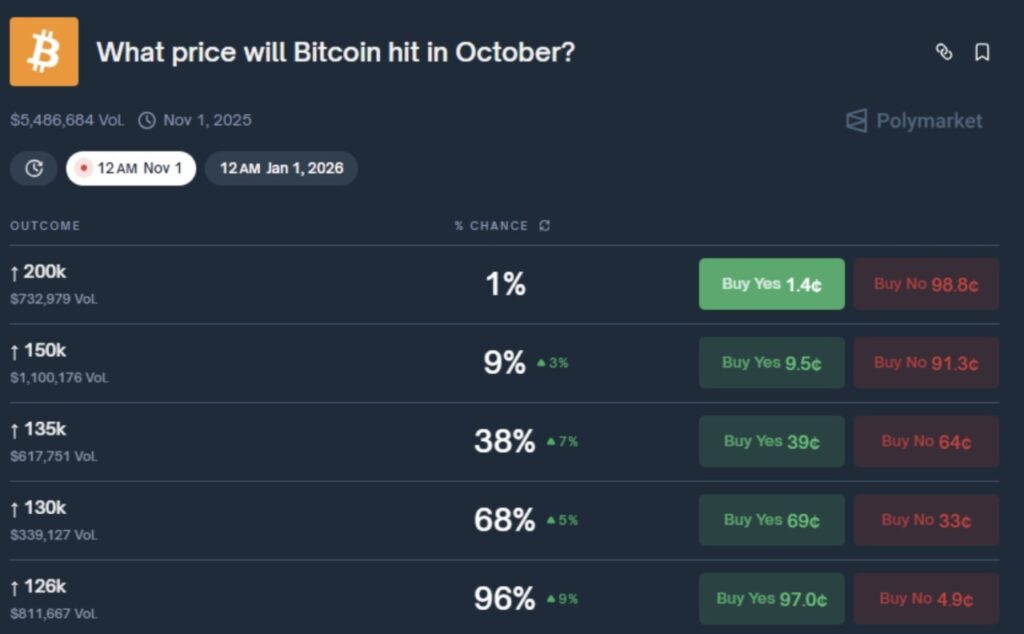

Based on data from Polymarket, there is a 68% chance that Bitcoin will hit $130,000 this month, as well as a 38% chance of reaching $135,000, in line with Standard Chartered’s projections.

Meanwhile, the chances of Bitcoin breaking $150,000 are around 9%, which would be a new milestone for the world’s largest cryptocurrency.

Crypto analyst Titan of Crypto also predicted that BTC could potentially break the $135,000 level within this month.

He noted that Bitcoin’s price movement is currently moving up in an ascending channel pattern, with the trend direction indicating the potential for continued gains to surpass the $135,000 target before the end of October.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitcoin Tops $126,000 as Market Prices In Three-Week U.S. Government Shutdown. Accessed on October 7, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.