Is Dogecoin Poised for an 82% Breakout? Symmetrical Triangle Pattern Points to a $0.466 Target

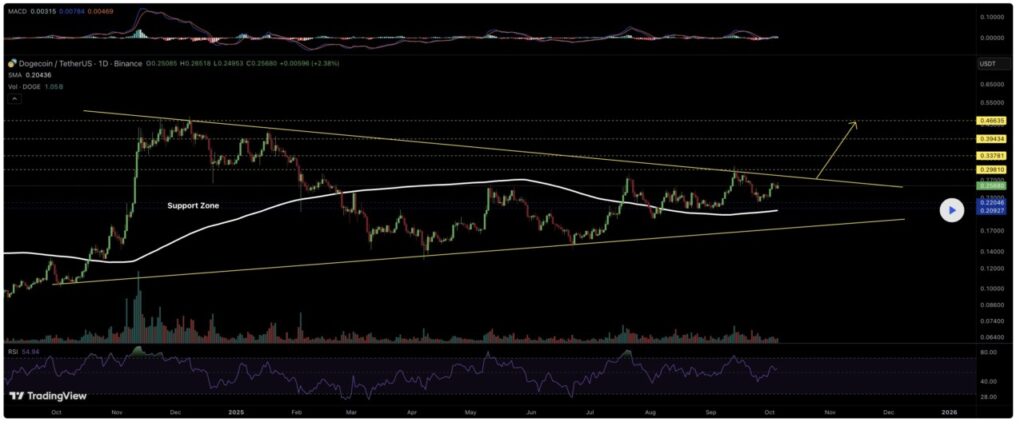

Jakarta, Pintu News – Dogecoin (DOGE) has the potential to re-attempt its highest level in December 2024 if it manages to break through the narrowing symmetrical triangle pattern on the daily chart.

TradingView ‘s analysis of Bithereum_io on October 5 revealed this opportunity, which came amid a broader market consolidation phase. Interestingly, Dogecoin corrected along with the rest of the crypto market after a positive start to the month – down around 3% on October 6, 2025.

Ideal Areas to Buy Dogecoin

Despite the market correction, Sunday’s analysis shows that there is still a positive outlook for Dogecoin. As such, the market watcher advised crypto enthusiasts to consider buying Dogecoin at current price levels.

Read also: Dogecoin Climbs 4% Today: Is a 20% Rally Next on the Cards?

However, despite the bullish market sentiment, analysts warn that DOGE could still experience a further correction.

For investors who have not yet entered the market, the area between $0.220 to $0.209 is considered a potential buy zone, as this region coincides with the 200-day simple moving average (SMA) which is currently around $0.204.

Since breaking through that level in August, Dogecoin has managed to stay above the strong $0.20 support and 200-day SMA, signaling price stability. If the current correction phase continues and the price tests these areas again, analysts expect Dogecoin to most likely bounce up from there.

DOGE’s Upside Target After Breaking the Triangle Pattern

Interestingly, Bithereum_io also predicts some price targets for Dogecoin if the asset manages to break out of the symmetrical triangle pattern. The first target suggests a potential upside of 16% towards $0.298.

Moreover, there are still three further upside targets for Dogecoin. One of them is a sustained rally towards $0.337, which reflects a 32% increase from the current price of $0.256.

The last two targets put the potential price increase to $0.394 and $0.466, equivalent to a 54% and 82% jump from current levels, respectively. In comparison, the highest target of $0.466 almost touches the December 2024 peak of $0.4846, signaling a possible retest of that important price level.

Whale Action Drives Dogecoin’s Bullish Outlook

Meanwhile, whale activity in the Dogecoin ecosystem further reinforces the positive sentiment, signaling the potential for continued price gains. Leading analyst Ali Martinez shared data from Santiment showing that whales bought around 30 million DOGE in the last 24 hours (6/10).

Read also: 2 Altcoins Gaining Attention Ahead of the Fed’s Policy Decision at FOMC Meeting

This accumulation action took place among whales holding 1 million to 10 million DOGE, where they increased their holdings in anticipation of further potential price gains. With the latest purchase, the whale group now holds a total of 10.77 billion DOGE.

This phenomenon of massive accumulation shows that large market participants still believe in Dogecoin’s potential, and expect the price to continue to rise. This also boosts the confidence of other retail investors, which could lead to a significant price spike when the market picks up again.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- The Crypto Basic. Dogecoin Symmetrical Triangle Breakout Targets 82% Rally to $0.466. Accessed on October 7, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.