Caution Ahead: 3 Altcoins at Risk of Major Liquidations This Week

Jakarta, Pintu News – Total crypto market capitalization set another new record in October, surpassing the $4 trillion mark. The bulk of market liquidity is now flowing into Bitcoin (BTC) and a number of key altcoins, which also means that the potential volume of liquidations on those assets has increased sharply.

This article discusses the risks that top altcoins may face, potentially triggering a massive wave of liquidation for short-term traders with highly leveraged positions in the second week of October, citing the BeInCrypto page.

Ethereum (ETH)

In early October, a report from Messari revealed that institutional investors (DATs) now hold a larger percentage of Ethereum (ETH) supply than BTC. This finding confirms that the accumulated demand for ETH is still very strong.

Read also: Ethereum Bullish Cycle is Back! Grayscale Launches Spot Staking ETP – ETH Could Hit $7,331?

“Growing ETF inflows, ETH staking ETF approvals, and expanding global liquidity are the main factors that could drive ETH’s rise to the next stage,” said Rick, an analyst from Messari.

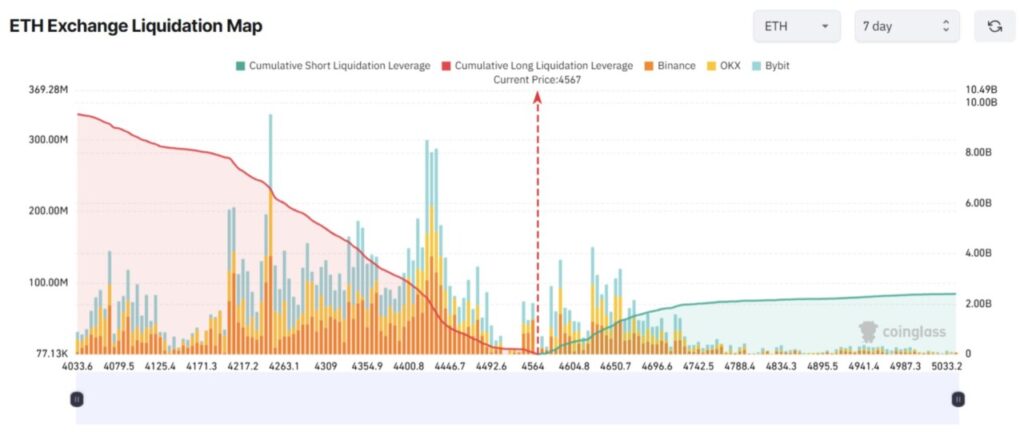

Short-term traders are now more confident in opening long positions, with the expectation that ETH prices will reach new highs this month. This is evident from the volume of liquidation of long positions, which has recently surpassed short positions.

According to data from Coinglass, if ETH prices fall to around $4,030 this week, more than $9 billion of long positions could potentially be liquidated. Conversely, if ETH breaks above $5,000, around $2 billion of short positions are likely to be wiped out.

However, there are some warning signals that long traders seem to ignore:

- Around 97% of all ETH addresses are currently in profit. Historically, when this ratio crosses the 95% mark, it often signals a potential market top, as many investors begin to take profits.

- On-chain data also shows that some long-term whales have started selling their ETH. On October 5, Trend Research firm deposited 77,491 ETH worth $354.5 million on Binance for sale. In addition, Lookonchain also noted that another ETH whale became active again after four years of dormancy and started moving its coins to exchanges.

If selling pressure continues to build throughout this week, then a massive wave of liquidation of long positions could potentially occur in the Ethereum market.

XRP

This October, the SEC is scheduled to review a number of XRP ETF applications from major financial institutions such as Franklin Templeton, Hashdex, Grayscale, ProShare, and Bitwise.

“Some of the biggest names in the industry are involved, with funds ranging from $200 million to $1.5 trillion. If even just one of these proposals is approved, it could bring a huge influx of institutional funds into XRP,” Crypto King analysts said.

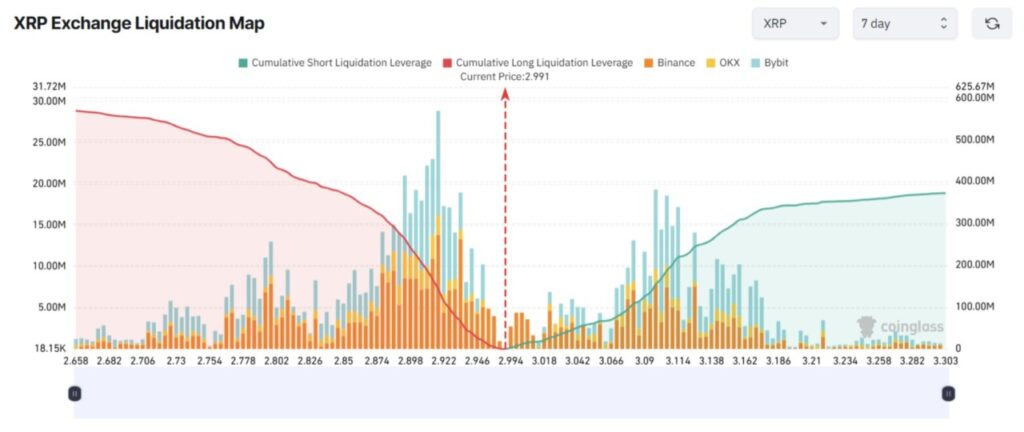

Such optimism prompted many traders to bet on the continuation of XRP’s (XRP) bullish trend. The liquidation heatmap shows a clear imbalance – long positions dominate significantly.

According to the latest data, if XRP falls to $2.65 this week, then around $560 million of long positions could potentially be liquidated. Conversely, if the price rises to $3.3, around $370 million of short positions could be wiped out.

Read also: Crypto Whale Moves $55 Million in XRP to Ripple — Is a Major Sell-Off Coming?

However, there are some warning signals for long XRP traders:

- XRP balances on exchanges increased sharply in early October, with approximately 320 million XRP deposited into various platforms.

- XRP whales appear to be selling off heavily, bringing their holdings down to their lowest level in almost three years.

Both of these factors point to significant profit-taking activity – and could be a major risk for highly leveraged long positions if selling pressure continues to build.

Binance Coin (BNB)

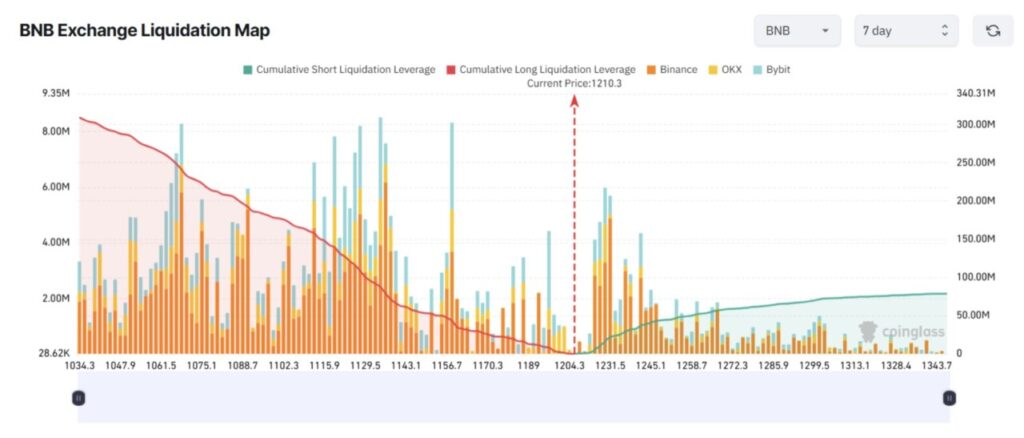

BNB (BNB) continued to set new records in October, with prices now trading above $1,200. Many traders seem to be caught up in the FOMO (Fear of Missing Out) rally, flocking to open bullish positions in pursuit of short-term profits.

The liquidation map for the past 7 days shows that if BNB drops to the $1,034 level, the total liquidated long positions could exceed $300 million. Conversely, if the price rises to $1,340, short positions worth around $80 million could potentially be wiped out.

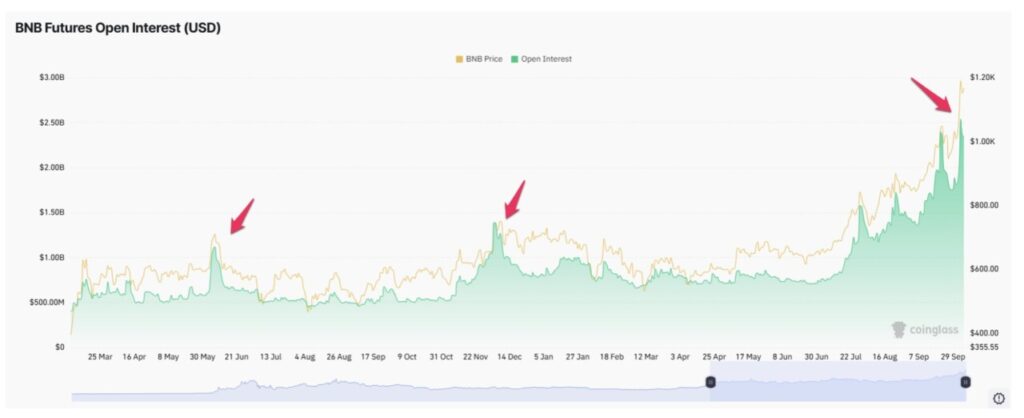

Although BNB still has a chance to continue its rally, its total open interest (OI) in October has surpassed $2.5 billion – its highest level in history. Based on historical data, OI spikes like this are often the first sign of a sharp market correction.

Traders with long positions can still make profits if the uptrend continues. However, without disciplined risk management, they could potentially suffer huge losses due to sudden liquidation in the event of a sudden market reversal.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Altcoins Liquidations Risk in October Second Week. Accessed on October 10, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.