Bitcoin Must Reach $148,000 to Match Gold’s Rally, Says Peter Schiff

Jakarta, Pintu News – The Bitcoin (BTC) market that recently hit an all-time high was called a “bear market rally” by economist Peter Schiff, signaling a short-term rebound but a long-term bear market decline. Despite the US government shutdown, Bitcoin (BTC) continues to rise on hopes of another Fed rate cut this month.

Bitcoin Bear Market Rally

Peter Schiff, a renowned economist, described Bitcoin’s (BTC) latest rise as a bear market rally, suggesting that this is only a temporary recovery. According to Schiff, although Bitcoin (BTC) reached a new record high, this does not signal the beginning of a bull market, but rather just a rebound within a larger bear trend.

Schiff emphasized that investors should be wary of the potential for further declines. Despite the US government shutdown, Bitcoin (BTC) continues to show gains. This is driven by market expectations of an upcoming Federal Reserve interest rate cut. This rise, according to Schiff, should not be seen as an indicator of the long-term health of the crypto market, but rather a reaction to current macroeconomic conditions.

Bitcoin vs Gold: Asset Competition

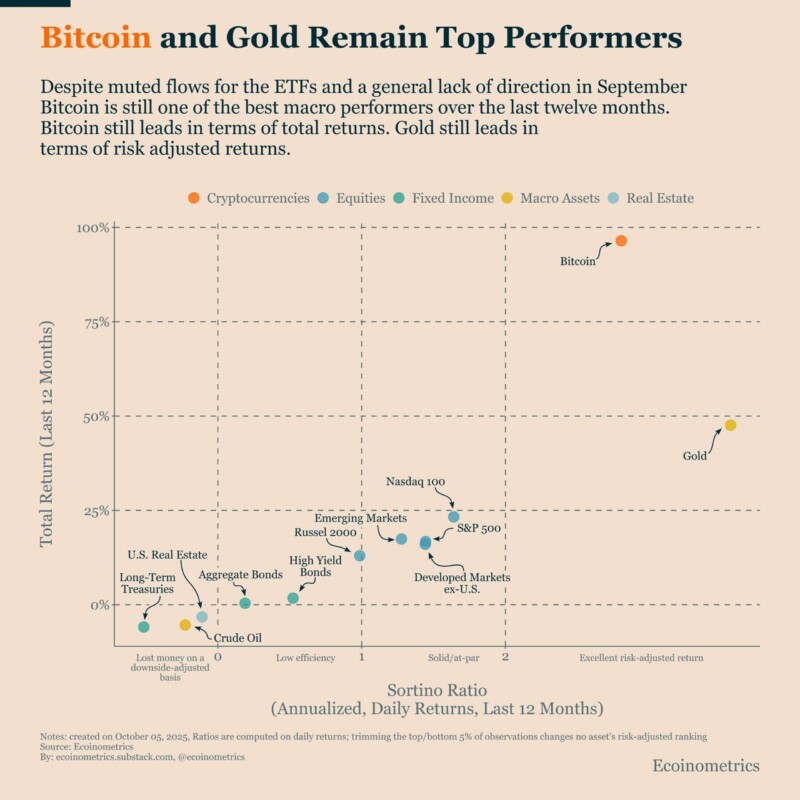

In recent years, gold has surpassed Bitcoin (BTC) as an asset class. By 2025, gold has become a $27 trillion asset class, extending its lead over Bitcoin (BTC) by more than 10 times. The rise in gold prices suggests that investors may see gold as a safer option compared to crypto in times of economic uncertainty.

Also read: Gold Vs Bitcoin: Peter Schiff’s Prediction on Gold’s Dominance Over Bitcoin

Peter Schiff suggested that Bitcoin (BTC) would have to reach a value of $148,000 per unit to equal the rise of gold. This comparison shows the distance Bitcoin (BTC) still has to travel to be considered on par with gold in terms of storage value and investor confidence. Schiff argues that without this achievement, Bitcoin (BTC) will continue to be in the shadow of gold as a safe haven asset.

Conclusion

In the face of market uncertainty and changing economic dynamics, a deep understanding of the movements of assets such as Bitcoin (BTC) and gold is crucial. Analysis such as that delivered by Peter Schiff provides perspective that can help investors make more informed decisions. While market views may change, the need for accurate and timely information remains key.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Bitcoin Should Be at $148,000 to Match Gold Rally, Says Peter Schiff. Accessed on October 8, 2025

- Featured Image: Generated by Ai

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.