Bitcoin (BTC) falls from peak, is this a sign that the market will turn around in October 2025?

Jakarta, Pintu News – After hitting a new record high, the price of Bitcoin (BTC) has taken a dip. Currently, the cryptocurrency is trading at around $121,000, slightly below its latest peak. Despite the decline, market analysts think that this is a healthy correction phase and shows investors’ confidence in Bitcoin’s (BTC) long-term prospects.

Bitcoin (BTC) Investors Secure Profits

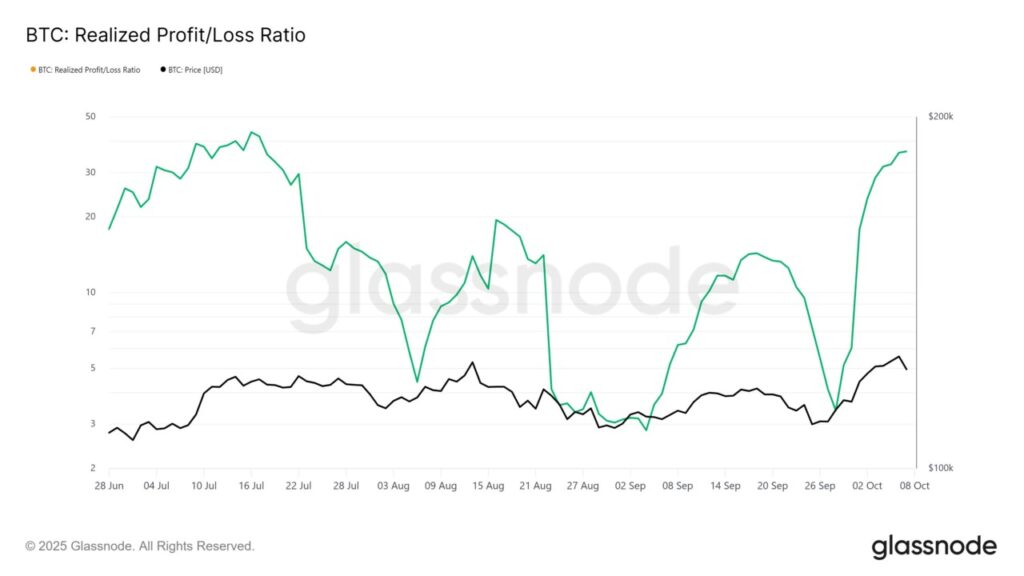

The Realized Gain/Loss ratio, which is an important metric on the chain, shows that Bitcoin (BTC) investors have been selling their assets in recent days. This indicator recently hit a three-month high, signaling that profit-taking has increased after a significant price surge. This phenomenon is common after a long bullish period.

Despite the apparent selling, this does not necessarily indicate a decline in confidence. Instead, it reflects a natural correction phase where traders are securing their profits. With Bitcoin (BTC) consistently rising in value since the beginning of the month, this short-term cooling period allows the market to stabilize before possibly resuming its uptrend.

Also Read: Trading capital of IDR 20 thousand, is it possible? This is how to trade crypto with cheap capital!

Bitcoin (BTC) Price Remains Stable

Currently, Bitcoin (BTC) is trading at $121,353, remaining firmly above the $120,000 support level. The asset is just below the $122,000 resistance, which has become an important short-term threshold for traders looking for potential breakout signals.

The recent price drop is largely due to profit-taking after Bitcoin (BTC) reached its current record high of $126,199. Given the current strength of technical and on-chain indicators, Bitcoin (BTC) is likely to reclaim $122,000 and consolidate in a stable range before attempting another upside push.

Downside Potential if Selling Pressure Increases

However, if selling pressure increases and investors take additional profits, Bitcoin (BTC) could slip below $120,000. In that scenario, a drop towards $117,261 remains possible, which could temporarily invalidate the prevailing bullish view.

This situation requires close monitoring of market dynamics and investor response to price changes. Bitcoin (BTC) price stability above or below key thresholds will be an important indicator of market sentiment and potential future price movements.

Conclusion

Bitcoin’s (BTC) price drop from its peak may signal a healthy correction phase within the larger market cycle. Investors and traders should pay attention to key indicators and support levels to anticipate the next price movement. With proper analysis, this period could be an opportunity for a wiser investment strategy.

Also Read: 5 Coin Memes Predicted to Explode After Bitcoin Breaks $125,000

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Bitcoin Price Ends ATH Run. Accessed on October 9, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.