5 facts about Bitcoin Whale’s giant fund transfer: New Strategy or Massive Sell-Off?

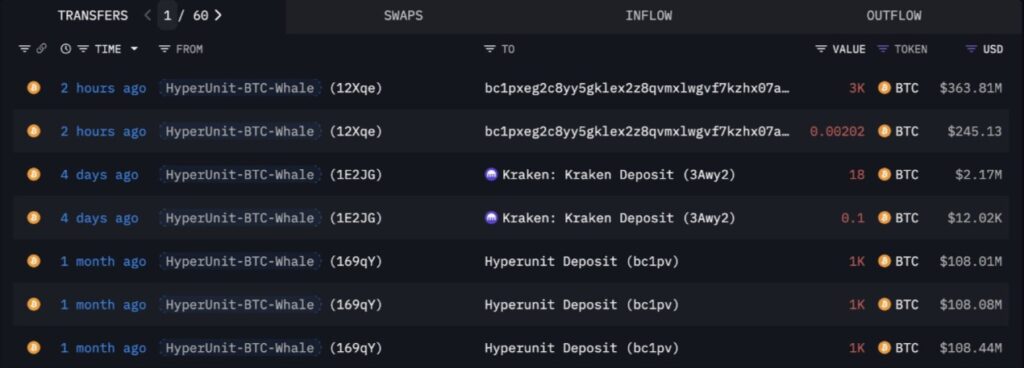

Jakarta, Pintu News – A Bitcoin (BTC) whale with more than $10 billion in assets has stolen the spotlight in the crypto world after transferring $363.81 million (around Rp6.02 trillion) to decentralized trading platform Hyperliquid. According to data from block chain analytics firm Arkham, this is not the first time the whale has made such a big move.

Two months earlier, the same entity was recorded selling $5 billion worth of Bitcoin to buy USDC stablecoin, which was then used to accumulate Ethereum (ETH). This repeated activity has led to speculation about the whale’s long-term strategy in the face of evolving cryptocurrency market dynamics.

1. Trial Transaction Before Main Transfer

According to Arkham’s report, the Bitcoin (BTC) whale took a step that large investors rarely do – sending 0 . 002 BTC first before moving large amounts. This small step is thought to be a security test to ensure the entire process goes smoothly without any technical issues.

This action reflects a high level of caution in managing large crypto funds. After successful testing, the whale immediately executed a major transfer to Hyperliquid, reinforcing the notion that the strategy taken was highly planned and measured. Based on Arkham block chain records, this large transaction also shows the level of confidence of large investors in Hyperliquid as one of the flagship platforms for high-scale crypto trading.

Also Read: Trading capital of IDR 20 thousand, is it possible? This is how to trade crypto with cheap capital!

2. Hyperliquids Take Center Stage for Crypto Whales

Hyperliquid ‘s platform is now one of the main destinations for large investors looking to move their digital assets to a decentralized trading ecosystem. According to block chain analysis from Arkham, Hyperliquid relies on the Hyperunit protocol that facilitates the transfer of assets like Bitcoin (BTC) directly to its internal trading system.

The main advantages of Hyperliquid lie in the high liquidity and flexibility of the asset. Investors can swap Bitcoin for other assets such as Ethereum (ETH), Ripple (XRP), or the stablecoin USDC quickly and at low cost. This makes Hyperliquid a popular choice among whales (large investors) who want to diversify or rotate assets without relying on centralized exchanges.

3. Diversification Strategy or Preparation for Big Change?

Analysts from Arkham and several other crypto experts argue that this move by Bitcoin (BTC) whales may be part of a long-term risk diversification strategy. With the high volatility of the cryptocurrency market, moving some funds to active trading platforms could be a way to capitalize on short-term price opportunities.

However, others see this action as an indication of a major shift in investment strategy. In recent months, the whale has been known to strengthen its holdings of Ethereum (ETH), which has been “in the news” due to increased network activity and potential institutional adoption. Many analysts have called this move a signal of asset rotation from Bitcoin to resilient altcoins, as important metrics such as total value locked (TVL) increase in the Ethereum-based DeFi ecosystem.

4. Impact on Market and Retail Investors

Such a massive transfer of funds received widespread attention from the global crypto community. According to Arkham’s data, Bitcoin transaction volume briefly increased by more than 8% in the 24 hours after the transfer was made. This sparked speculation that the whale was preparing for a significant market move, which could affect Bitcoin’s price in the short term.

Retail investors have also started monitoring whale wallet activity in anticipation of a potential “sell wave” or further accumulation. In the crypto world, such whale activity is often an indicator of market direction – whether a particular asset is being bought up or sold off heavily. However, analysts caution that it’s important to be cautious and not get carried away with speculation without solid data.

5. What’s Next for This Bitcoin Whale?

Currently, the whale still controls around 29,300 BTC, worth $3.56 billion , in its main wallet. The whale’s future activities will remain closely monitored by analysts and the crypto community. Some are predicting the next big buyout of Ethereum (ETH) or other altcoins that are garnering attention such as Pepe Coin (PEPE) and Solana (SOL).

With the high volatility and fast dynamics of the cryptocurrency market, any move by a Bitcoin whale has the potential to move global sentiment. Is this a sign of a new strategy to adjust portfolios or just a temporary repositioning? Time will tell, but one thing is for sure – this whale has become one of the most influential actors making headlines in the crypto world today.

Also Read: 5 Coin Memes Predicted to Explode After Bitcoin Breaks $125,000

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Daily Hodl. $10,000,000,000 Bitcoin Whale Abruptly Moves $363,810,000 in BTC to HyperLiquid, Is Another Ethereum Swap Incoming? Accessed October 9, 2025.

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.