Bitcoin Holds Around $121,000 Today, 2025 — Rising Sell-Offs Signal Fading Momentum

Jakarta, Pintu News – The largest crypto asset, Bitcoin (BTC), set a new record high of $126,199 on Monday (6/10), marking a significant milestone in its price movement. However, after reaching that peak, BTC went sideways, suggesting indecision among market participants.

Many traders are now forecasting a possible corrective move below the $120,000 area, while a number of on-chain indicators are starting to signal that a short-term downtrend could be imminent.

Then, how will the Bitcoin price move today?

Bitcoin Price Drops 0.37% in 24 Hours

On October 10, 2025, Bitcoin was trading at $121,310, equivalent to IDR 2,018,874,944, marking a 0.37% decline over the past 24 hours. During this period, BTC dipped to a low of IDR 1,995,971,215 and reached a high of IDR 2,054,257,474.

At the time of writing, Bitcoin’s market capitalization stands at approximately IDR 40,056 trillion, while its 24-hour trading volume has increased by 12%, reaching IDR 1,069 trillion.

Read also: Bitcoin Price Outlook: Analysts Spot Weekly Breakout — Is BTC Poised for Its Next Big Rally?

Bitcoin Momentum Weakens as Holder Sell-off Increases

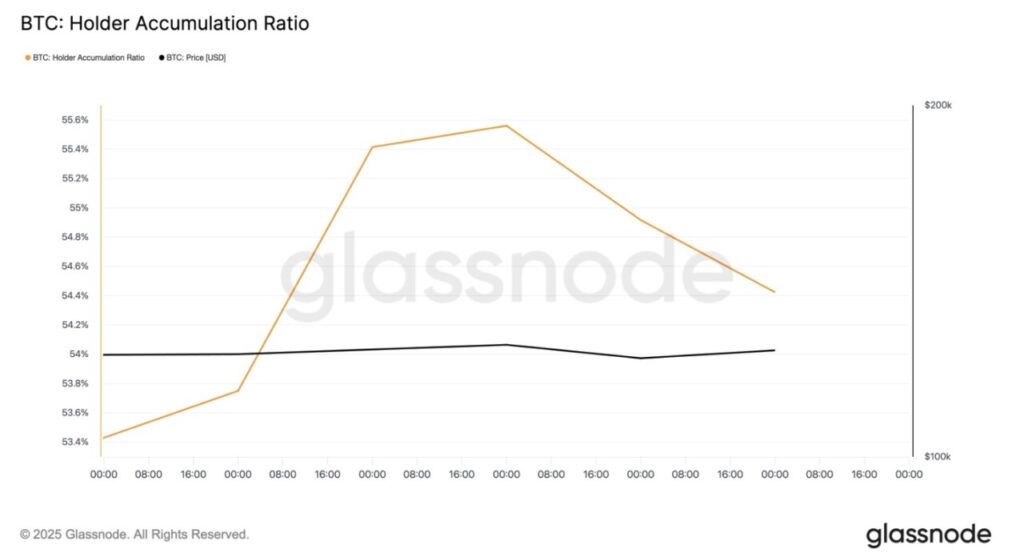

Signs of weakening momentum have begun to appear along with Bitcoin’s sideways movement in recent days. Based on data from Glassnode, the Holder Accumulation Ratio – a metric that measures how much active investors are adding to holdings versus subtracting from them – has been steadily declining since Monday.

As of now, the ratio stands at 54.42%, down about 2% in the last four days. A high ratio usually signals that more investors are holding and adding to their BTC holdings, reflecting high confidence and an accumulation phase.

Conversely, a decrease in the ratio indicates that more holders are choosing to sell or transfer their assets instead of adding to them.

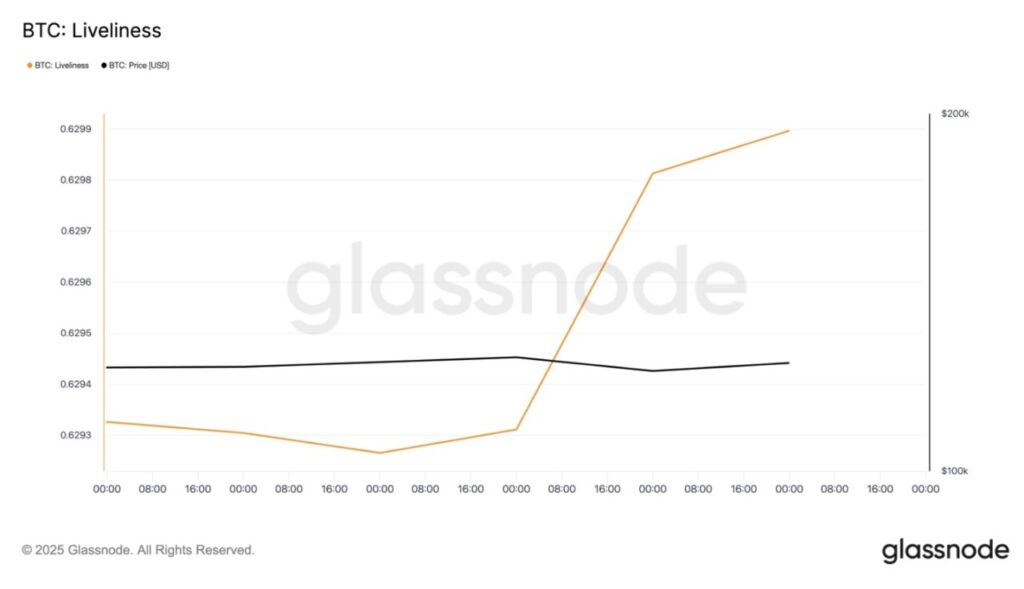

At the same time, another metric, BTC Liveliness, has shown an upward trend since Monday, and was recorded at 0.6298 as of October 8. This metric tracks the movement oflong-held/dormant tokens by comparing the number of coin days destroyed against the total coin days accumulated.

When Liveliness falls, it means thatLong-Term Holders (LTHs) are moving assets from exchanges to private storage – a positive signal indicating accumulation.

However, when this metric rises like it is currently doing, it signals that LTHs are starting to move and sell their coins, indicating caution and potential profit-taking that could pressure BTC prices in the short-term.

Read also: 3 Key Factors that Could Push Solana (SOL) Price to the $300 Level

Can Buyers Enter Before a Deeper Correction?

Without any renewed buying interest, Bitcoin is at risk of dropping towards the $120,000 area. If the support level at $120,090 is broken, then a potential further drop to $118,922 could occur.

However, if new buyers start coming in and demand picks up again, BTC prices have a chance to stabilize above current levels and even retest its record high of $126,199.

As such, the next price movement largely depends on how quickly the market can recover buying momentum after this consolidation phase.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Why Bitcoin’s Record High May Be Followed by a Decline Below $120,000. Accessed on October 10, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.