Heatmap Analysis ShowsBitcoin Gearing Up for a New Surge, Targeting $150,000!

Jakarta, Pintu News – Bitcoin (BTC) has recently shown signs of decline after failing to break the all-time high zone between $123,000 and $124,000. Despite the apparent short-term retraction, the broader market structure continues to show bullish signals.

This correction is seen as a healthy reset phase before Bitcoin (BTC) gathers momentum for the next big wave, with the next target being $150,000.

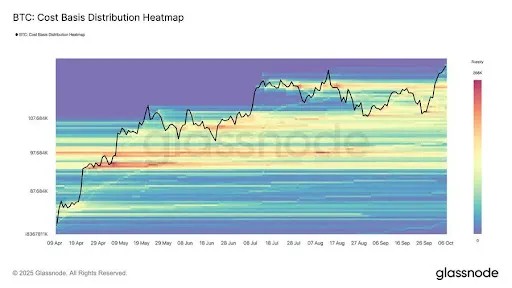

Heatmap Analysis Reveals Bitcoin Support Loophole

ZYN, a leading crypto analyst, recently shared findings in a Bitcoin (BTC) cost basis heatmap that shows limited support between the $121,000 and $120,000 levels. This zone is considered fragile and Bitcoin (BTC) could easily slip through the area if selling pressure increases. Below that, ZYN highlights an important area around $117,000, where around 190,000 BTC has been bought previously.

This accumulation zone reflects a strong base of new buyers and could be a critical level where market participants step in to absorb selling pressure. If Bitcoin (BTC) pulls back towards $117,000, this could set the stage for renewed accumulation rather than a deeper correction. ZYN emphasized that although Bitcoin (BTC) lacks significant cushion around $121,000, a solid foundation seems to be forming at $117,000.

Also Read: Trump’s Secret Plan May Push Bitcoin (BTC) to $250,000!

Bitcoin Struggles to Stay in the All-Time High Zone

In a recent market update, Crypto Candy noted that Bitcoin (BTC) has once again struggled to maintain momentum above the ATH resistance zone between $123,000 and $124,000. This level has proven to be a difficult barrier, with price attempts above it quickly met with selling pressure. As a result, Bitcoin (BTC) failed to close and sustain above this critical area, leading to a retraction in line with previous expectations.

Currently, this short-term correction is seen as part of a natural and healthy market cycle, rather than a signal of weakness. If the current momentum continues, Bitcoin (BTC) could drop to the $116,000-$118,000 range before finding strong support. This range is seen as a potential accumulation zone where buying interest could re-emerge, setting the stage for renewed bullish momentum.

Long-term Outlook Remains Optimistic

Despite the drawdown, the long-term outlook remains optimistic. Crypto Candy confirmed the long-term psychological target of $150,000 for Bitcoin (BTC), suggesting that the current price action is just a temporary pause before the next leg higher. This shows that investors and analysts remain confident in Bitcoin’s (BTC) growth potential despite the existing market volatility.

Conclusion

With strong support expected at the $117,000 level and an ambitious long-term target of $150,000, Bitcoin (BTC) seems to be gearing up for its next phase of growth. Investors and market watchers will continue to monitor these indicators to make informed investment decisions in the future.

Also Read: 5 Robert Kiyosaki Predictions: USD Crashes & Crypto is Bought, Bitcoin Price Breaks Rp2 Billion!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Sees Healthy Correction After Recent Surge. Accessed on October 10, 2025

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.