Bitcoin & Altcoin Open Interest Patterns Resemble December 2024: What Does It Mean?

Jakarta, Pintu News – Recently, an analyst from the CryptoQuant community, Maartunn, revealed that the Open Interest trend for Bitcoin (BTC) and altcoins shows a similar pattern to the one that occurred before the market crash in December 2024. Open Interest is an indicator that measures the total open positions that exist across all centralized derivatives exchanges and includes both long and short positions.

A rise in this indicator signals increased speculation in the market as traders open new, often riskier positions. When Open Interest increases, this is usually followed by an increase in volatility due to greater leverage in the market. Conversely, a decrease in Open Interest could indicate that investors are starting to reduce risk or are being forced to liquidate by their platforms, which could ultimately increase market stability.

Trend and Impact Analysis

From the chart shared by Maartunn, it can be seen that the Open Interest for Bitcoin (BTC) has seen a significant increase alongside the latest price rise, signaling that investors have opened new bets in the derivatives market. This phenomenon is not unusual, especially during rally periods that draw more attention to the crypto asset.

However, the scale and speed of this increase needs to be watched as it could leave the market vulnerable to liquidation pressures. Meanwhile, Open Interest for altcoins has also seen a similar spike, suggesting that speculative activity across the sector has increased. Something similar happened in December 2024, which was then followed by a period of stagnant markets and an eventual fall of over 30%.

Also Read: Trump’s Secret Plan May Push Bitcoin (BTC) to $250,000!

Recent Market Volatility

The market has started to feel the impact of the warming in Open Interest as Bitcoin (BTC) and altcoins experienced significant volatility recently. Bitcoin (BTC) fell sharply from above $125,000 to below $121,000 within hours, before recovering back to near $123,000.

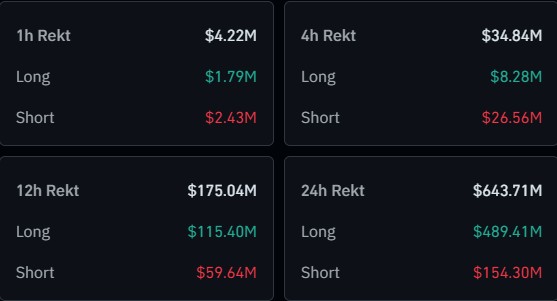

Meanwhile, Ethereum (ETH) and several other cryptos have yet to show a significant recovery from the downturn. This volatility has led to the liquidation of nearly $644 million in the crypto derivatives market, according to data from CoinGlass. This situation emphasizes the importance of monitoring Open Interest and the potential risks it can pose to market stability.

Conclusion: Beware of Market Symptoms

By understanding Open Interest trends and their impact on the market, investors and traders can be more aware of potential risks. Analyzing historical patterns and current market conditions is key to making informed investment decisions. While rising prices can be exciting, it is important to consider the risks associated with increased volatility and the potential for massive liquidations.

Also Read: 5 Robert Kiyosaki Predictions: USD Crashes & Crypto is Bought, Bitcoin Price Breaks Rp2 Billion!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin and Altcoin OI Warning Setup Dec 2024: Analyst. Accessed on October 10, 2025

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.