Antam Gold Price Chart Today October 13, 2025: Up or Down?

Jakarta, October 13, 2025 – Gold prices are back in the spotlight, especially from the BRANKAS LM platform, which recorded price increases in the corporate gold and physical gold categories.

Based on official data updated at 08:31 a.m., the corporate BRANKAS gold price was recorded at IDR2,245,600 per gram, up IDR6,000 from the previous day. Meanwhile, the price of physical gold also jumped to IDR 2,305,000 per gram, also an increase of IDR 6,000.

Here are 5 important facts about the development of the gold price and its relationship with the latest crypto market movements.

1. Gold Price Increases by IDR 6,000: Compact Corporate & Physical Categories Surge

According to data from BRANKAS LM, the gold buying price for corporate customers rose from IDR2,239,600 to IDR2,245,600 per gram, marking a daily increase of IDR6,000.

The physical gold category also recorded a similar increase, from the previous price of IDR 2,299,000 to IDR 2,305,000 per gram. This indicates a positive trend in market demand or expectations for gold, especially among institutional buyers.

Also Read: 5 Coin Memes Predicted to Explode After Bitcoin Breaks $125,000

2. Price Chart for the Last 6 Months Shows a Steady Rise

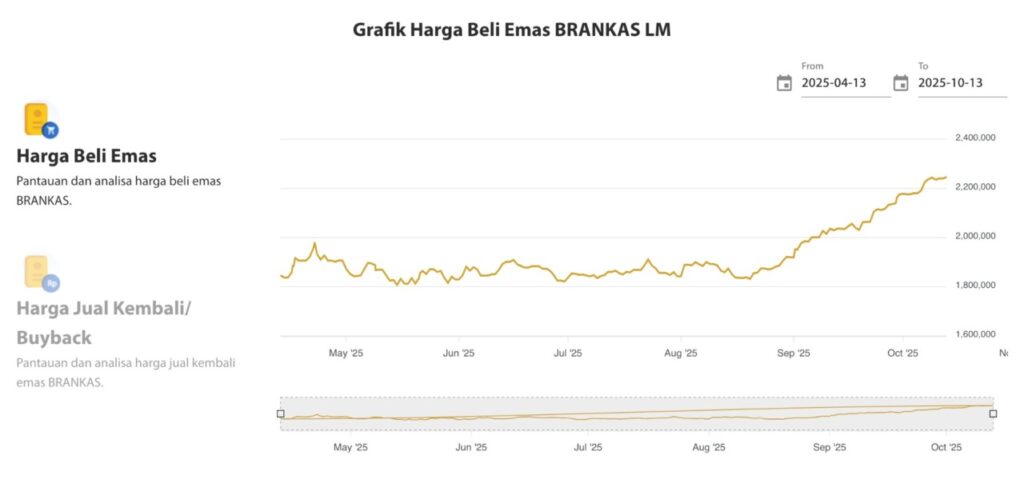

Chart data from April 13 to October 13, 2025 shows that gold prices have experienced a steady average increase, especially since early September. The graph shows an upward trend from the range of Rp1,900,000 to above Rp2,200,000 per gram.

According to technical analysis of gold prices, this surge is in line with the growing market sentiment towards hedge assets amid crypto volatility and global economic turmoil. Thus, the medium-term chart shows a positive direction for long-term investors.

3. Crypto Market Sentiment Affects Gold Price Movement

According to Pintu Market’s analysis, the crypto market is also receiving attention and could affect gold prices. When altcoins and crypto assets such as Bitcoin (BTC) and Ethereum (ETH) experience a sharp correction, investors tend to turn to gold as a safe haven.

At the same time, as of October 13, 2025, Bitcoin (BTC) is trading at approximately Rp1,947,286,319 and Ethereum (ETH) at Rp70,310,939, registering gains of 4.06% and 10.92% respectively in the last 24 hours. Although crypto assets are rebounding, volatility remains a reason for investors to monitor gold as a more stable alternative.

4. Correlation with Dollar Exchange Rate and Global Markets

The price of gold in Indonesia is influenced by the US Dollar to Rupiah exchange rate, as the commodity is transacted in USD on the international market. At an exchange rate of IDR16,585 per USD, the international gold spot price currently stands at around $2,400 per ounce, equivalent to IDR39,804,000 per ounce or approximately IDR1,279,161 per gram.

However, the higher selling value of gold in the domestic market reflects the margins of distribution costs, taxes, and buy-sell price spreads. Therefore, local investors should consider exchange rate factors and domestic market premiums when planning to buy or sell gold.

5. Gold prices are a concern for corporate players, not retailers

The prices listed on BRANKAS LM are for corporate customers only, as indicated on the platform’s official dashboard. For individual customers or retail investors, prices are different and can usually be seen through the mobile app or specific precious metal outlets.

According to financial analysts, the corporate market has greater purchasing power and deals in large volumes, making gold price movements in this segment an important metric often monitored by institutional market participants. This also explains why corporate gold prices can be slightly lower than retail physical gold.

Conclusion

The rise in gold prices shows that the precious metal is still attracting attention as an investment asset, especially amid crypto uncertainty and global market dynamics. Although the crypto market is showing great potential, including resilient altcoins such as Pepe Coin (PEPE) and API3, gold is still considered a more conservative and stable asset by many long-term investors.

With a positive price trend and chart gains in the last six months, gold is still the instrument chosen by institutional market participants for portfolio diversification. Stay wise and do your research before making any investment decisions, be it in the crypto market or precious metals.

Also Read: Shocking Prediction of Uniswap (UNI) Price Until 2030 According to CoinCodex!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BRANKAS LM. BRANKAS Gold Price Dashboard. Accessed October 13, 2025.

Latest News

© 2025 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). The trading of crypto asset futures contracts is carried out by PT Porto Komoditi Berjangka, a licensed and regulated Futures Broker supervised by BAPPEBTI, and a member of CFX and KKI. Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja and PT Porto Komoditi Berjangka do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.