6 Global Policies that Changed the Course of Crypto Markets This Week

Jakarta, Pintu News – Cryptocurrency adoption around the world is accelerating, and governments are striking a balance between innovation and economic stability. In the past week, a number of new policies from the United States, United Kingdom, Europe, to Kenya have had a major impact on the global crypto market. Some rules are considered to encourage growth, while others actually hold back the pace of innovation in the digital asset industry.

1. US government shuts down operations, crypto ETFs come to a halt

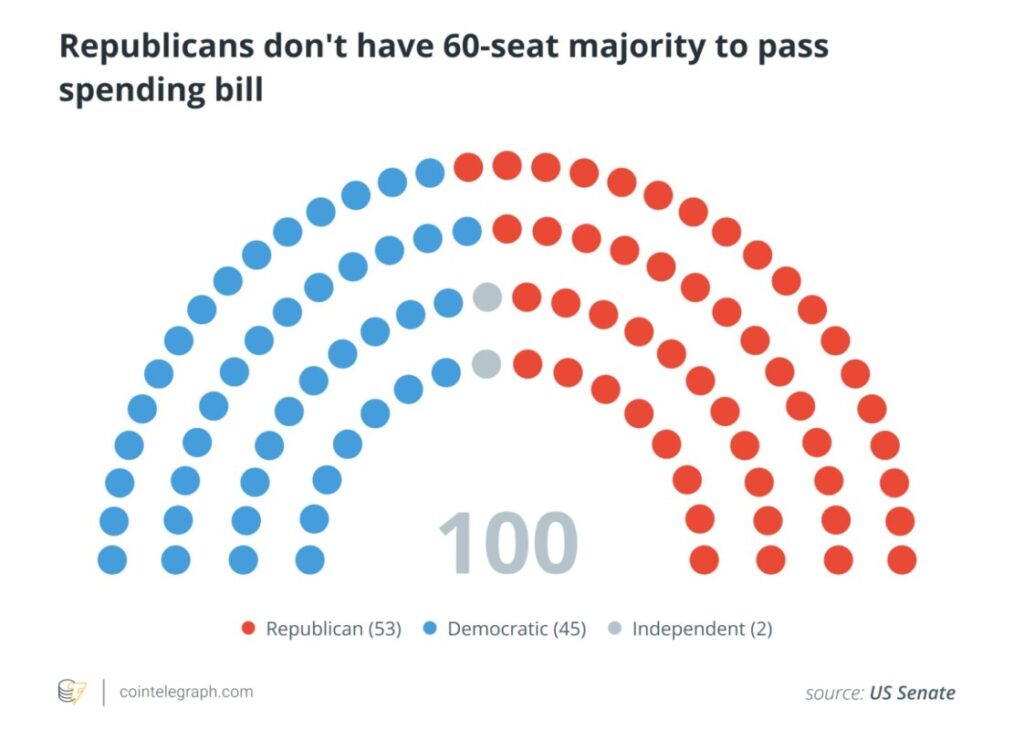

The political impasse in Washington saw the United States government officially shut down on October 1, 2025. The disagreement between Democrats and Republicans over the budget bill has caused many federal agencies to stop operating, including the Securities and Exchange Commission (SEC) which is the main regulator of the country’s crypto industry.

As a result, the approval process for various crypto-based investment products, such as exchange-traded funds (ETFs), has been put on hold. One of those affected was Canary Capital’s proposal for a Litecoin (LTC) ETF that passed the deadline without a decision.

But there is positive news: Jonathan McKernan has been appointed as Under Secretary for Domestic Finance at the US Treasury Department. This figure is known to oppose “debanking” policies that are detrimental to crypto players, so the market hopes that his presence can bring a friendlier regulatory direction in the future.

2. UK Lifts Ban on Crypto Exchange-Traded Notes

Good news coming from the UK, where the Financial Conduct Authority (FCA) officially lifted the ban on crypto exchange-traded notes (ETN). ETNs are debt instruments that allow investors to gain exposure to crypto assets without having to own them directly.

According to the FCA’s statement, the crypto market is now considered “more mature and easier to understand,” making it viable for retail investors to access. Previously, a ban on ETNs was imposed in 2021 as they were considered high-risk for individual investors.

Read also: Ready for Another Bull Run? Fundstrat’s Tom Lee predicts ETH price could hit $5,500!

Even so, the regulator continues to ban crypto derivative products such as futures and options for the public. This policy reflects the UK government’s cautious approach to regulating financial innovation without neglecting consumer protection aspects.

3. Luxembourg Sovereign Wealth Fund Dives into Crypto ETFs

A surprising move comes from Luxembourg, one of the richest countries in Europe. Their sovereign wealth fund announced that it has allocated 1% of its total portfolio to the Bitcoin (BTC) ETF. With total assets under management reaching around €764 million as of June 2025, this means that around €149 billion ($9 million) is now invested in crypto assets.

Bob Kieffer, Luxembourg’s Treasury Director, said this small step is a big signal towards the long-term potential of Bitcoin and cryptocurrencies. Although the portion is still small, this decision shows that even the country’s conservative financial institutions are starting to see crypto as part of a legitimate alternative investment portfolio.

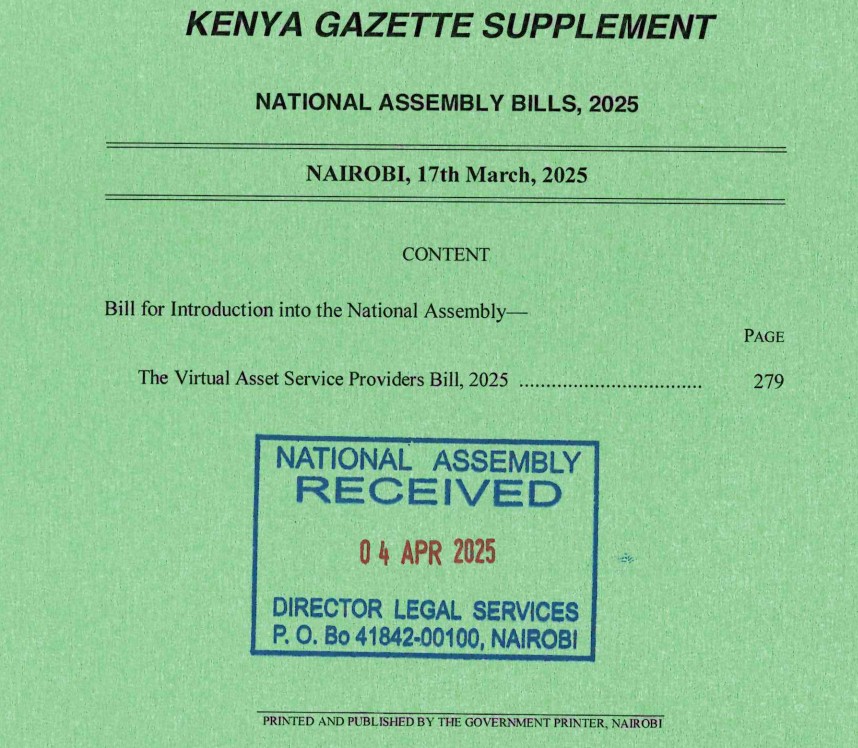

4. Kenya Passes Digital Assets and Crypto Exchange Bill

Africa is not far behind. Kenya, one of the countries with the most developed tech ecosystem on the continent, officially passed the Virtual Assets Service Provider’s Bill on October 8, 2025. This law creates a legal framework for crypto exchanges, brokers, digital wallet providers, and token issuers.

The bill is now awaiting President William Ruto’s signature before it officially comes into effect. The regulations provide legal certainty and consumer protection standards in a previously unregulated sector. According to Chebet Kipingor of Busha Kenya, the move signals Kenya is ready to “balance innovation with user protection.”

5. EU Expands Authority of Crypto Regulators

In Europe, the European Securities and Markets Authority (ESMA) announced plans to expand its authority to oversee crypto exchanges across the European Union. The move will shift oversight from national regulators to a European-level agency in order to create a more unified and globally competitive capital market.

Read also: 3 Crypto Airdrops Worth Monitoring After Weekend Market Crash

Verena Ross, Chair of ESMA, emphasized that these changes are necessary to address market fragmentation and ensure consistent enforcement across countries. This comes amid concerns from a number of national regulators, including France, Austria and Italy, that the implementation of MiCA (Markets in Crypto-Assets) regulations has been uneven across the region.

6. Bank of England softens stance on stablecoins

In the UK, the Bank of England (BoE) is reportedly reviewing thecap for stablecoins, both for individuals and corporations. Currently, the cap is set at £20,000 for individuals and £10 million for companies.

Internal sources say the BoE is considering easing this rule for companies that require large stablecoin reserves to maintain liquidity. According to GC Cooke of Brava Finance, Governor Andrew Bailey is now more open to the idea of coexistence between stablecoins and central bank digital currencies(CBDCs).

This move could pave the way for a hybrid financial system where crypto assets and traditional financial instruments complement each other.

Conclusion

These six major policies show how the world is getting serious about the cryptocurrency landscape. From the US to Africa, more mature regulations are emerging, signaling a new phase where crypto is no longer just speculation, but part of an evolving global financial system.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Six global policy changes that affected crypto this week. Accessed October 18, 2025.

- Featured Image: Generated by AI

Latest News

© 2026 PT Pintu Kemana Saja. All Rights Reserved.

The trading of crypto assets is carried out by PT Pintu Kemana Saja, a licensed and regulated Digital Financial Asset Trader supervised by the Financial Services Authority (OJK), and a member of PT Central Finansial X (CFX) and PT Kliring Komoditi Indonesia (KKI). Crypto asset trading is a high-risk activity. PT Pintu Kemana Saja do not provide any investment and/or crypto asset product recommendations. Users are responsible for thoroughly understanding all aspects related to crypto asset trading (including associated risks) and the use of the application. All decisions related to crypto asset and/or crypto asset futures contract trading are made independently by the user.